Can AAVE’s price sustain its uptrend? These are the factors that say so!

- After its latest breakout, AAVE showed strong bullish momentum over the past week

- Traders should watch the $142.68 resistance closely, as a break above this level will signal sustained upside

Aave (AAVE) recently saw a steep rally, breaking above key resistance levels and flipping them to support after recording a 55% jump in just over a week.

However, with the broader market sentiment still in the ‘Fear’ zone at press time, the question is whether the bulls can sustain this momentum.

AAVE bulls provoked a 55% rally in just over a week

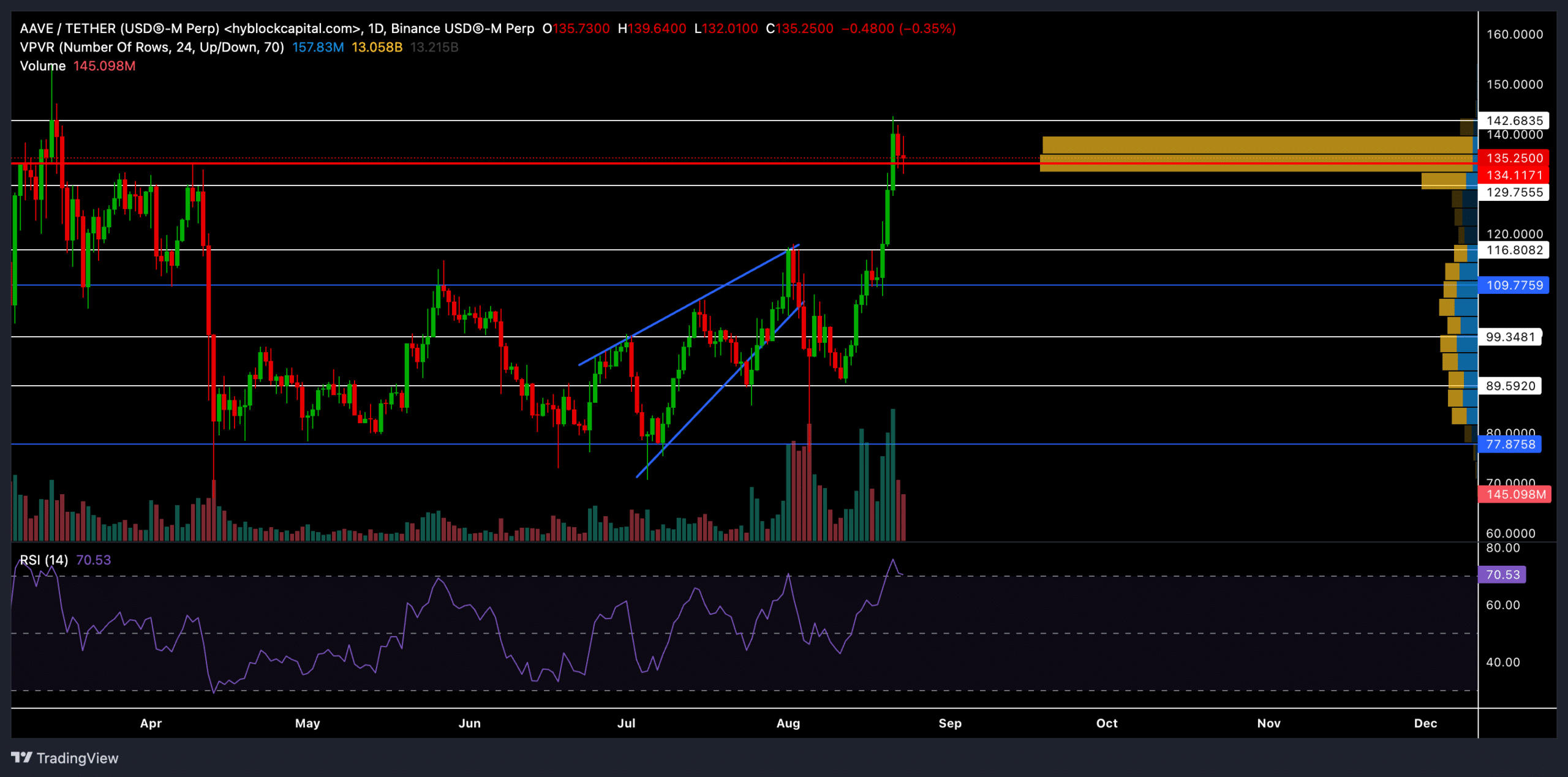

During the first week of August, AAVE witnessed a classic rising wedge breakdown after failing to break above the $116 resistance (now support) level.

However, the recent rebound from the $89 support level has set the stage for buyers to change the trend. This rally pushed the price significantly higher, with AAVE trading at $135.68 at press time. The price then hit the resistance near the $142.68-level, which could be a crucial barrier for the bulls to overcome. Here, it’s worth noting that the recent surge was accompanied by strong volume, but the price entered a relatively high volatility zone.

The Volume Profile Visible Range (VPVR) indicated strong resistance around the $135-$142 range, which coincided with the previous high-volume rally. Failing to break above this level could result in a pullback towards the $116 support level.

After its most-recent buying rally, the technical indicators turned overbought. So, a potential correction could be plausible, especially with the Relative Strength Index (RSI) reversing from the 75-zone.

Key levels to watch

The immediate resistance to watch seemed to be at $142.68. If AAVE can break and sustain itself above this level, the next target could be around $150. On the downside, if the price fails to hold above $129, it could revisit the $116 support.

Since the altcoin recently flipped the $129 level from resistance to support, we could see a potential re-test of this support, followed by a consolidation phase.

The overall volume fell by 33.05% over the past 24 hours while the Open Interest dropped by 6.60%. This suggested that some traders have been taking profits or closing positions after the rally.

The long/short ratio for the last 24 hours, at press time, was 0.9889, indicating nearly balanced sentiment with a slight bearish edge.

Finally, the AAVE/USDT long/short ratio on Binance was notably bearish at 0.2758, This could mean that some traders are expecting a pullback. Investors should also monitor broader market trends and any significant news that could affect AAVE’s price action in the coming days.