Can Polygon [MATIC] overcome the bears as exchange supply hits…

![Can Polygon [MATIC] overcome the bears as exchange supply hits…](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-02T111554.707.png.webp)

- MATIC exchange supply increased as trading activities suggested sell pressure.

- Addresses holding 10,000 to 100,000 MATIC held back on transacting.

Over 20 million Polygon [MATIC] tokens were onboarded on exchanges in the last seven days. According to data from Santiment, the exchange supply, which experienced a notable downshift till 24 March, reversed in the opposite direction the next day.

Is your portfolio green? Check the Polygon Profit Calculator

The metric indicates the percentage supply of an asset being stored on centralized exchanges. When the value of this metric decreases, it means that tokens are being moved out of exchanges.

Time to erase the gains?

However, the current trend displayed by MATIC supports the opposite. And this could mean that investors are entering the market with the motive to sell. Hence, this could have a bearish effect on MATIC.

On the other hand, this could also signal accumulation in the long term. If investors take such action because of a prolonged storage period, then it could prove to be instrumental to the asset’s bullish strides.

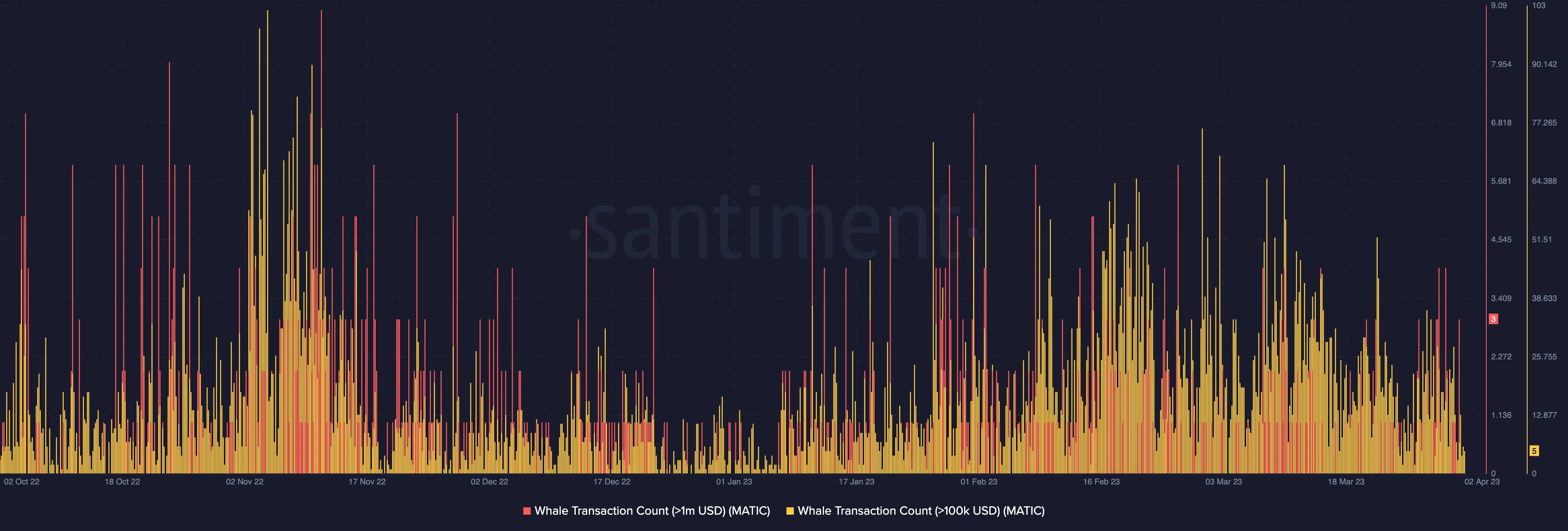

But looking at on-chain data, the steps taken by addresses holding between 10,000 to 100,000 tokens showed a decline in transacting large volumes. Although there were a few spikes, the overall sentiment suggests restraint.

Therefore, it seems that sharks were not particularly involved in topping up their MATIC holdings despite the recent positive development around the Polygon ecosystem.

Exchange inflows exceed outflows

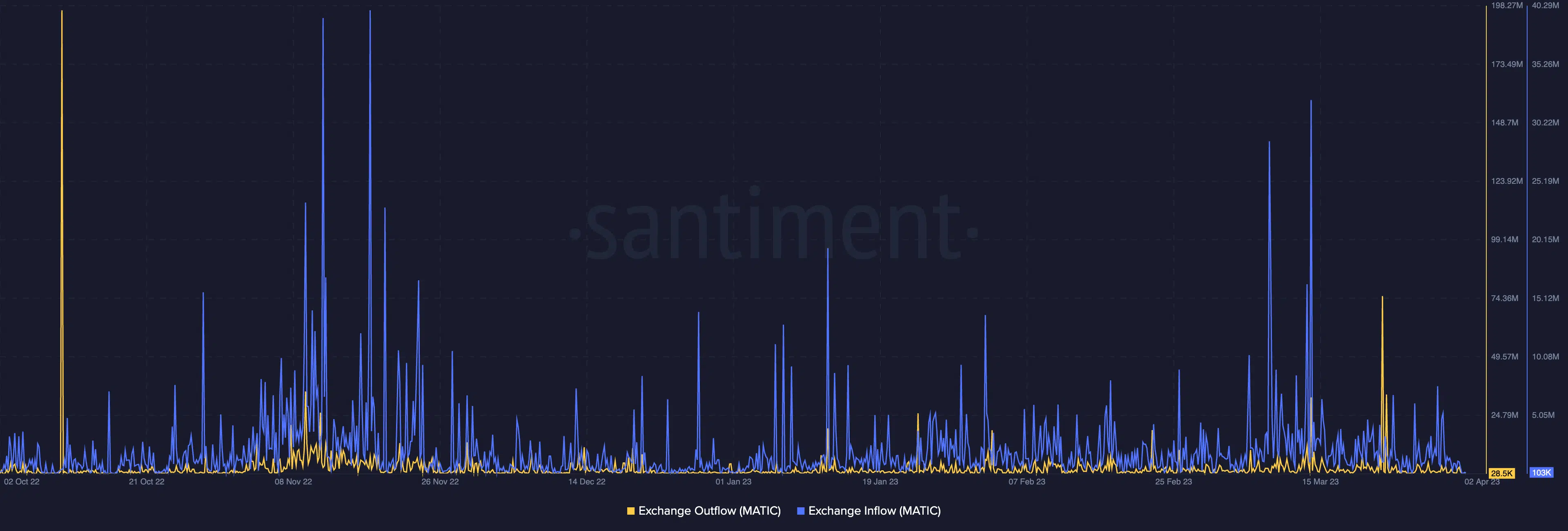

Is sell pressure expected in the short term, especially as MATIC’s growth in the last seven days cumulatively peaked at 2.34%?

Well, on-chain data showed that exchange inflow at press time was 103,000. The metric interpretation is similar to that of the exchange supply.

So, this implies that 103,000 MATIC tokens could be in line to be dropped off. In contrast, the exchange outflow was 25,000 around the same period. Thus, one cannot rule out a forthcoming dump in the MATIC value with such a wide margin.

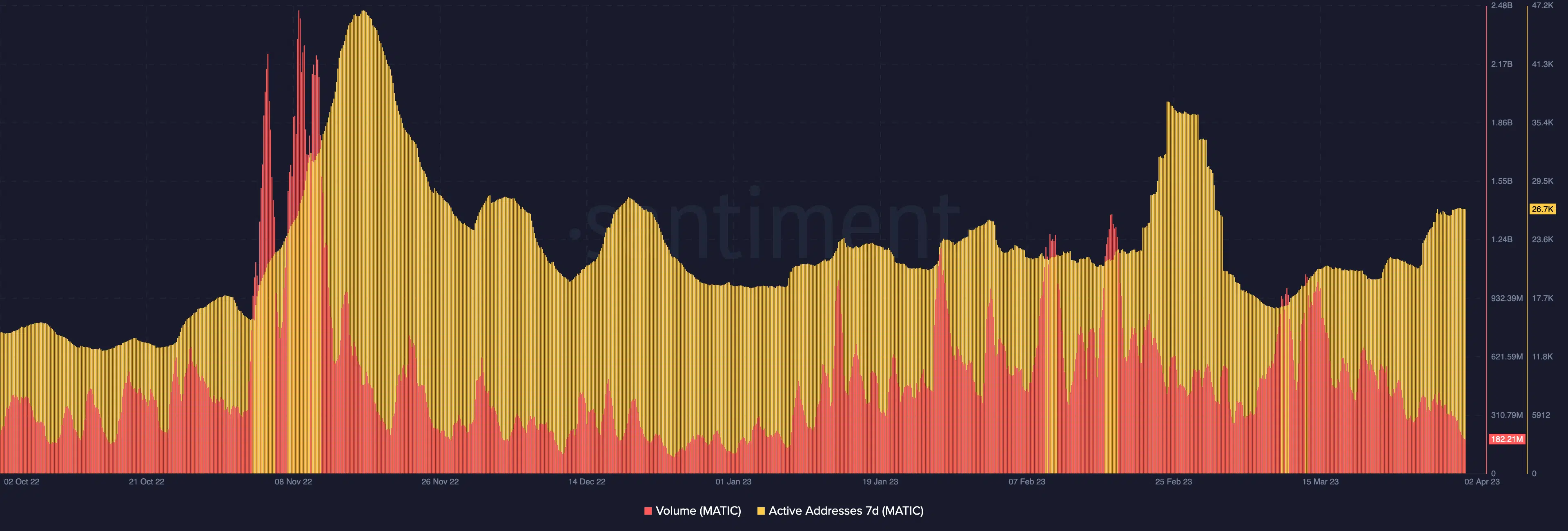

However, the possible intent to sell might not happen in quick succession. This was because the MATIC volume was suppressed in the last 24 hours. At the time of writing, the volume was down 34.63% to 182.21 million.

How much are 1,10,100 MATICs worth today?

The volume represents crowd sentiment and shows the number of tokens involved in transactions on a network. Hence, the projected fall in price might not be immediate since the MATIC volume was down.

Furthermore, active addresses on the Polygon network have grown in the last seven days. This indicates that there was a lot of speculation around the token. And traders have actively deposited intending to jump on the price action.