CAKE, Maker, Compound: Why top DeFi tokens have offered double digit gains in the past two days

Dogecoin is not the only altcoin that has rallied offering double-digit gains, nearing a 100% in the current alt season. Top DeFi tokens have offered double-digit gains in the past two days. LUNA and CAKE have offered 16% and 13% gains respectively. The price for top DeFi tokens has increased consistently despite several price corrections. Tokens like CAKE (Rank 31), MKR (Rank 35), COMP (Rank 42), LUNA (Rank 24) are rallying post the correction.

The price is up in response to the increasing trade volume and volatility. Top DeFi tokens have high demand among retail traders since the rewards are lucrative for traders. Founder of Messari Crypto, Ryan Selkis recently tweeted,

Mental model for active vs passive DeFi rewards:

+ short-term capital / liquidity -> active LPs

+ long-term capital / market depth -> passive LPsUniswap v3 crushes passive LPs…good! They're not very efficient. DeFi debt markets reward passive LPs because duration is longer.

— Ryan Selkis (@twobitidiot) April 24, 2021

Uniswap V3 has offered higher rewards and outperformed passive Liquidity Providers that are not as efficient. However, in the DeFi debt market, passive Liquidity Providers have been rewarded over a longer duration. There are several DeFi tokens, ranking below the top 50 based on market capitalization and this is the equivalent of low liquidity, however, they have offered higher returns. The volatility is low in response to low liquidity and consistent gains make up for lost upside in the bull run.

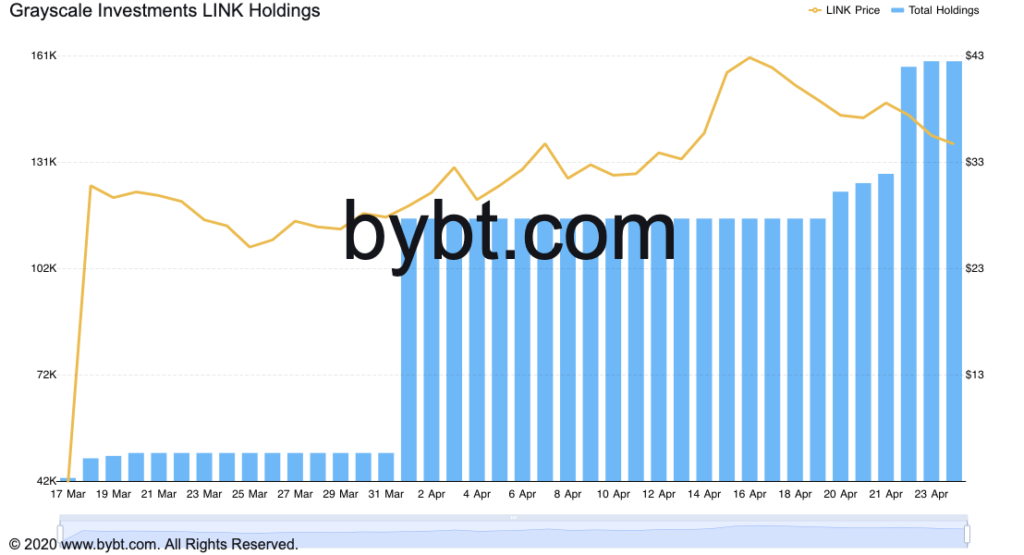

At the same time, there are DeFi tokens that offer high short-term ROI, driven by the large HODLers and institutional buying. Particularly in the case of LINK, the accumulation by Grayscale picked up in response to the recent price dip based on the following chart from bybt.com.

Source: Bybt

LINK Holdings have increased following every dip in LINK’s price. This could be considered accumulation or buying the dip, more largely HODLing through the dip and not selling during the drop. This has helped LINK’s price and this becomes evident from large HODLers and 83% HODLers are profitable at the current price level. The trade volume has dropped in the past 24 hours but this could help reduce the selling pressure across exchanges.

Besides LINK, there are other tokens, however, they are largely undervalued even at the current price level post recovery from the dip. CAKE, MKR, COMP, and LUNA among others are undervalued and there is scope for accumulation by large HODLers in the case of these tokens. These DeFi tokens are offering higher rewards and driving towards a price rally, unlike most altcoins in the top 25.