BTC, ETH, MATIC, ETC- analyzing ‘good, bad’ sign of crypto market

After the prices of several crypto assets plunged into abysmal depths in the first six months of 2022, July so far has ushered in gains for many digital assets.

As of 18 July, the king of coins, Bitcoin [BTC], broke the $22,500 level and touched a high of $22,800 during the intraday trading session. Ethereum [ETH] also traded above the $1,600 region, a position it last touched on 12 June.

In its newly published July mid-month report, Santiment, an analytics firm found that many crypto assets have posted gains in the last 30 days. According to the report, crypto assets like Polygon (MATIC), Quant (QNT), Curve (CRV), and Arweave (AR) have doubled their market capitalizations in the last 30 days.

Furthermore, the report highlighted “the good signs and bad signs” as the prices of cryptocurrencies remain unstable. Let’s take a look at these signs.

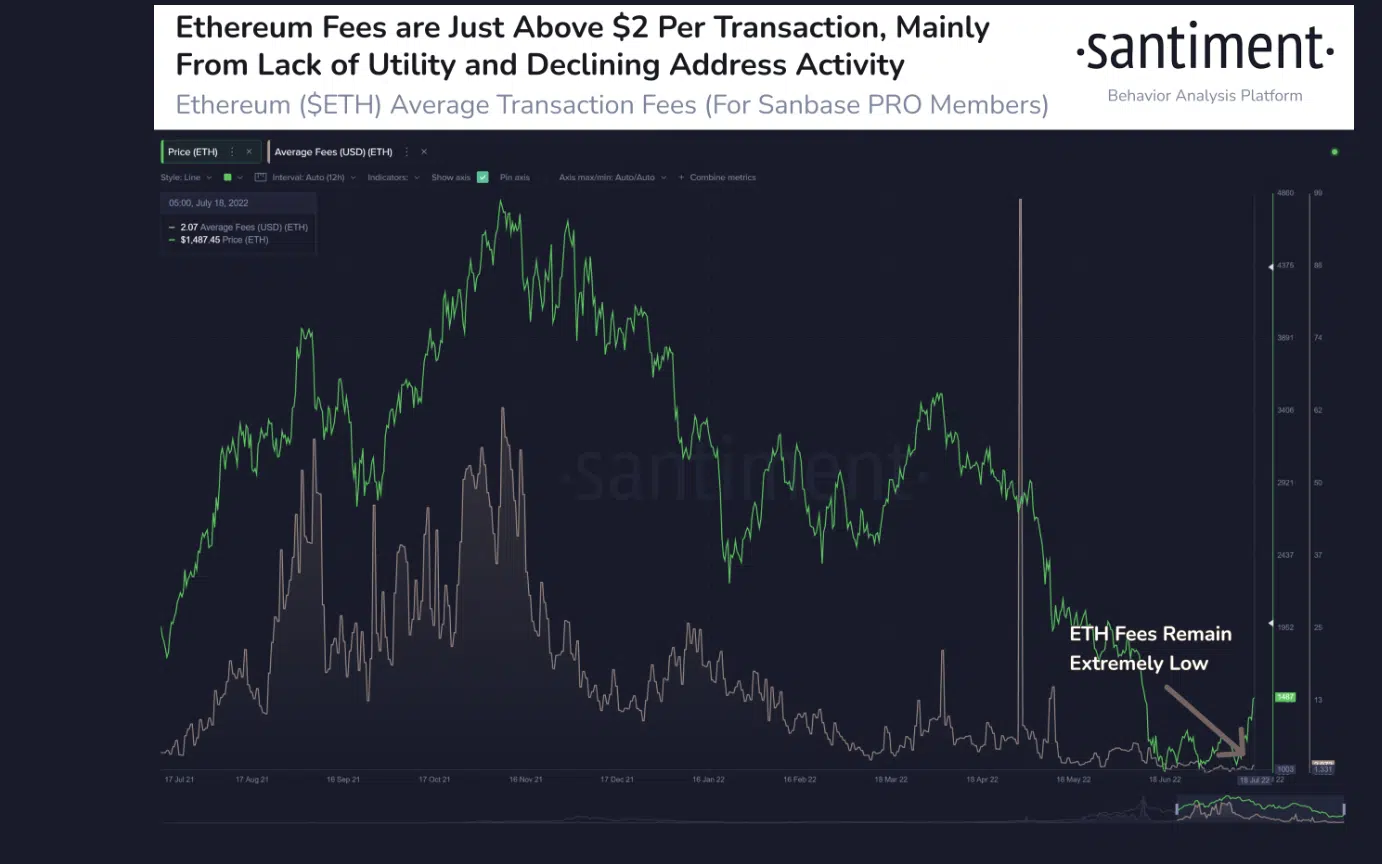

A decline in ETH fees

According to the report, in the thick of the bear market, the fees for processing transactions on the Ethereum chain dropped to the lows it recorded in December 2020.

With the price of ETH dropping nearly 80% from its all-time, the “less utility, declining address activity, and minimal, speculative fever across the range of DeFi and NFT protocols” led to the decline in ETH transaction fees.

While noting that this qualifies as one of the positive sides of the bear run so far this year, Santiment pointed out that with the rising price of the Ether coin, a slight increase in the cost of each transaction should be expected.

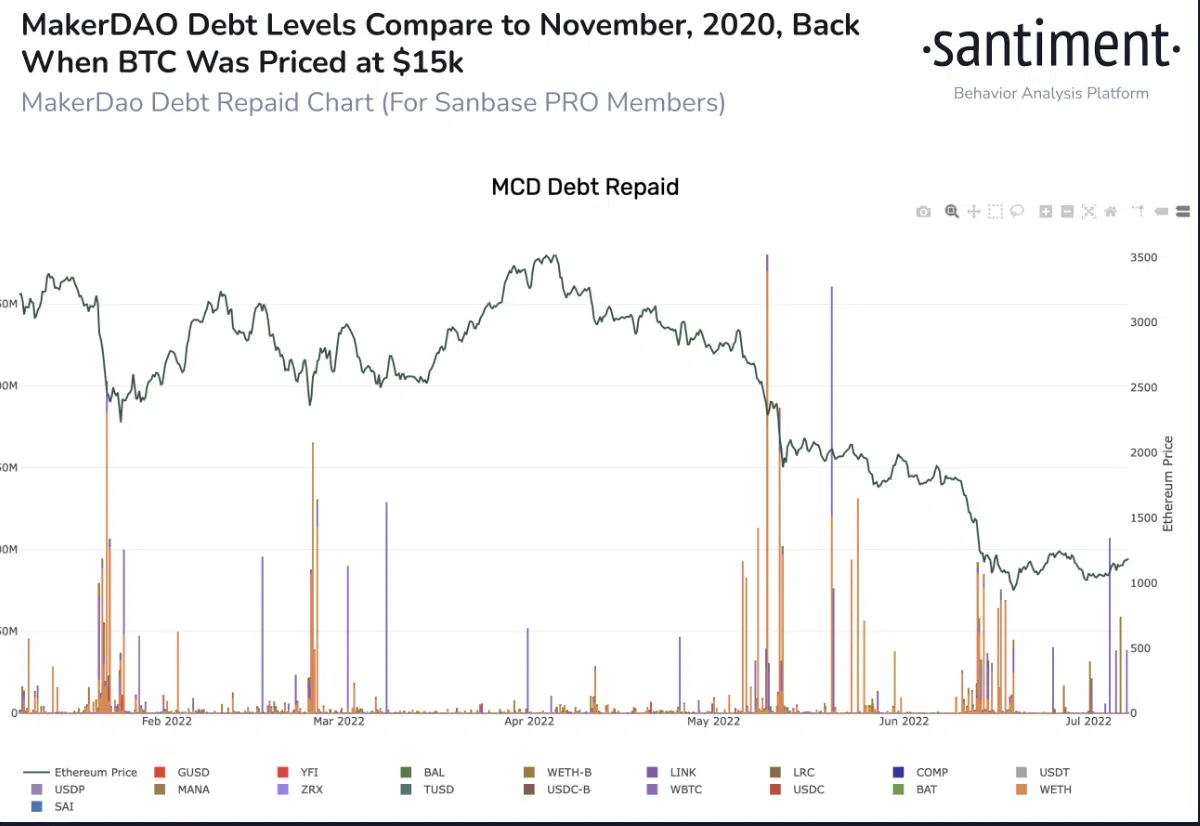

MakerDAO is averse to taking new debts

Another “good” of the bear market, according to Santiment, was that as a result of fears of potential liquidation, MakerDAO debt levels have consistently dropped amid the bear run.

This has been due to the risks associated with heavy debt levels.

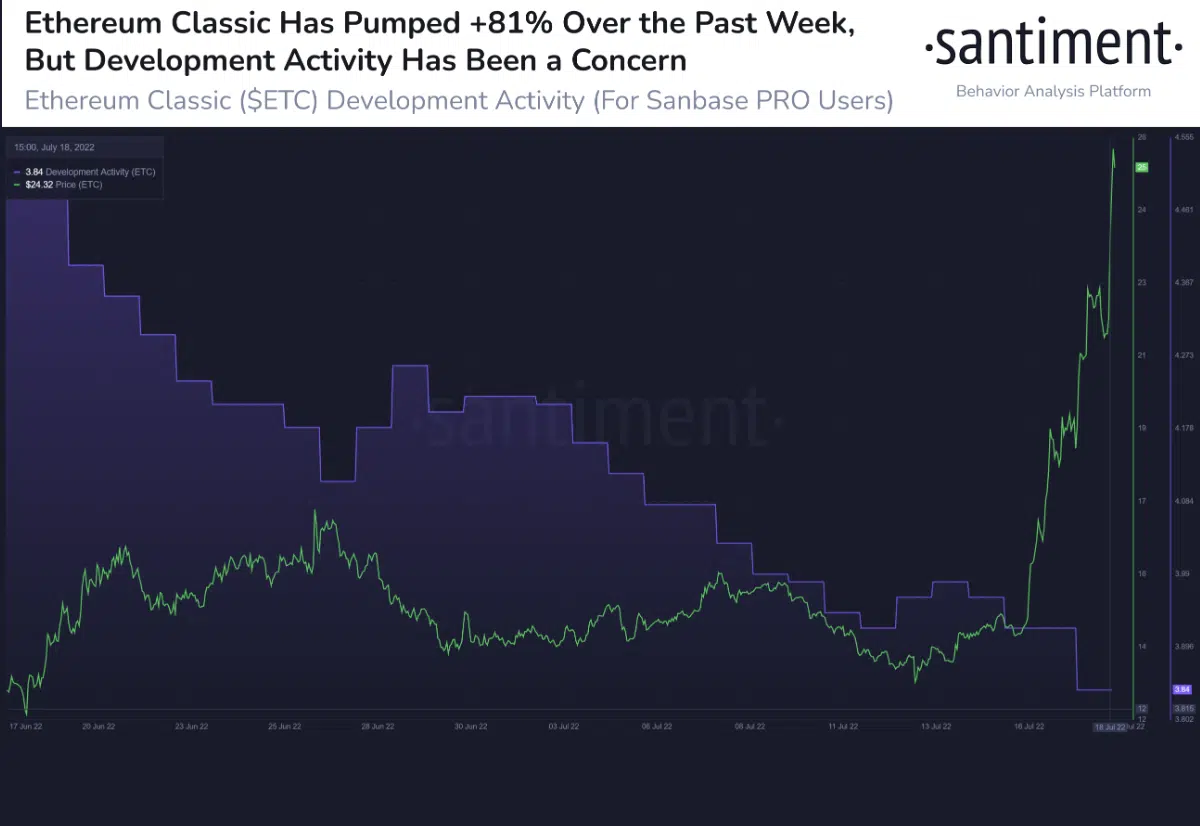

While the prices of some altcoins rallied significantly during the bear run, Santiment stated that the lack of a corresponding growth in the market capitalization of these coins was a bad sign as it represented an inorganic growth. According to Santiment,

“Among the assets that have really been making huge rises this week include ETC, KSM, and AR, which are widely regarded to not correlate as much with overall market success when they’re leading the pack.”

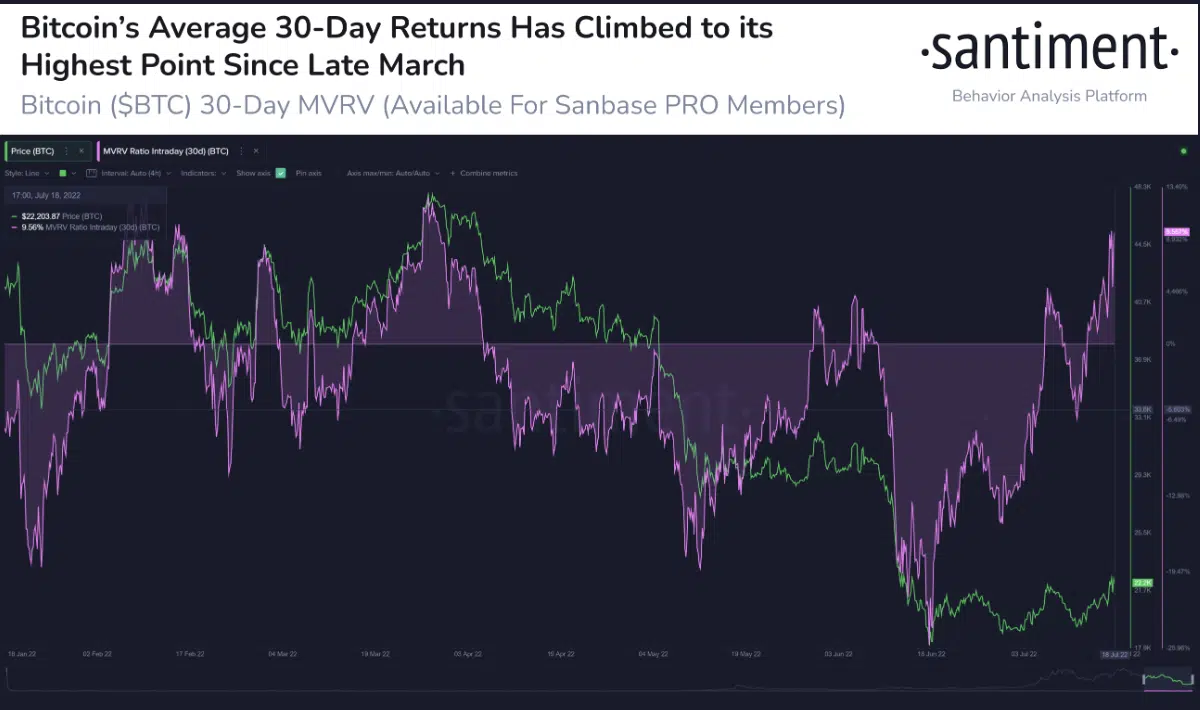

Another ‘bad sign,’ according to the report, was the position of BTC’s 30-day MVRV.

Santiment stated that BTC’s 30-day MVRV jumped by over 9.5% when preparing the report. This uptick represented the highest value of mid-term trading returns since late March when the price per BTC was above $45,000.

While the current position of the coin’s 30-day MVRV was far from the +15% danger zone, Santiment stated that “there is still an increased risk being invested in an asset that is above its resting average of 0%.”