Can LDO pivot finally now that Lido staking deposits are recovering?

- Lido Finance experienced a drop in the popularity of its staking platform in November.

- However, LDO’s money flow did register some upside in the last few days despite the downside.

LDO fans are in for a treat following Lido Finance’s latest analytics update. The staking platform revealed that it observed an increase in staking deposits on multiple chains that support its operations.

Read Lido DAO’s [LDO] Price Prediction 2023-2024

Lido Finance experienced a drop in the popularity of its staking platform in November during and after the FTX collapse.

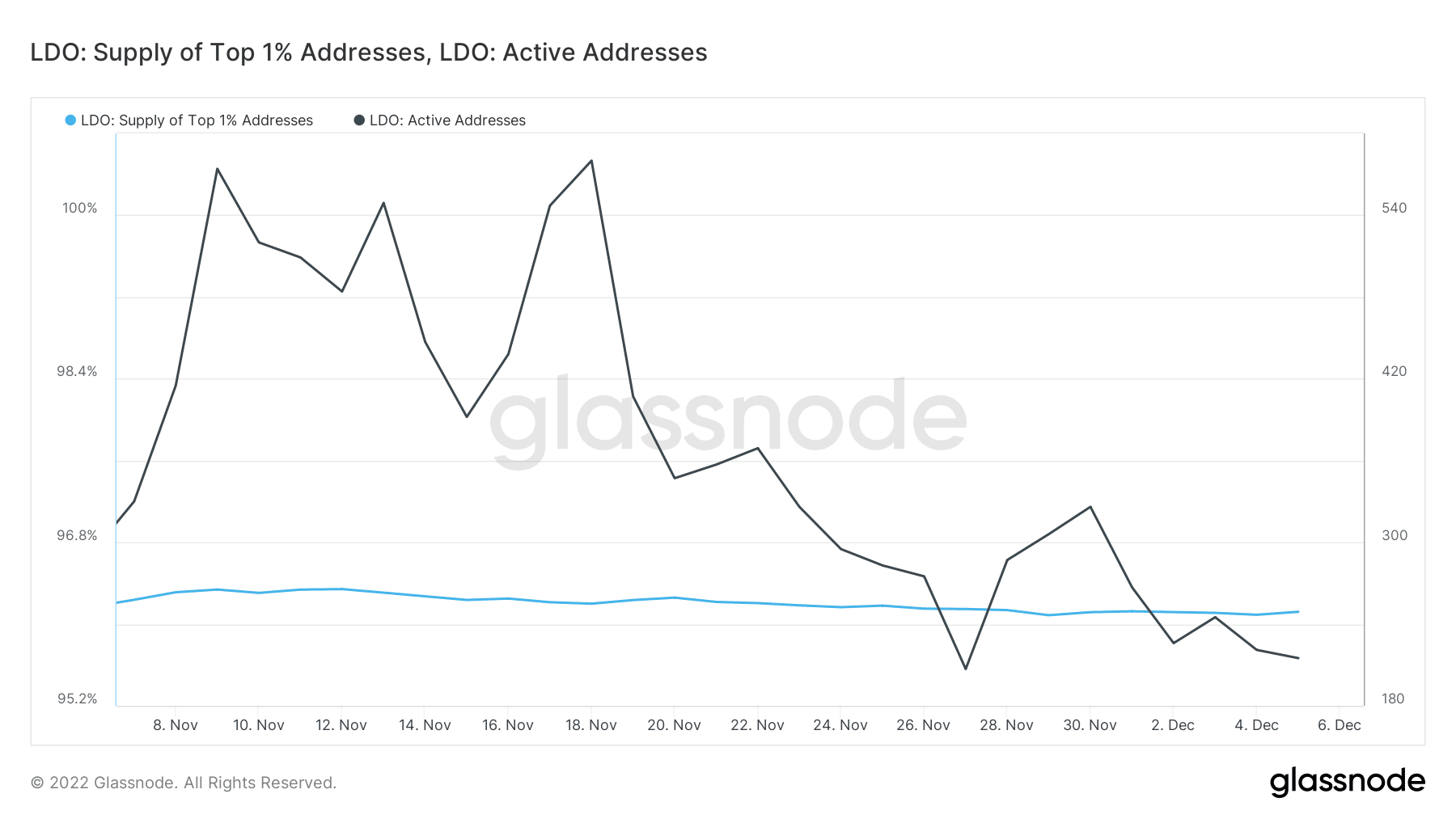

Its LDO token subsequently faced less demand and as a result, saw more downside. The number of active addresses holding the token subsequently dropped from the second week of November to the end of the month. Similarly, the supply of the top 1% of addresses registered significant outflows.

At press time, active addresses were still low but the supply held by the top 1% of addresses did register a slight uptick. This was not the only upside registered in the last few days. Lido’s latest data revealed that staking deposits were up significantly since the end of November.

? Lido Analytics: Nov 28 – Dec 05, 2022

TLDR:

– Lido staking deposits rose across all chains but Polkadot.

– stETH/ETH rate is gradually recovering after Nov turbulence and now is 0.9891.

– December rewards for integrations are live totalling 3,155,500 LDO. pic.twitter.com/XA6swdClu1— Lido (@LidoFinance) December 5, 2022

You might ask, why are these observations important? Well, because a return of investors’ interest means the staking platform can now get back onto the fast lane.

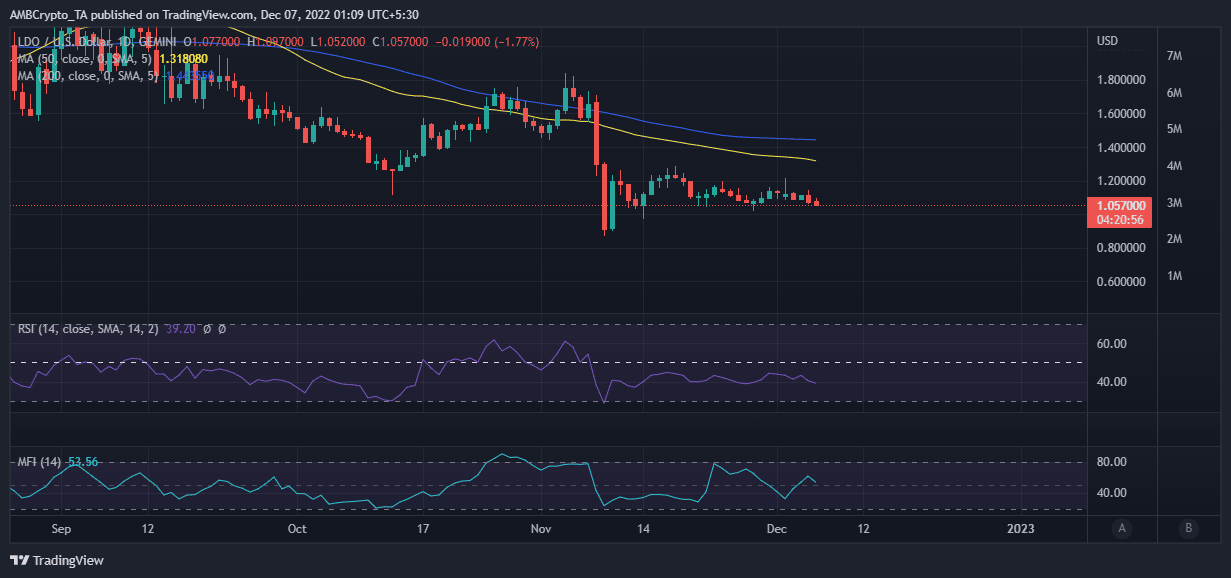

This could theoretically translate to more demand for the LDO token. The latter has been on a strong downtrend since mid-August and is yet to deliver a sizable recovery after its bearish performance in November.

LDO’s $1.05 press time represented a 12% retracement in the last five days. This means it has continued to seek more downside despite the fact that demand for Lido staking is recovering.

LDO’s money flow did register some upside in the last few days despite the downside. This might be an indication of demand recovery and accumulation. Enough accumulation will eventually lead to a bullish pivot and that may happen any time from now.

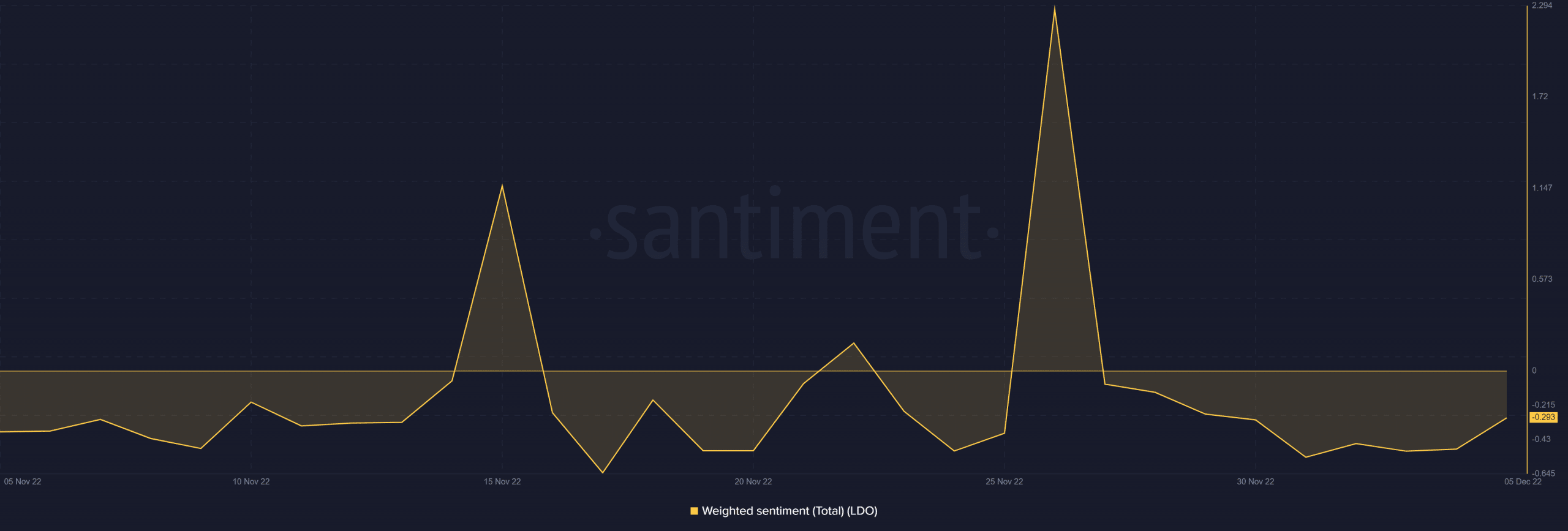

The expectations of a bullish pivot are further supported by a slight uptick in LDO’s weighted sentiment. This indicates that the number of analysts and traders with a bullish bias/expectation have increased.

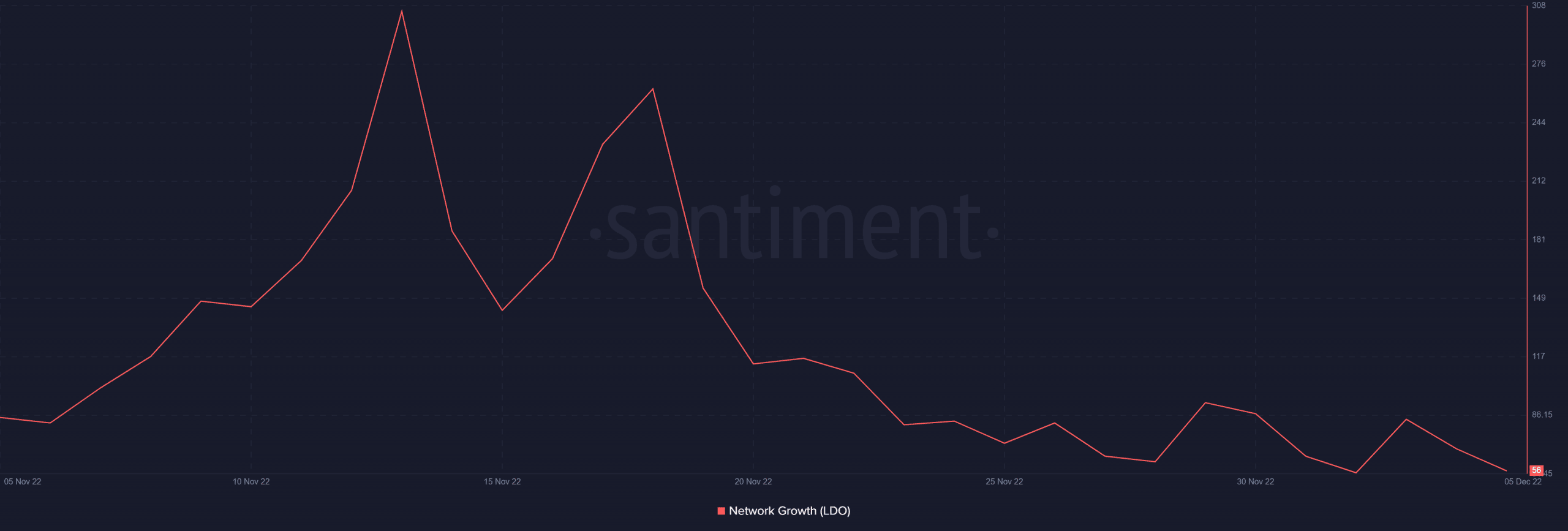

Nevertheless, this upside is minimal, hence not an indication of a strong incoming bullish wave. One potential reason for this is that Lido’s network growth is still low despite the bullish signs and the resurgence of demand for Lido staking.

Nevertheless, the network growth metric has been hovering within the same bottom range since the end of November.

Judging by the above observations, the increasing demand for Lido staking is a positive sign for LDO’s performance for the remainder of 2022. LDO still has the potential for an end-of-year rally especially if the rest of the market adopts a favorable sentiment.