BTC: These indicators signal HODL behavior, but a decisive daily close…

Bitcoin fell under the $41K mark on 21 April, at press time, it was down by 4.27% over the last day. In fact, the whole cryptocurrency market retreated to $1.88 trillion mark.

But how’s the morale?

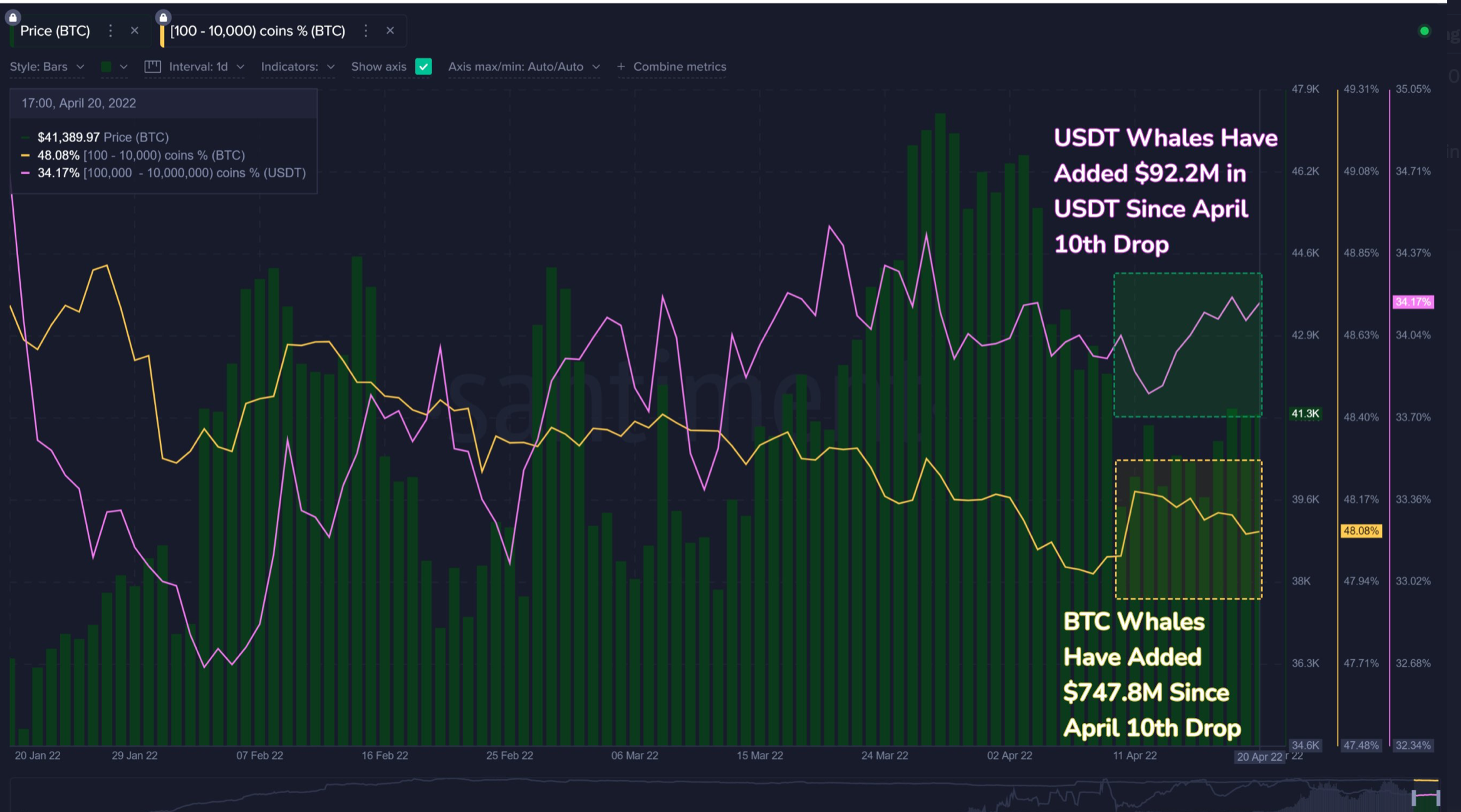

Well, still very high. Dominant buyers continue to acquire more Bitcoin despite the price witnessing a correction. On-chain data provider Santiment reported that whales were accumulating during the recent price drop under $40,000.

Looking at the graph, the analytical platform noted:

“Bitcoin whale addresses holding 100 to 10k $BTC have collectively accumulated 18,104 more $BTC since the April 10th price drop below $40k. However, their holdings are still down substantially since October. Meanwhile, USDT buying power looks promising.”

Indeed, the holdings declined a bit but a major chunk still continues to add value despite the volatility. On the other hand, Bitcoin spot exchange reserves reached their lowest levels in over four years, according to data from Crypto Quant published on 21 April. This was another bullish development for the BTC holders.

$BTC Spot Exchanges' Reserve hits over a 4-year low

Live Chart?https://t.co/52cmYEeYFo pic.twitter.com/BqB7koB5i0

— CryptoQuant.com (@cryptoquant_com) April 21, 2022

As past bore the witness, large quantities of Bitcoin moving off exchanges caused prices to climb if the trend maintained for a few days.

This wasn’t the first time that BTC holders showcased this holding pattern. In fact, in mid April, Bitcoin experienced its largest exchange outflow in five weeks. As much as 25,878 or $1.04 billion BTC left crypto exchanges in just a day. Santiment shared this insight in a tweet dated 15 April.

Warning bells are ringing

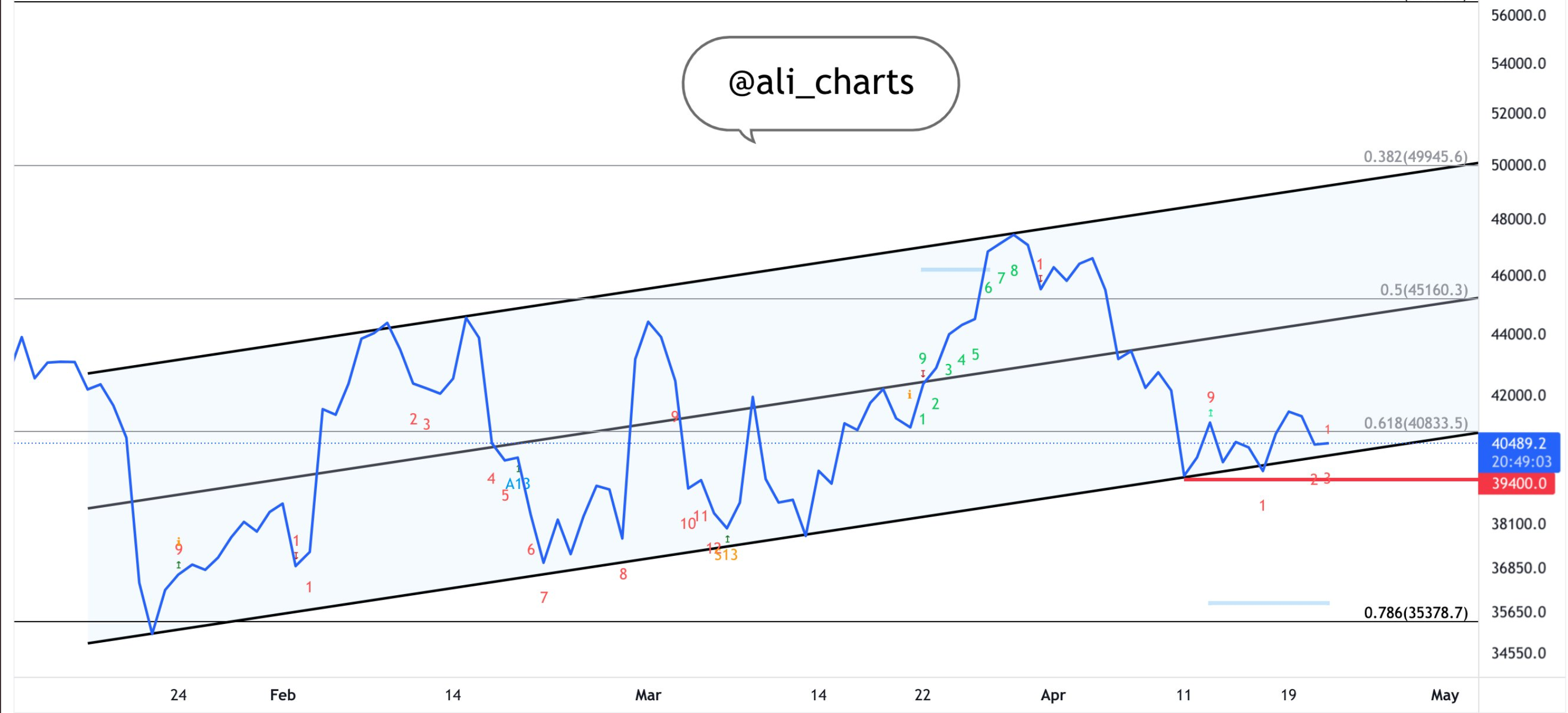

Every peak comes with its fair share of warnings. BTC’s current situation fell under the same narrative. Given the current technical chart levels, crypto analyst Ali Martinez signaled an alarm.

Source: Twitter

He opined:

“Bitcoin needs to get back above $40,800 for a chance to rebound to $45,000 or even $50,000. Be aware a decisive daily close below $39,400-$38,500 can invalidate the optimistic outlook and result in a retracement to $35,000 or even $30,000 for $BTC”.