Can Ethereum actually fall to $2700 just because investors want it to

Ethereum has seen bouts of hikes and falls this month with single-day increases touching almost 11.3% and single-day falls sitting at 10.5%. In such an unanticipated market, why are people turning bearish for Ethereum is the question.

And, even if they are, what are the chances of Ethereum actually falling further?

Investors want Ethereum to fall?

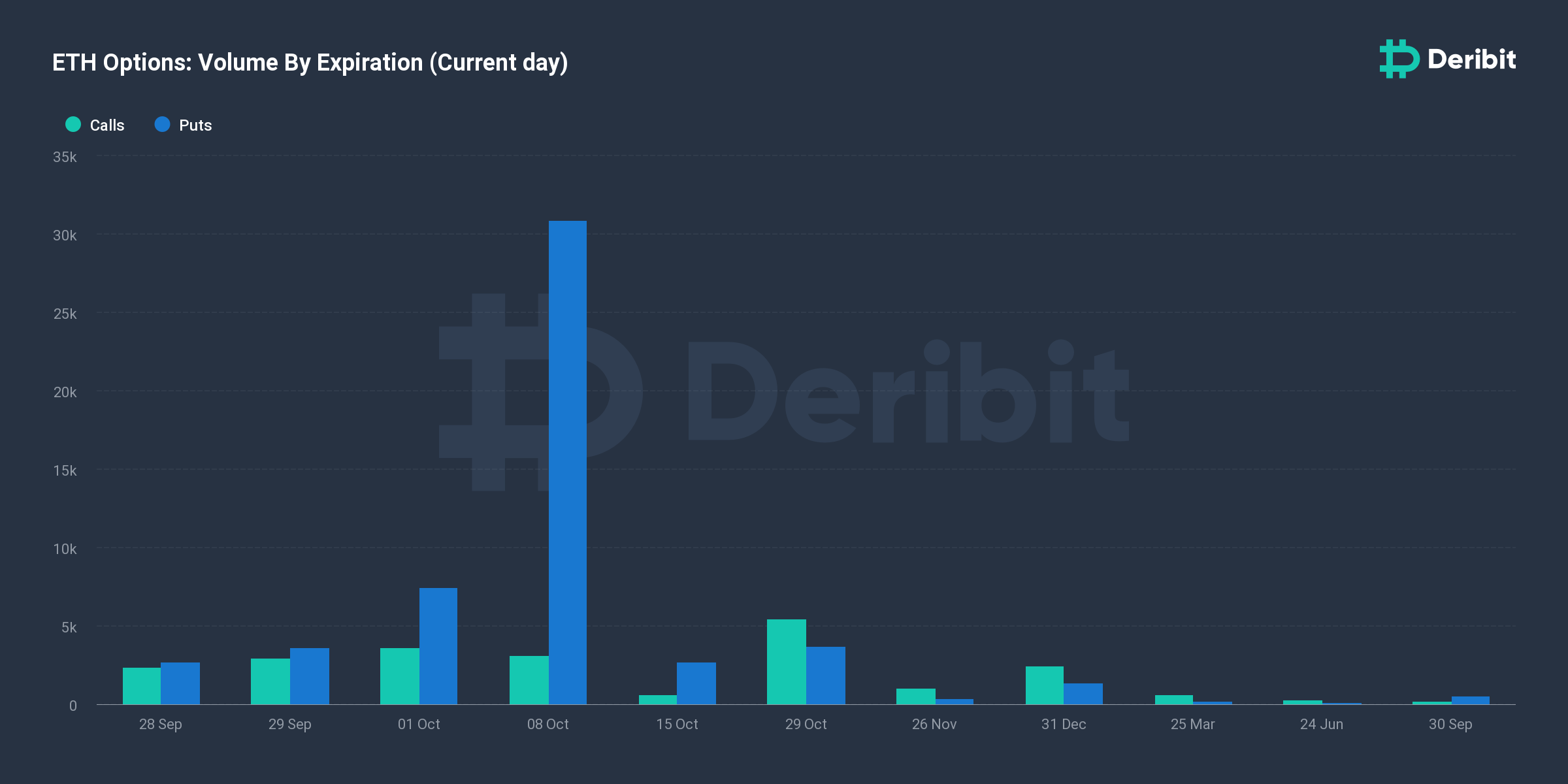

Not all, obviously. The observation comes from Deribit’s puts and calls contracts data. According to the same, trading volumes of Puts Options have been as high as 31k, amounting to more than $90 million. These options are targeted mostly for Ethereum to hit $2700.

Now, since Deribit represents almost 96% of all Open Interest in the Options market, it can be considered as almost all of the market’s opinion.

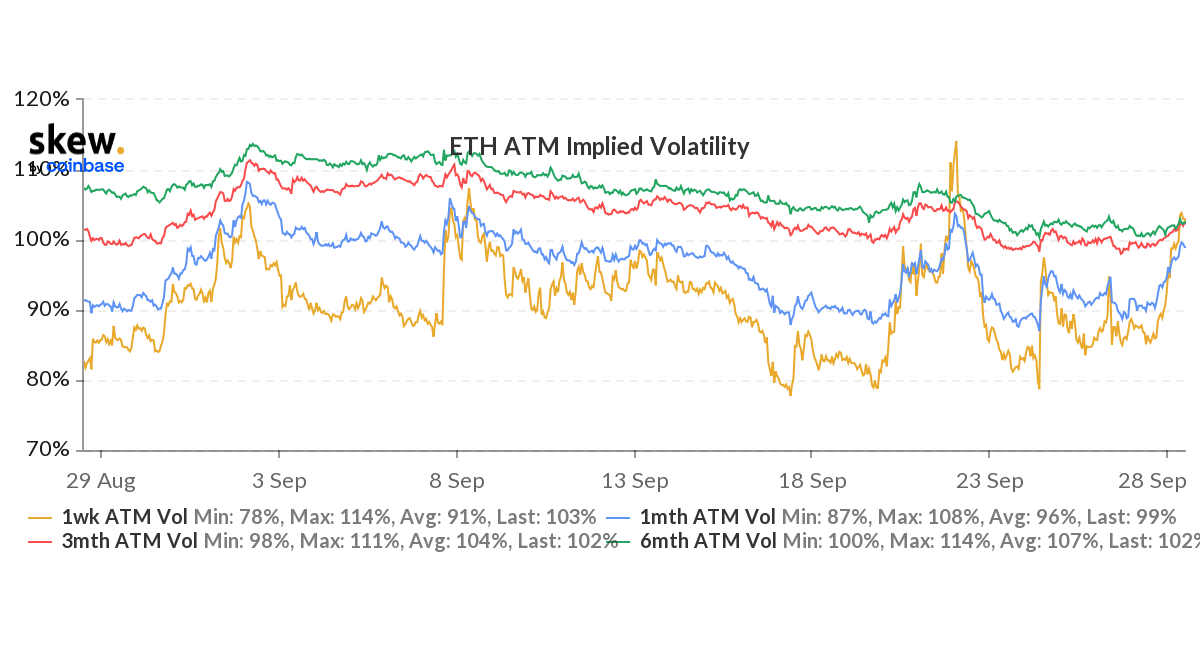

This observation comes despite the fact that for over a month now, the Options market has witnessed bullishness rising. The Implied Volatility (IV) to Realized Volatility (RV) spread signals this as the IV has been superseding RV for a while now.

And, with the at-the-money (ATM) implied volatility reaching above 100% for all 1 month, 3 months, and 6 months, the market can expect some price swings in the positive direction.

Ethereum ATM IV | Source: Skew – AMBCrypto

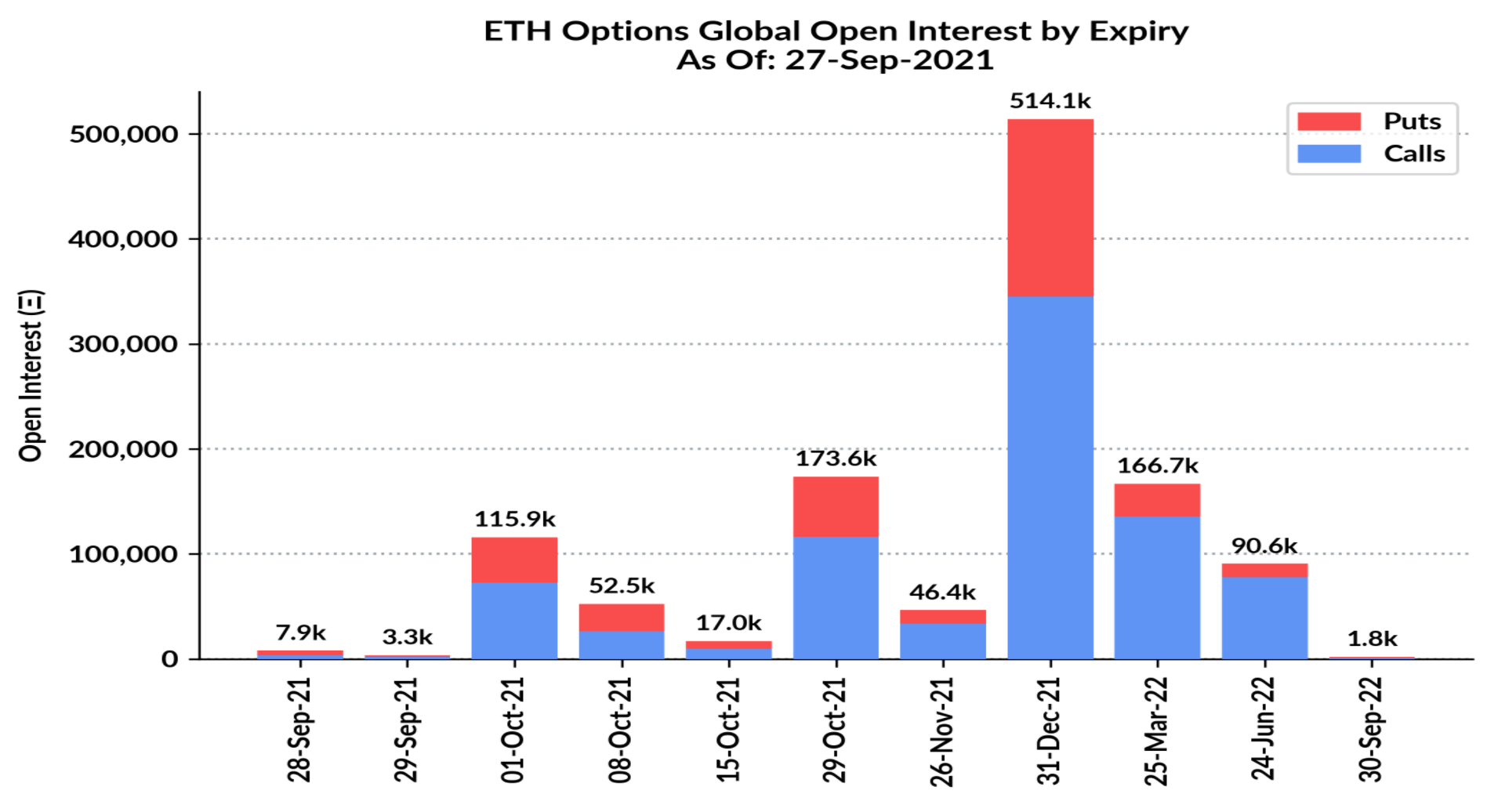

There is also a 60% domination of Calls Options for contracts expiring on 1 October where investors are coveting for Ethereum to hit $3200.

But then again, there is a 40% Puts domination as well expiring on 1 October, in addition to the ones that are expiring on 8 October.

Ethereum OI by expiry | Source: Skew – AMBCrypto

What are the chances of Ethereum dropping?

Nothing can be said with any certainty, but there is a fair chance of a price fall happening. According to the probability index, for instance, in October, there’s a 54% chance Ethereum will drop to $2700.

If the market wants to reduce this 54% probability and avoid a fall, some buying pressure is needed stat. The price over the week has already gone down by 12.3%. Looking at the RSI and the SAR movement, no immediate change in trend is guaranteed either.

Ethereum’s 12.31% Price fall over the week | Source: TradingView – AMBCrypto