Discussing Ethereum’s [ETH] bottom probability in the wake of sell pressure

![Discussing Ethereum's [ETH] bottom probability in the wake of sell pressure](https://ambcrypto.com/wp-content/uploads/2023/02/shubham-dhage-geJHvrH-CgA-unsplash-1-e1677488312621.jpg)

- Ethereum addresses began to sell their holdings at a loss.

- The number of retail investors continued to increase.

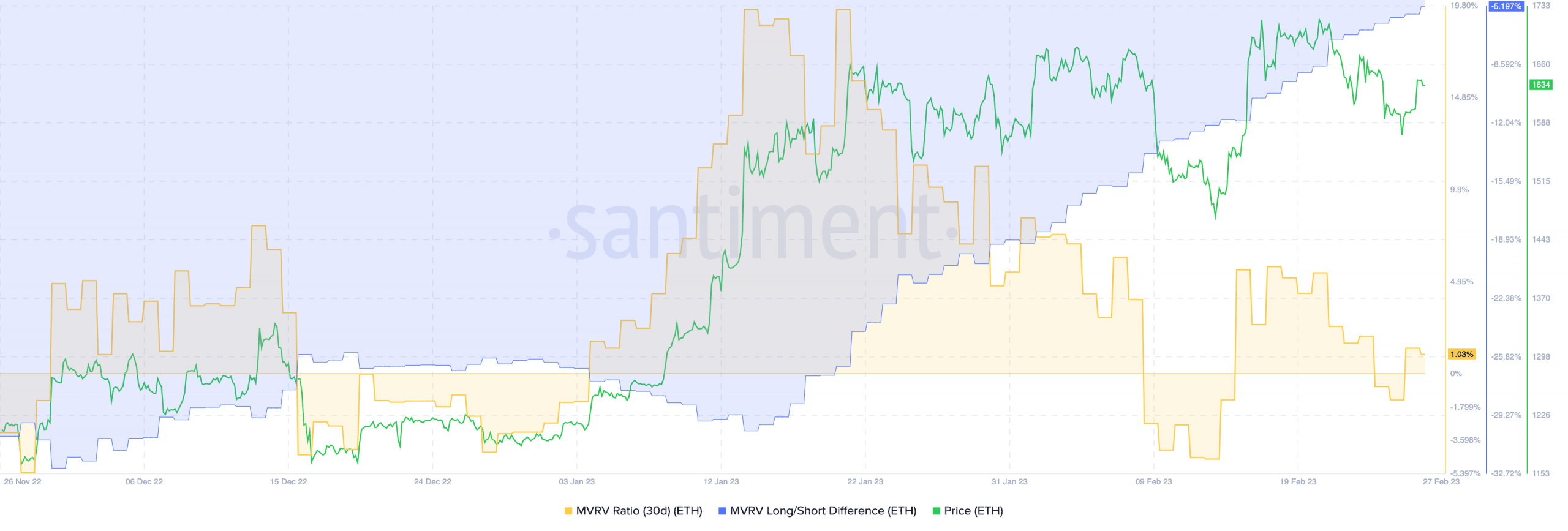

According to Santiment’s data, a few addresses have started to sell their ETH holdings at a loss. Historically, once the crowd starts exiting their positions more frequently at a loss, bottoms are likely to form.

Long-term holders stay put

Even though Ethereum’s prices have been rising over the past month, many of the Ethereum holders remained skeptical as they continued to sell their ETH.

Read Ethereum’s Price Prediction 2023-2024

Despite the sell-off, the MVRV ratio for Ethereum remained positive. This suggested that a majority of the ETH holders at press time would still be profitable if they sold their ETH. Furthermore, the declining long/short difference implied that it was mostly short-term holders who were selling their ETH for a loss.

Even though a decline in the number of short-term holders could be positive news for Ethereum, there were other areas where the network was vulnerable.

For instance, according to WhaleCharts data, 39% of all Ethereum was being held by crypto whales as opposed to Bitcoin, where whales held 11% of the overall supply.

A high concentration of ETH being held by whales would make Ethereum a lot more centralized.

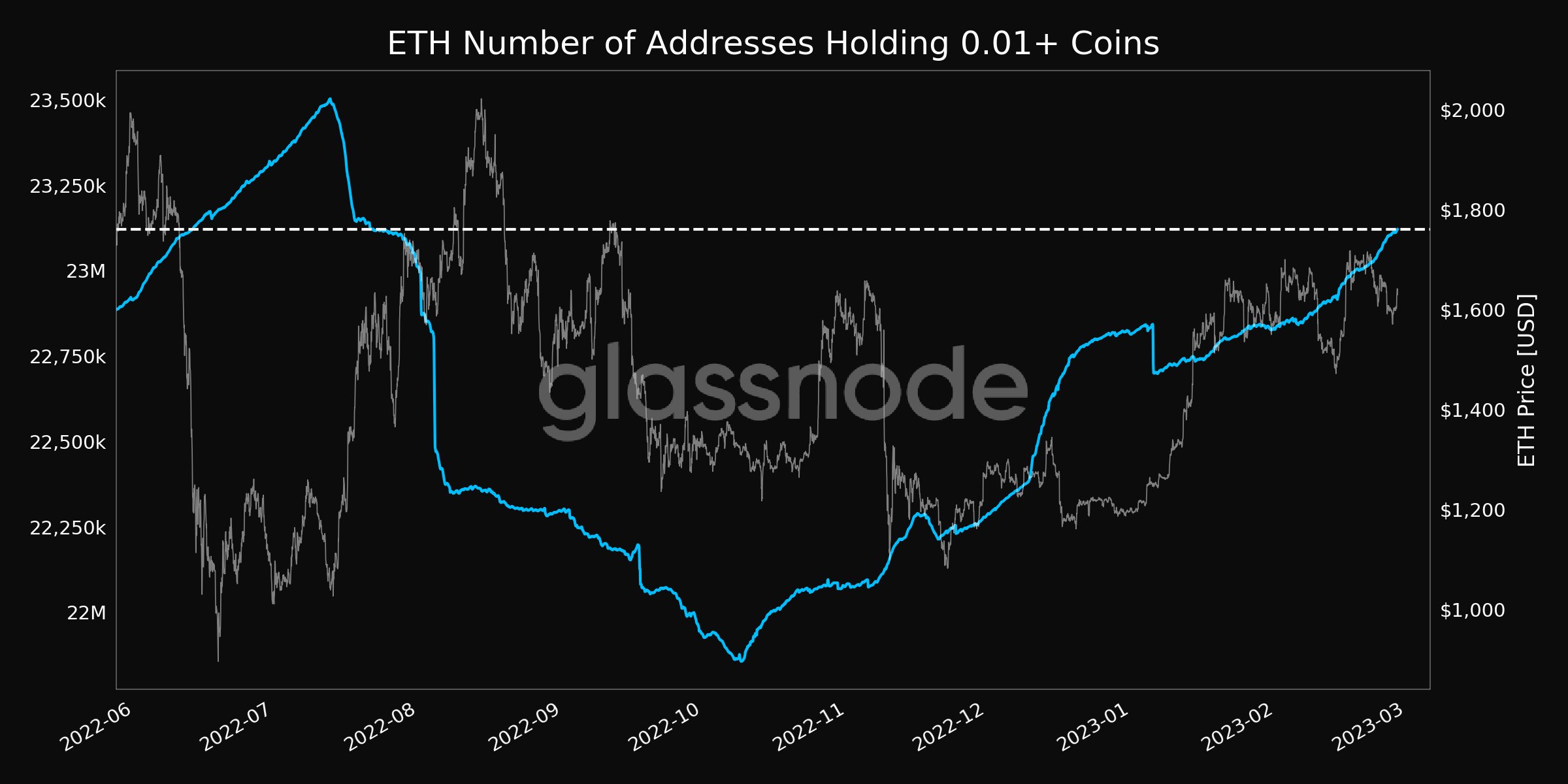

It would also make retail investors more vulnerable to price swings. These retail investors were observed to be showing interest in the Ethereum network despite the whale concentration.

According to glassnode’s data, the number of retail investors on the network grew significantly over the past month.

At press time, the number of addresses holding more than 0.01 coins, reached a 7-month high.

Traders start getting “short” sighted

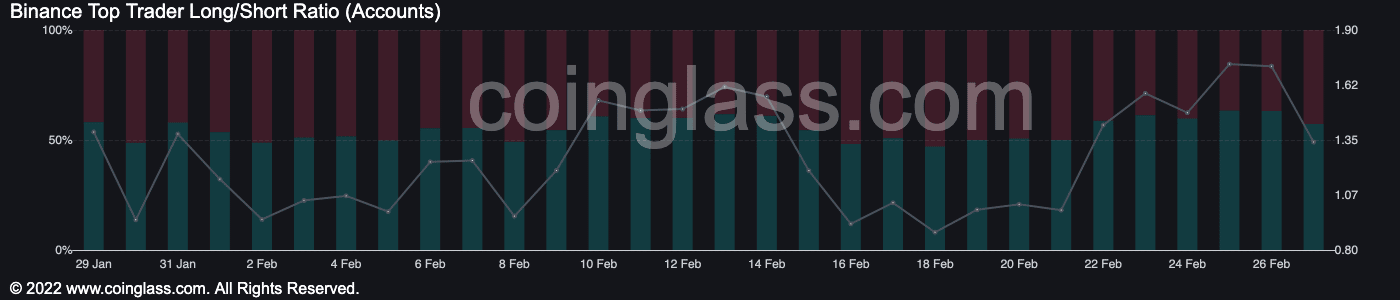

Although retail investors continued to show faith in Ethereum, the same couldn’t be said for ETH traders.

According to coinglass’ data, the number of accounts holding long positions on Ethereum started to decline materially over the last 30 days.

Is your portfolio green? Check out the Ethereum Profit Calculator

As the Shanghai Upgrade approaches, the FUD surrounding Ethereum has risen. Hence, traders should proceed with caution.