The ‘but’ to Bitcoin holders expecting a rally

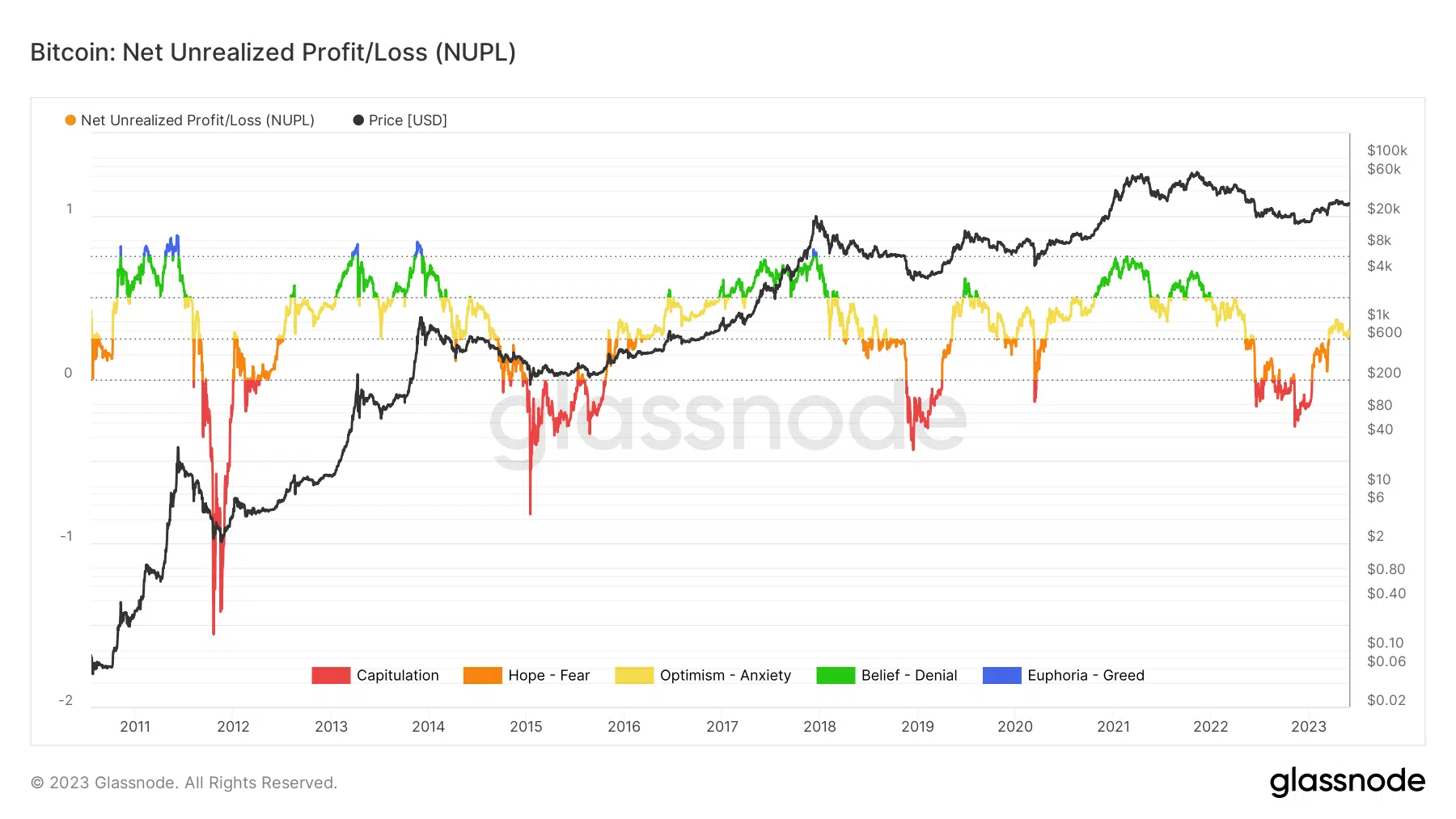

- Bitcoin’s Net Unrealized Profit/Loss indicator was 0.27, indicating that the network was in profit.

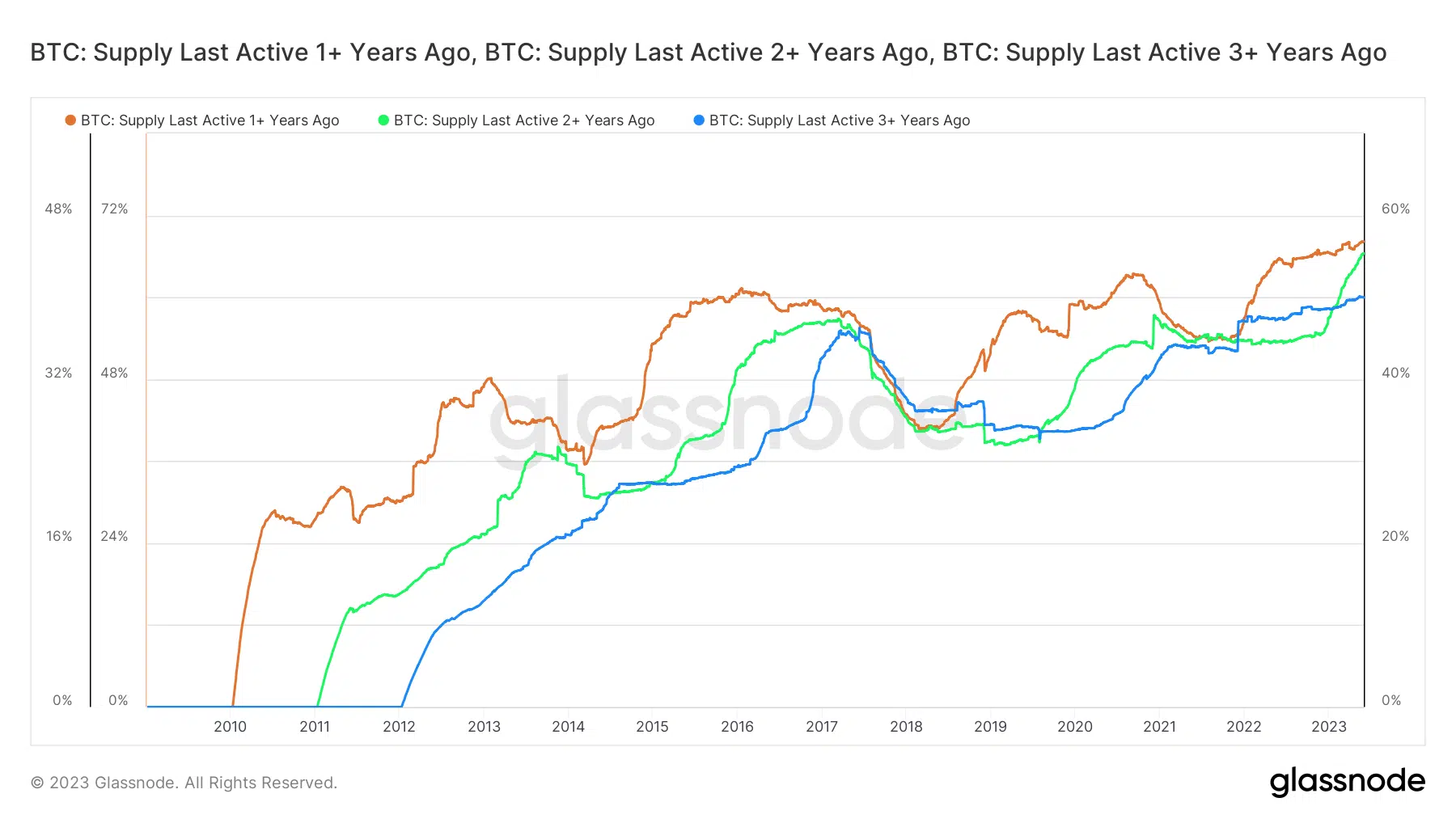

- The increasing dormant supply of BTC served as evidence of investors’ unwillingness to sell.

Battered and bruised after the bloodbath of 2022, the world’s largest digital asset Bitcoin [BTC] made a robust recovery in 2023. This reinforced faith in its long-term potential. The king of crypto coins rallied more than 60% on a year-to-date (YTD) basis, even touching the $30k level in mid-April, data from CoinMarketCap revealed.

As per Glassnode, Bitcoin’s Net Unrealized Profit/Loss indicator at the time of publication was 0.27. This indicated that the network, on the whole, was in a state of profit.

However, despite the surge, many holders resisted the temptation to sell their coins in pursuit of profits. This highlighted an intriguing behavioral trend.

In for the long haul?

This narrative was analyzed with more scrutiny by a financial researcher on Twitter. According to him, BTC holders were showing resilience and were unfazed by the surge in profitability.

Weekly $BTC Network Activity Update:

The upbeat move of #BTC has not inspired cohorts to realize their gains. There is an absence profit realization,

but what does this mean moving forward?

Let's explore the contours and get introspect into these behavioral trend

?1. pic.twitter.com/ZrxWNqzaNq

— NeuroInvest Research (@Neuro__Invest) May 31, 2023

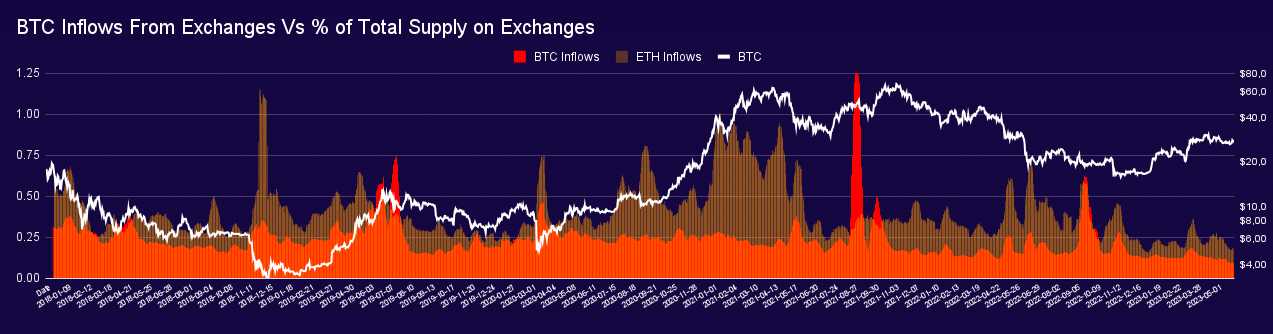

He stated that market participants have been steadily shifting coins out of exchanges, evidenced by dwindling exchange inflows as indicated below. The supply on exchanges, as a result, dropped to significantly low levels.

The increasing dormant supply of BTC served as further evidence of investors’ unwillingness to sell. The percentage of supply held for longer than a year climbed to record highs in the month of May. Most age bands recorded an uptick in their hodling activity.

This also highlighted the fact that long-term coin holders, also known as “diamond hands,” believed that BTC’s peak was yet to come. These holders were also hopeful of a bullish surge in the days to come.

Is the narrative changing?

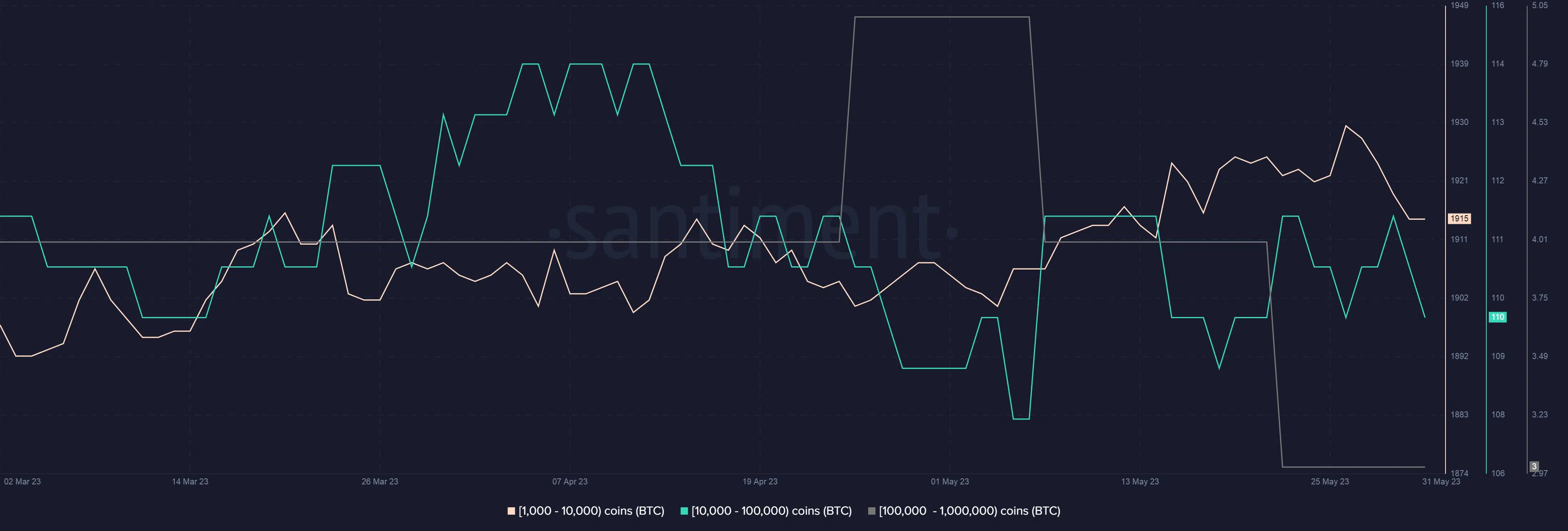

On a larger scale, the aforementioned hodling story was accurate, but some oddities began to show up. According to data from Santiment, there was a significant outflow of coins from large addresses, evidenced by the noticeable drop in the number of addresses holding more than 1,000 BTCs.

The cohort of users holding more than 1,000 coins are called whales and their trading behavior, including sell-offs and accumulation, tends to impact BTC’s price.

Is your portfolio green? Check out the Bitcoin Profit Calculator

At the time this article was written, Bitcoin was trading hands for $26,856, and the market mood was balanced between greed and anxiety. This suggested that the accumulating phase can last for a while without the risk of a price correction.

Bitcoin Fear and Greed Index is 52 — Neutral

Current price: $26,856 pic.twitter.com/ZCY7zjJ5Uf— Bitcoin Fear and Greed Index (@BitcoinFear) June 1, 2023