BTC traders, read this before you lose confidence!

- Bitcoin might already have started its next bull run according to address activity.

- Short-term sell pressure still a function of the run-up as evidenced by profit-taking in the near term.

Bitcoin’s [BTC] stagnating performance combined with the previous failed attempts to push beyond the $30,000 level. This performance has led to a drop in confidence but investors should consider one key factor that may favor the bulls in the long term.

Is your portfolio green? Check out the Bitcoin Profit Calculator

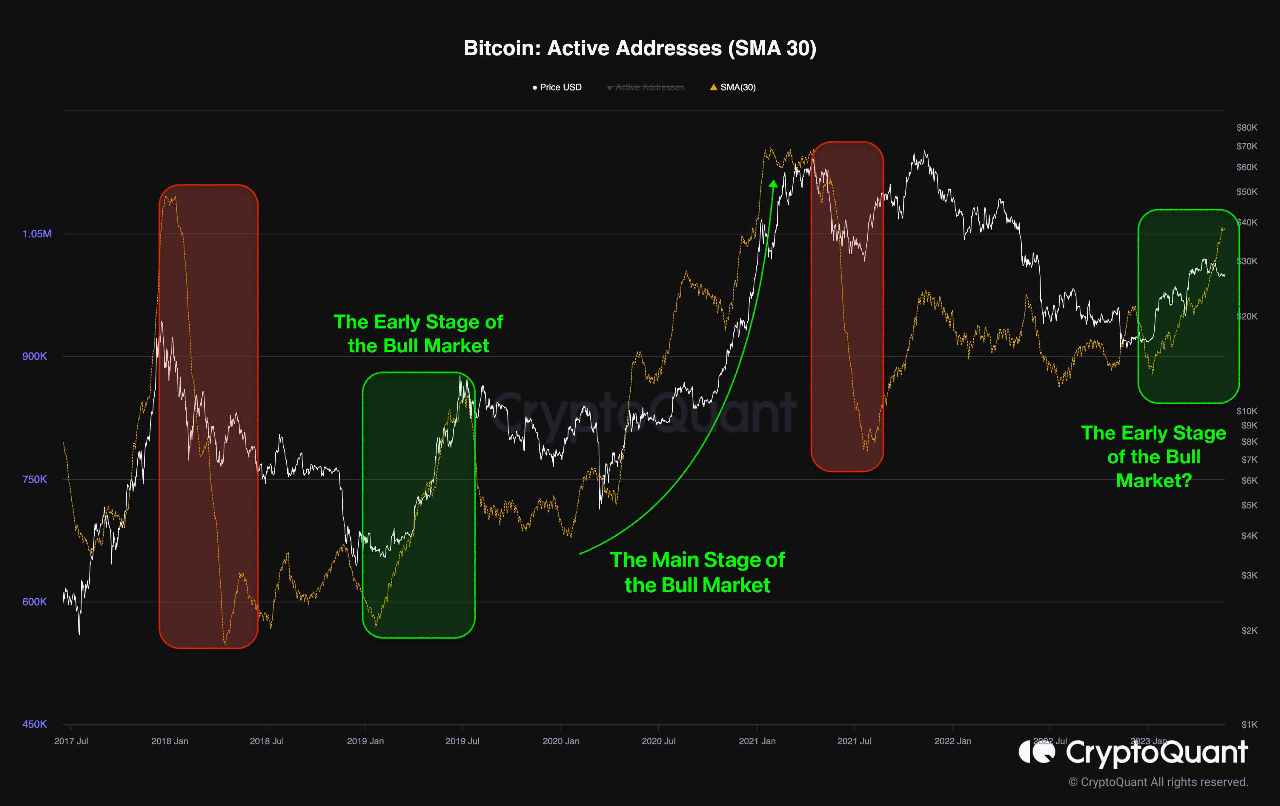

A recent CryptoQuant analysis suggested that Bitcoin might be in the early stages of the next bull market. This was largely based on active addresses on a 30-day moving average. It took into account scenarios where the number of active addresses witnessed significant growth after a consolidation phase.

Bitcoin recently enjoyed a significant surge in active addresses as was previously the case in 2019. If the same trend ensues, then it means BTC has already commenced the next bullish phase.

However, a closer look at the same chart revealed that there were instances where the market experienced corrections. This was reminiscent of the current situation where Bitcoin has been experiencing some retracement after a robust rally.

Assessing Bitcoin’s long-term flows and profit taking

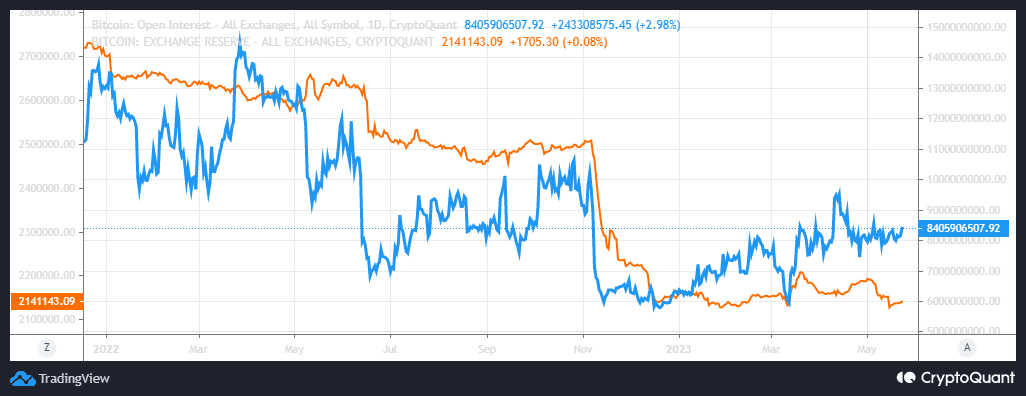

There were other observations in Bitcoin metrics that affirmed the long-term bullish expectations. For instance, Bitcoin’s exchange reserves have been on the decline and stood at their lowest historic levels. This reflected the demand that prevailed in the last few months.

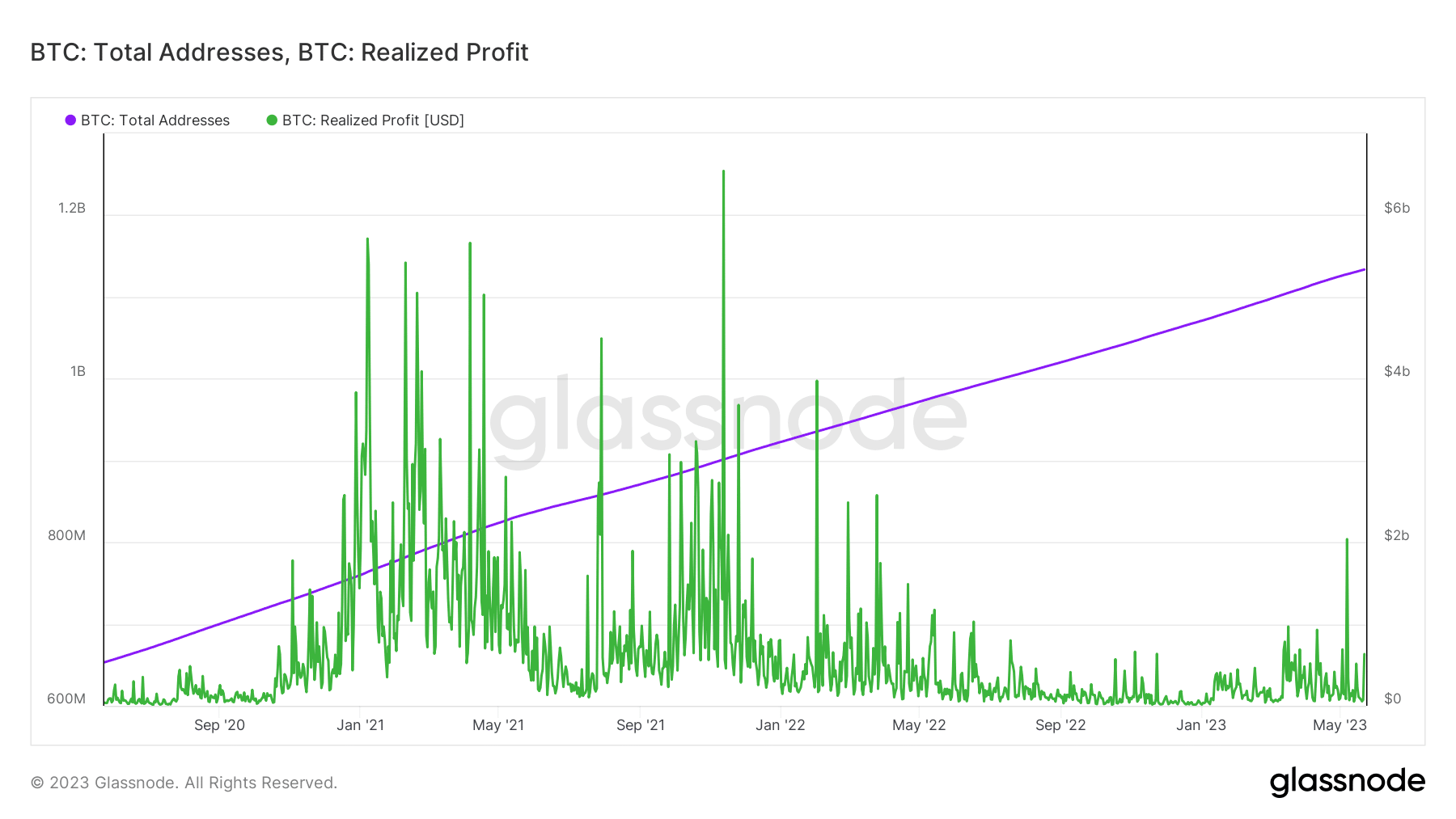

Bitcoin has saw a resurgence in open interest in the last five months. This resurgence reflected the steady growth in the number of addresses holding between which currently stood at $1.13 billion. Another key metric to consider was realized profit which revealed the level of selling that takes place at any given point.

Bitcoin’s realized profit registered its latest large spike on 7 May but since then cooled down a bit. An aggregate look over the last five months confirmed activity which reflected the selling pressure associated with short-term profit-taking.

How many are 1,10,100 BTCs worth today

Although the above analysis stood in favor of a strong bullish recovery, it didn’t necessarily mean that BTC was safe from short-term downside. The latter has been the case recently as the market cools down following its failure to sustain demand above $30,000.

Bitcoin has been trading in a ranging performance for almost two weeks. Its next move is still a toss-up because of the unpredictable nature of the market. However, BTC is now due for a breakout or breakdown from the current sideways price action.