Can Bitcoin ETFs restore crypto liquidity to pre-FTX levels

- There were expectations of increased flows on crypto exchanges post the approval.

- Bitcoin was well-placed to make an impressive start to 2024.

Crypto market was eagerly looking forward to the potential approval of spot Bitcoin [BTC] exchange-traded fund (ETF) applications, seen as a more convenient way for TradFi investors to gain exposure to cryptocurrencies.

With the final deadline of several applications due in January 2024, the question, however, in everyone’s mind was – will ETFs succeed in restoring crypto liquidity to levels seen before the FTX collapse?

Spot ETFs may turn it around for the market

A recent report by crypto market data provider Kaiko referred to ETFs as the “single biggest catalyst” in reviving the two measures of liquidity – market depth and trading volumes.

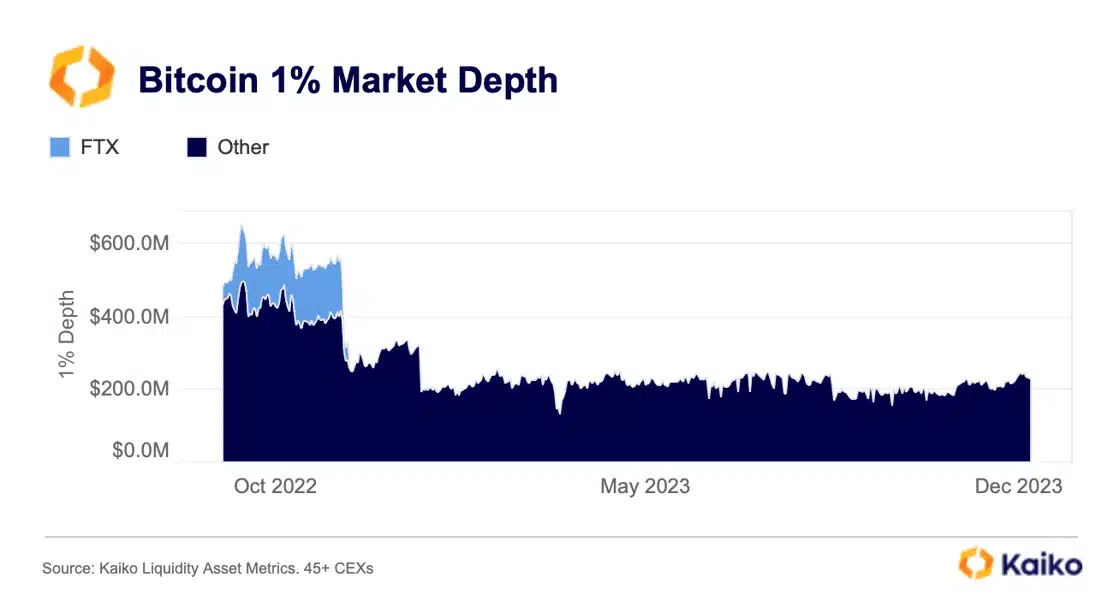

As seen from the graph below, market depth was hammered in the aftermath of FTX implosion and stayed suppressed for much of 2023. Even the ongoing market rally failed to bring about a meaningful recovery.

However, spot ETFs would require buying Bitcoins in huge quantity from authorized crypto exchanges or other holders. Occasionally, they might also be selling coins to rebalance their holdings. This could boost trading activity on exchanges.

Furthermore, spot ETFs are expected to mimic the actual price of underlying Bitcoins. To maintain this, arbitrageurs would continuously buy and sell depending on whether ETF shares are trading at a premium or discount to Bitcoin’s price.

Hence, there was a higher likelihood of enhanced liquidity in the market once spot ETFs are green-lighted, Kaiko noted.

Conditions favorable for Bitcoin?

AMBCrypto had earlier reported capital inflows of $155 billion into the Bitcoin market upon clearance of the ETFs, with Bitcoin’s spot price zooming to somewhere between $50,000 and $73,000 as a result.

This was yet another strong example of spot ETFs having a favorable impact on the market.

As of this writing, BTC held on to its gains above $42,000, AMBCrypto spotted using CoinMarketCap’s data.

Is your portfolio green? Check out the BTC Profit Calculator

Shivam Thakral, CEO of India cryptocurrency exchange, noted a positive market sentiment following the U.S. Federal Reserve’s dovish stance.

He said,

“We can expect and impressive start of 2024 for Bitcoin and other assets as events like ETF approvals are lined up for early 2024.”