Can Solana traders expect a move to $18 after the bounce from $12.5?

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The lower timeframe structure flipped to bullish

- The bullish order block has seen two strong reactions within the past week

Solana has been one of the largest market-cap assets that are not a stablecoin in the crypto ecosystem for quite a while now. Its recent drop from $37 has wiped out nearly 60% of its value in the market, in the aftermath of the FTX collapse.

Read Solana’s [SOL] Price Prediction 2022-23

A recent article highlighted how a bounce could occur at the $13.5 region. In recent hours, SOL dropped much further to reach $12.07, but it did see a sharp reaction. In doing so, it highlighted the formation of a range as well.

Bullish order block to the rescue, but is it too late for the bulls to re-enter Solana?

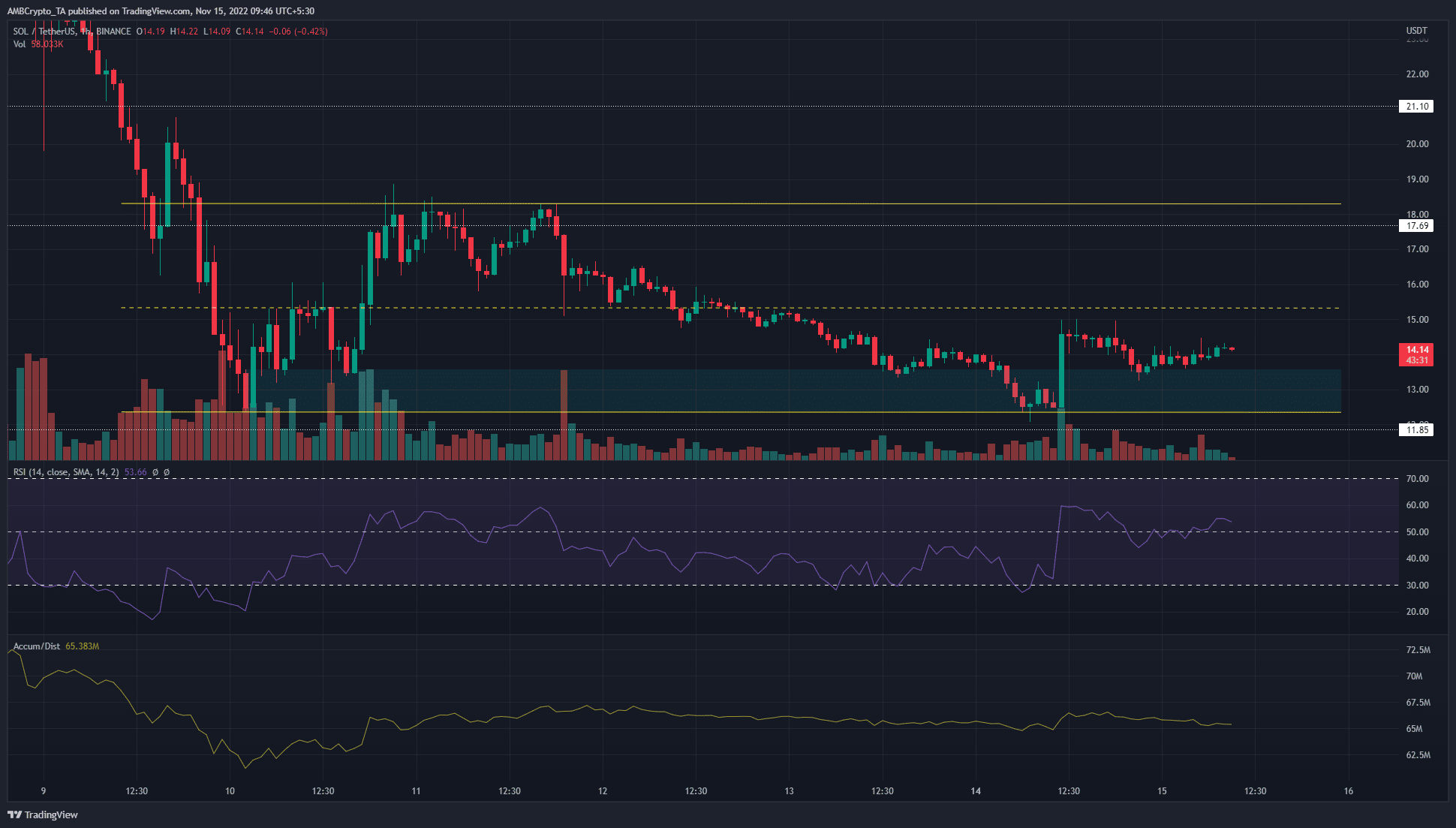

On 10 November, the hourly chart showed Solana to form a bullish order block. Highlighted by the cyan box, it was observed that Solana has given a strong, almost immediate positive reaction at this zone twice since that day.

Another aspect to highlight was the formation of a range (yellow) between $18.3 and $12.35, with the mid-point of the range at $15.33. This value has acted as support and resistance in recent days.

The second time was on 14 November, when the price broke the lower timeframe bearish structure by zooming past the lower high at $14.43. Therefore the price has flipped its bias to bullish for short-term traders. However, it was still a bit risky to enter a long trade.

The buying pressure at the $12.3 mark was encouraging, but it was 11.56% beneath where the price was trading, at the time of writing. The optimistic take-profit price sat at $18.3, almost 30% to the north. Traders looking for a better entry can focus on the fair value gap that SOL left in the wake of its surge from $12.5.

This inefficiency lay in the $13-$13.25 region. SOL has already tested it in recent hours, and another test could offer a better R: R buying opportunity.

Meanwhile, the technical indicators were hardly inspiring from a bull’s perspective. The RSI resolutely occupied the 50-55 region in recent hours. The A/D has also been in a very minor decline during the same period. Hence, buyers would need to manage risk carefully, as the volatility of Solana could easily ruin the setup.

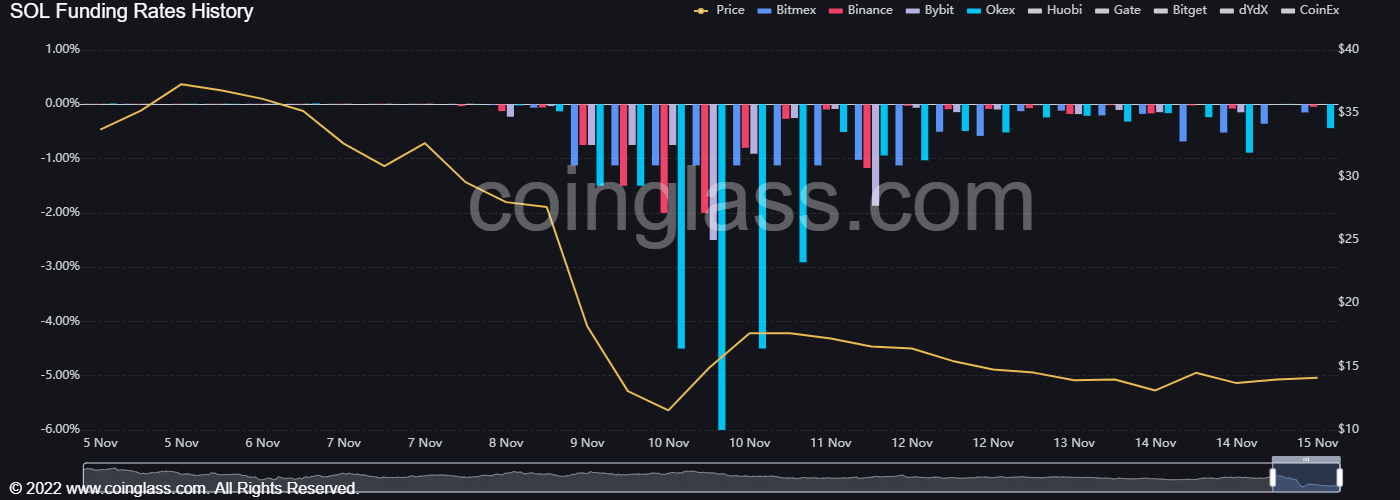

Funding rates went wildly negative but have toned down in recent days

Source: Coinglass

The sharp crash on 9 and 10 November saw funding rates take a huge hit. The short trade was so overcrowded that short positions paid 2% of their nominal position size in funding every eight hours at one point on Binance.

Since then, things have meandered back toward 0%. Yet, the funding rate still showed that short positions were preferred in the futures market.