Can ETH reclaim the $2000 throne as the market enjoys some bullish relief

- ETH volumes and liquidations highlighted subdued activity.

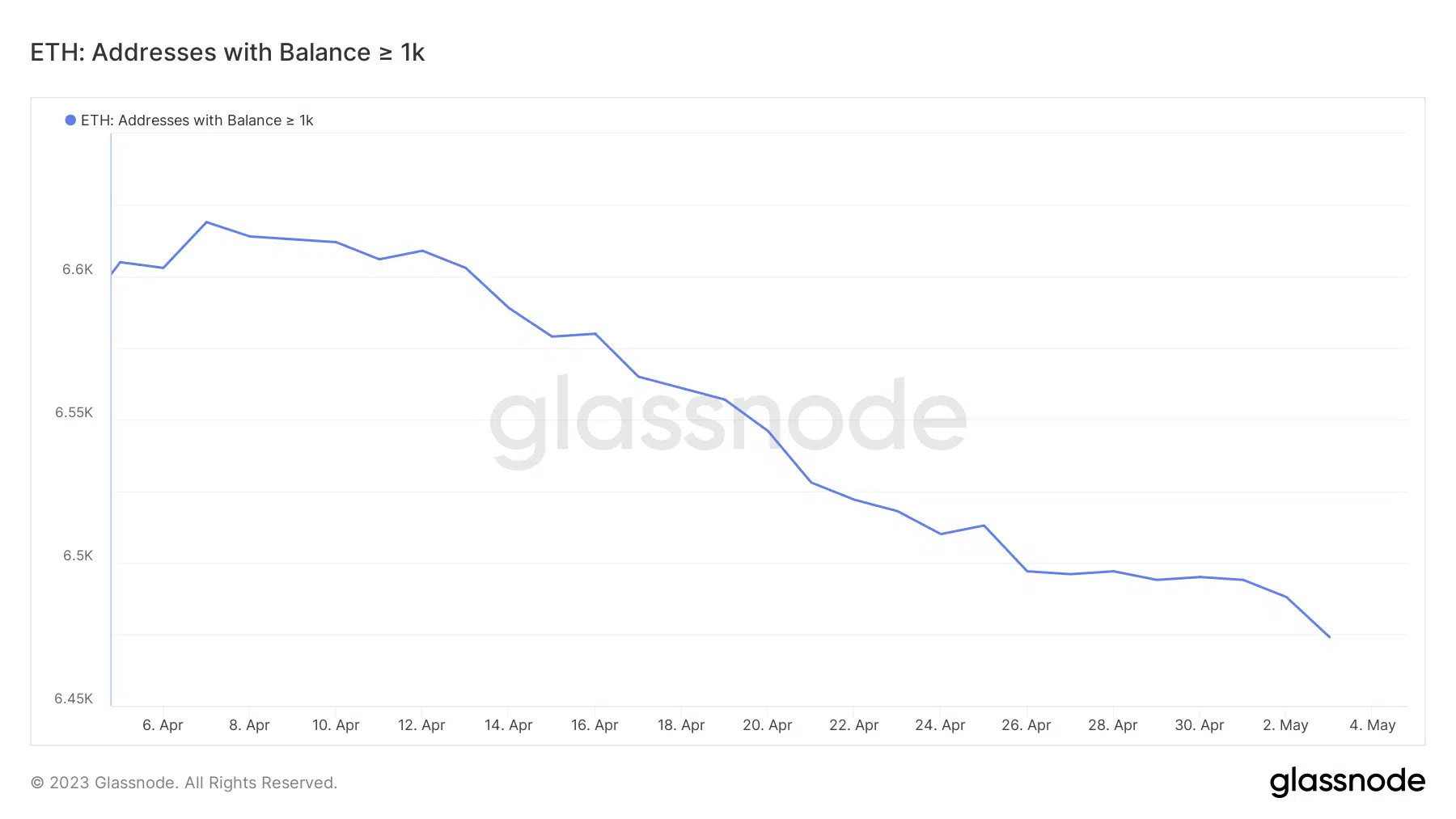

- ETH’s struggle to gain bullish momentum was seen as whales continued selling.

Ethereum’s native cryptocurrency ETH has been stuck in a bit of a stalemate for two weeks, and investors are anxiously waiting to see which direction the market will lean.

The probability of a bullish breakout from the stalemate just went up a notch thanks to the U.S. Federal Reserve’s 25 basis point rate hike.

Some bullish strides here…

We observed the return of some bullish momentum in the previous instances where the U.S. Federal Reserve announced a similar rate hike figure. As such, ETH and most other top cryptos experienced a bit of bullish excitement in the few hours after the rate hike announcement. One of the main signs of the excitement was the surge in deposit contracts in the last 24 hours.

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 19,279,936 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/PjU1Xwlmpb

— glassnode alerts (@glassnodealerts) May 4, 2023

Now the big question is whether ETH will maintain the bullish momentum and head for yet another retest of $2,000. The answer depends on multiple factors, and the key among them is the level of demand that the cryptocurrency can achieve in the next few hours.

Is your portfolio green? Check out the Ethereum Profit Calculator

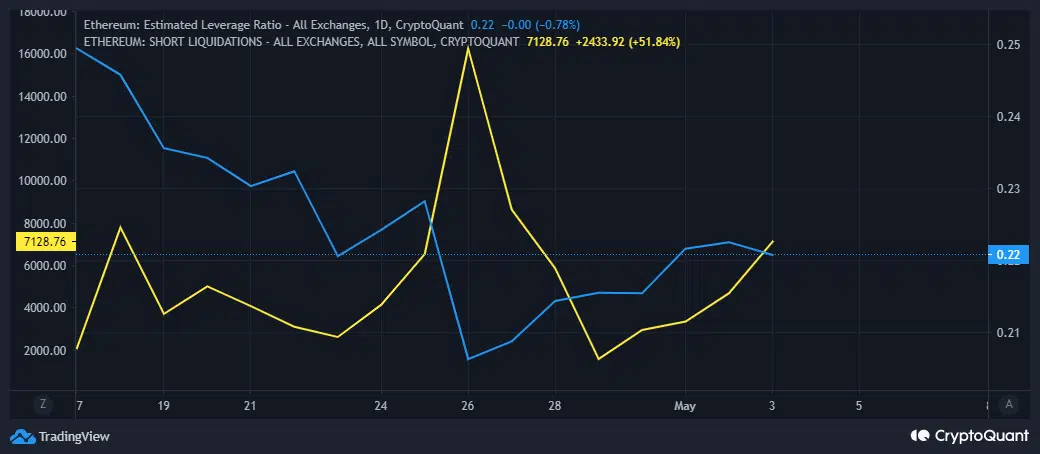

One of the best ways to assess the level of buy pressure is to look at the level of leveraged liquidations that may trigger buy pressure. The estimated leverage ratio achieved a downward pivot within the last two days as the price gained bullish momentum. Meanwhile, short liquidations soared since the start of May.

The above observations suggested that the leverage pivot may have disfavored leveraged shorts. However, the subsequent surge in liquidations has so far been smaller or less intense than the previous wave of liquidations on 26 April. In other words, the subsequent bullish momentum had been subdued, largely due to low volumes.

So far the markets have demonstrated a lack of significant confidence to support a decent enough rally to reclaim the $2000 price level. Not so long ago we looked into the fact that traders were shifting to a short-term focus and that seems to be the case in the last few days.

ETH: A tale of low volatility and directional weakness

ETH, at the time of writing, was still seen having a tough time securing more upside as seen in its recent price action despite the hopes of a sizable mid-week bounce. It exchanged hands at $1875 at press time.

How many are 1,10,100 ETHs worth today

ETH’s MFI confirmed that there were some inflows that were in line with the slight mid-week bullish momentum. However, a look at whale activity revealed that the whales continued selling despite the recent relief from the FED.

ETH traders should keep an eye out for whale activity. This is because the bulls will likely not have the strength to push past the $2000 range without support from the whales.