Can Solana reignite ‘Solana Summer’ amid price stagnation?

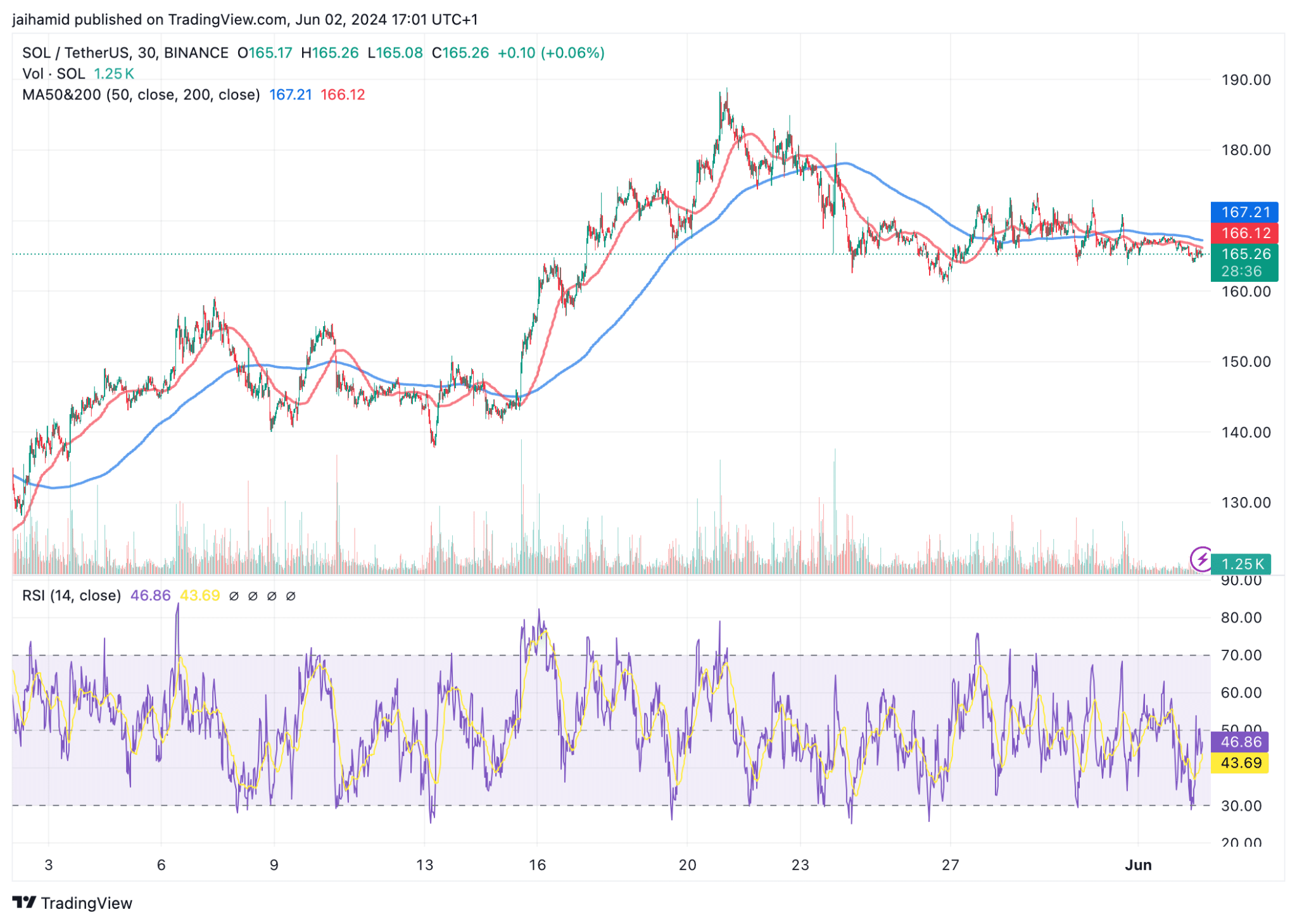

- SOL is currently consolidating, trading between $165 and $190.

- SOL needs to decisively break past the 200-day moving average to confirm a continuation of its bullish trend.

Solana [SOL] has been the cryptocurrency market’s best performer in the past year. Solana’s memecoins have been major catalysts of this bull cycle, and the crypto community is even calling this summer “Solana Summer.”

However, as of press time, SOL hasn’t seen an increase in over a week.

Solana’s struggle

The consistent trading range for SOL prices between $165 and $190 over several days highlights a consolidation phase.

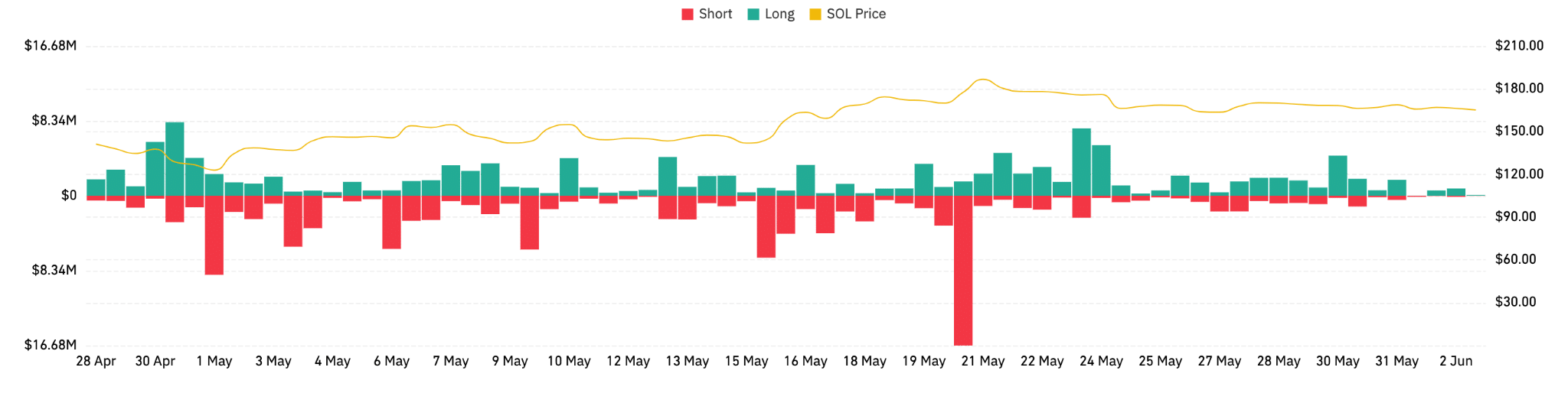

The derivatives data for SOL reveals a mix of increasing interest and declining trading volumes, reflecting a cautious yet attentive trading environment.

Interestingly, the data on ‘rekt’ (losses from liquidated positions) shows minimal losses on short positions in the last hour, suggesting that downward price movements were not severe enough to trigger massive short liquidations.

In other words, the bulls are still majorly in control.

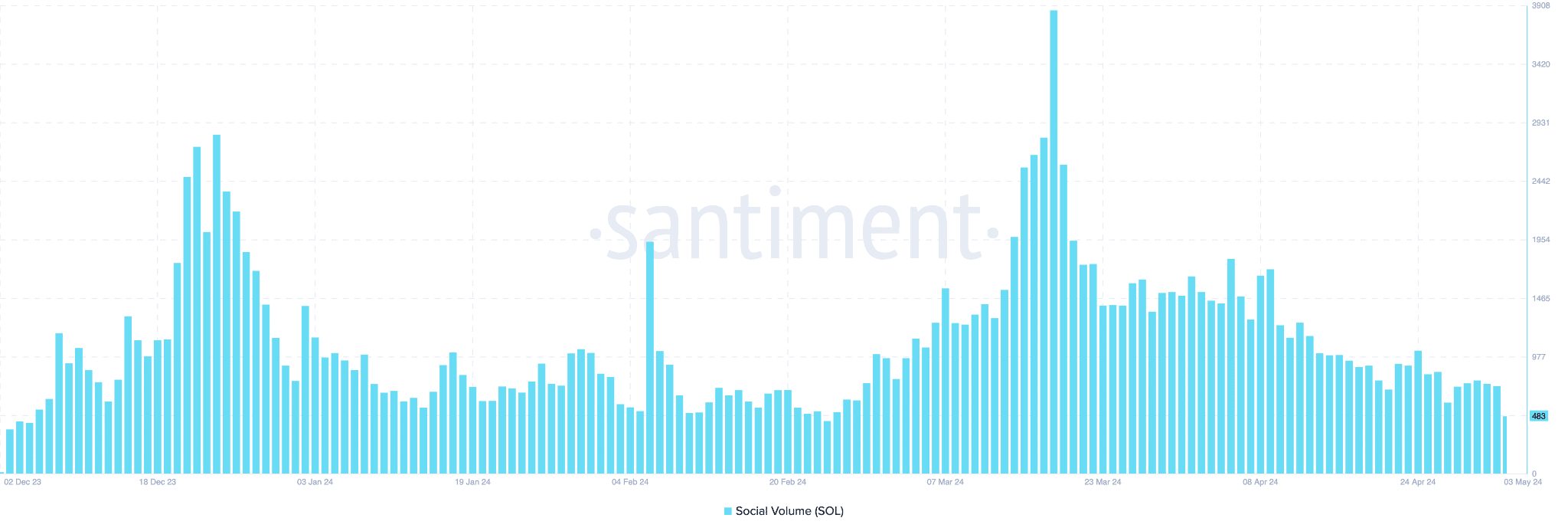

Turning our attention to social volume data from Santiment, we see massive spikes, particularly around March. It likely had to do with Bitcoin breaking two all-time highs that month.

However, in recent days, there’s been a noticeable decline in social volume. The Solana Fear and Greed Index presents a neutral sentiment at 45%.

SOL’s price is currently hovering just above its 50-day moving average (MA50), suggesting a tentative hold in bullish territory but struggling to maintain upward momentum.

The 200-day moving average (MA200) sits slightly above the current price, serving as a possible resistance zone that SOL needs to breach to stage a bullish takeover.

The Relative Strength Index (RSI) near the midpoint (around 47) aligns with this consolidation.

Read Solana’s [SOL] Price Prediction 2024-25

Solana must break past the $190 level to turn the current resistance into support and initiate a stronger rally.

All in all, we see a market that is hesitantly bullish but not fully committed, likely due to SOL’s recent performance plateau. This could lead to continued consolidation until a new catalyst either confirms a bullish continuation or initiates a bearish reversal.