Can Shanghai upgrade anticipation keep ETH selling pressure at bay?

- The majority of staked ETH is at a loss according to recent data.

- ETH traders show optimism, despite bearish metrics.

After the Ethereum merge, the prices of ETH declined massively and addresses were left holding their ETH at a loss.

Another upcoming significant event, the Shanghai Upgrade, which will be occurring this month, has made Ethereum holders worried about a possible sell-off of a similar fashion.

Read Ethereum’s Price Prediction 2023-2024

One of the reasons for the same would be that the Shanghai upgrade would enable holders to withdraw their staked ETH. These holders could end up selling their ETH and drive the price of the altcoin down.

A sign of hope

However, according to Crypto Quant’s recent data, there may not be as much selling pressure on these Ethereum stakers as previously believed. Based on the data, it was seen that 60% of the ETH staked was at a loss, representing 10.3 million ETH.

These holders would not have as much of an incentive to sell their holdings.

Even though 60% of the overall staked ETH addresses are expected to HODL, the same cannot be said for the rest of the 40% of holders on the network. The sell-off from the remaining profitable addresses could impact ETH’s prices negatively.

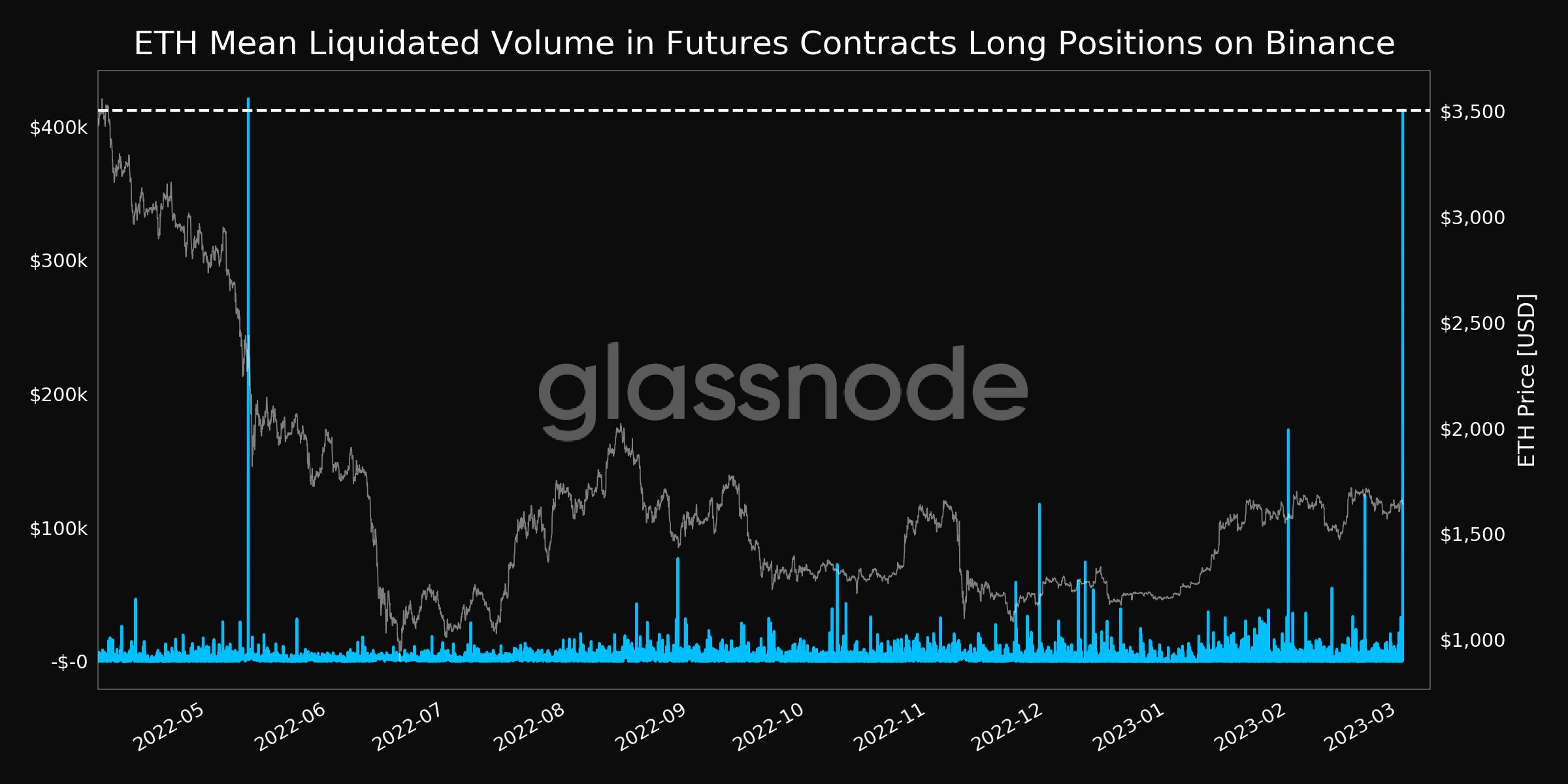

However, this did not stop traders from being hopeful about Ethereum. According to glassnode’s data, long positions taken on Ethereum reached a 9-month high on Binance.

It wasn’t just traders who were optimistic about Ethereum, retail investors also started to accumulate ETH. Over the past month, addresses holding more than 1 ETH increased and reached a high of 1,741,066 addresses.

Despite the traders’ and investors’ optimism, there were some metrics that suggested a bleak future for ETH.

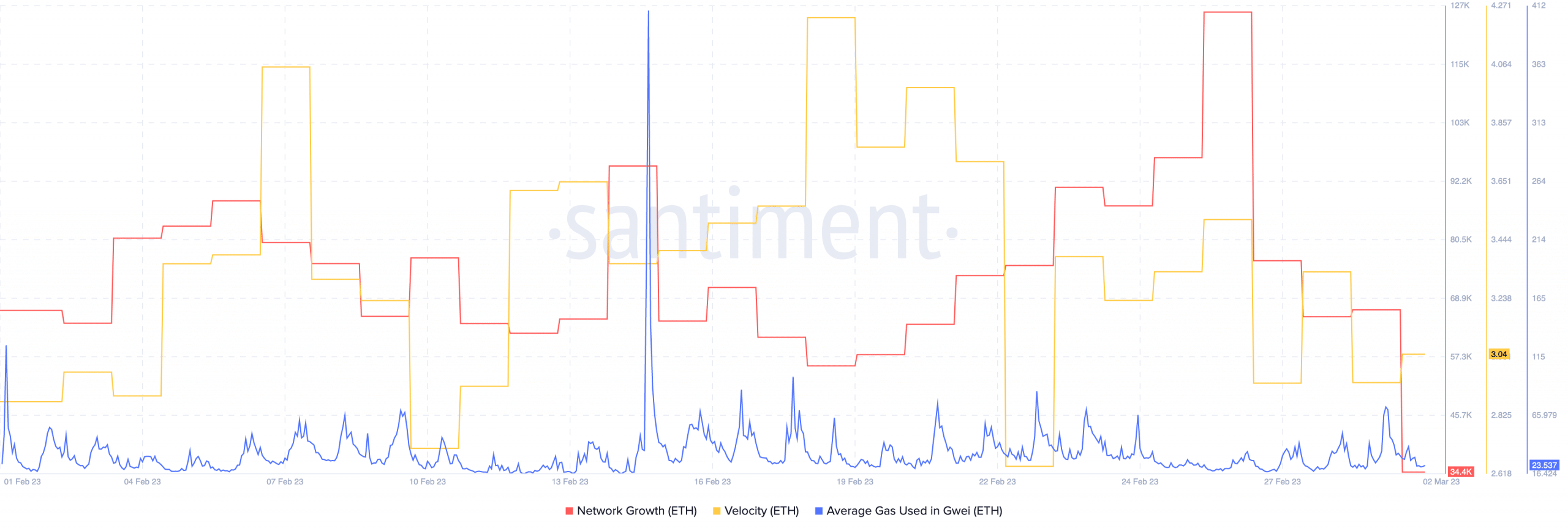

For instance, the network growth of Ethereum declined in the past few days. This implied that new addresses were not interested in buying ETH. Its velocity also fell, indicating a decline in the frequency with which ETH was being traded.

Realistic or not, here’s ETH market cap in BTC’s terms

Coupled with these factors, the overall activity on the Ethereum network declined. This was showcased by the declining gas usage on the Ethereum network.