Can Litecoin traders expect more

Most altcoins have witnessed a decent rally over the past couple of weeks. While some coins had more sustained upward rallies others struggled to break past their major resistances. The fourteenth ranked alt, Litecoin held ground firmly. LTC traded at $177.95 at press time, highlighting 16.13% weekly gains but had fallen by 0.62% on a daily chart.

Litecoin has had a pretty decent run since July 22, recording red candles on a daily chart only on three days. While LTC had rallied almost 31% in the last ten days, its price trajectory turned downward at the time of writing.

Additionally, LTC’s RSI which had been in the overbought zone since August 8, on a daily chart was also turning towards the neutral zone, highlighting a downtick. Litecoin, after reaching a local top at $186 on August 15, seemed to take a downturn, but does it mean that this was it for Litecoin, or could LTC investors expect more?

High noise, low activity

Social volumes and other social metrics like weighted sentiment for LTC highlighted a decent number but it still wasn’t as high as the May levels. If this feels worrisome, there’s more to it. Litecoin’s active addresses (24-hours) saw a steep decline. With network activity seeing a fall, it was evident that the network lost participants even as the price kept on going up.

Litecoin’s U-turn

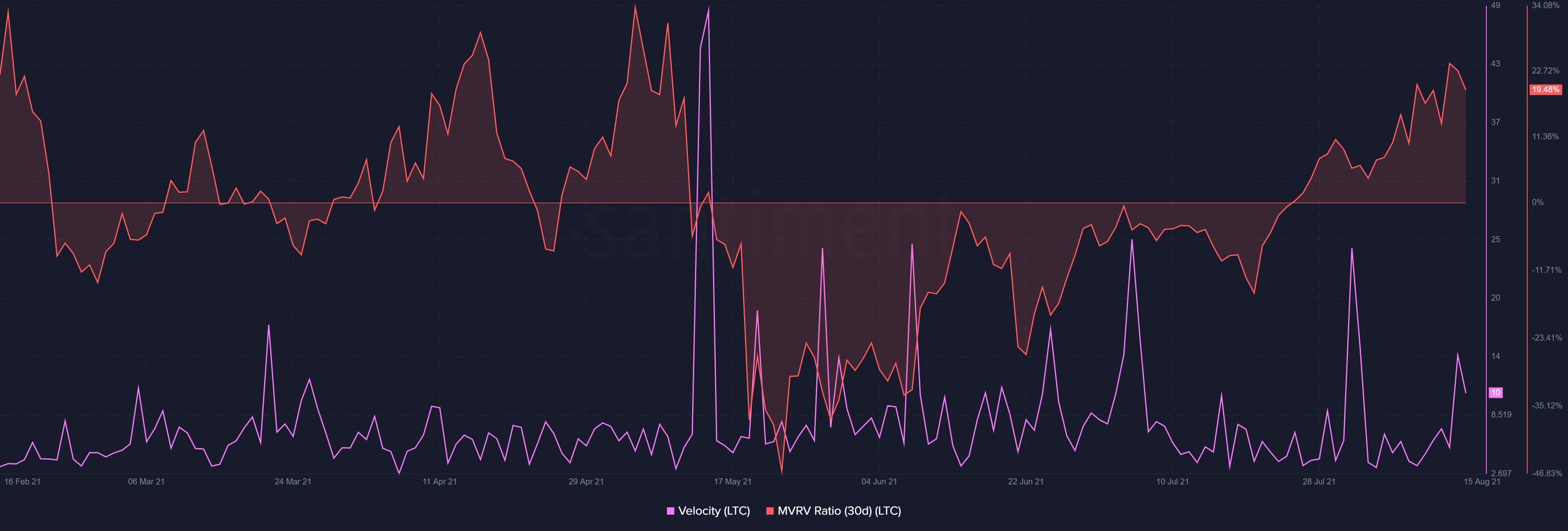

Litecoin’s MVRV ratio (30days) peaked at a three-month ATH on August 13 but took a U-turn after reaching those levels. Even though MVRV was positive which meant that market participants were in profit, its turn from the same highlighted that profits started cutting down after August 13.

Furthermore, LTC’s velocity also saw a sharp downturn on August 14; this meant that the crypto was used in transactions less often during that time frame. The velocity was 50% lower than its last ATH which was on August 1.

Network lacking solid development

Earlier this month, CoinShares Co. rolled out a new Litecoin ETP (a physically-backed cryptocurrency exchange-traded product). At launch, each unit of the Litecoin ETP was backed by 0.2 LTC, thus providing investors passive exposure to the alt. While external development for LTC seemed to be good, development activity on the network remained pretty low.

Even though LTC’s price still held its ground, on-chain metrics and network activity suggested that LTC’s peak had reached and the coin might go down from there. But, it’s not all bad, a lower Liveliness on LTC’s chart highlighted that it decreased because LTC Holders might be accumulating and this was a good sign for the network.

LTC highlighted a sustained upward trend and with some support from bulls in the next few days it could sustain its rally further. If not, LTC might see some losses in the short term.