Can sustained selling pressure flip XLM bearish?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bears extended selling leverage with XLM trading at a key price zone.

- Shorts primed to capitalize on the sustained selling pressure in the futures market.

The multiple rejections of Stellar Lumens’ [XLM] bullish rally at a critical price level has left buyers frustrated. With Bitcoin [BTC] and major altcoins posting losses over the past 24 hours, XLM sunk to a key bullish order block (OB).

Read Stellar Lumens’ [XLM] Price Prediction 2023-24

The price action at this order block will be super critical to XLM’s next move. Will bears break below the bullish OB and push prices lower or can buyers reverse the selling trend?

Bulls can’t scale key price hurdle

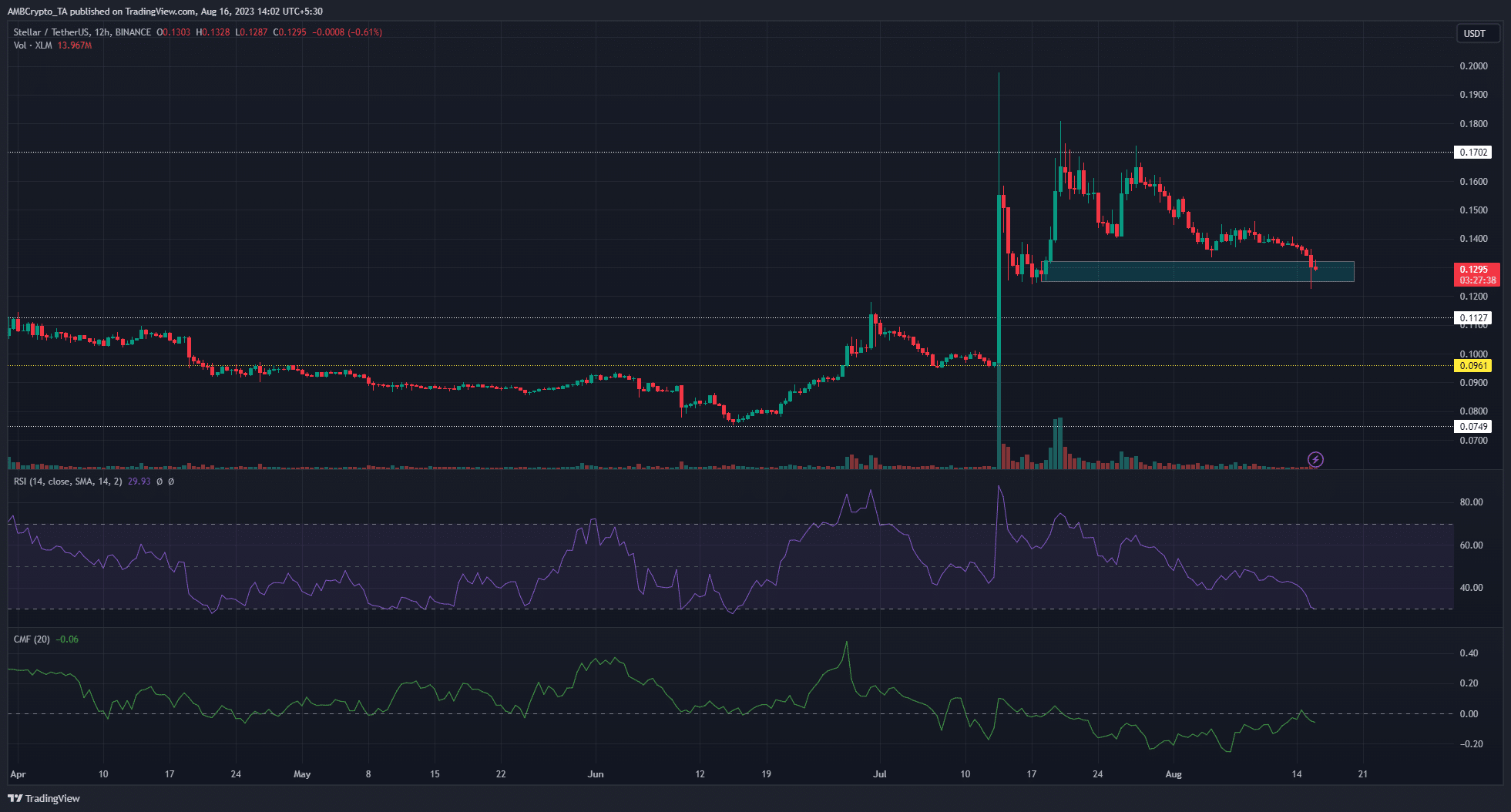

XLM reached a yearly high of $0.198 on 13 July following a breakout from its compact trading range. However, a keen price tussle ensued between bulls and bears with sellers leveraging the $0.17 resistance to halt the bullish advances.

Bullish attempts to extend the gains after the massive breakout have yielded little results. The most recent attempt to break the $0.17 resistance on 28 July led to bears breaking the previous higher low, as sellers looked to flip XLM bearish on the 12-hour timeframe.

The current selling pressure along with price resting at the bullish OB presents two distinct possibilities. A bearish candle close below the bullish OB could trigger an extended downward move with targets at $0.1 to $0.11.

On the other hand, the bullish OB could offer bulls new buying opportunities, as evidenced on 18 July. This could see another price rally from the $0.12 level, especially if Bitcoin mounts a significant price recovery above $29.5k.

In the meantime, the Relative Strength Index (RSI) descended into the oversold zone. This highlighted the strong bearish momentum for XLM. The Chaikin Money Flow (CMF) hovered just under the zero mark with a reading of -0.03, hinting at capital preservation moves by traders.

Sellers backed by strong bearish conviction in futures market

How much are 1,10,100 XLMs worth today?

The exchange long/short ratio data from Coinglass revealed a strong leaning by market speculators toward further price dips for XLM. Shorts held a 52.72% share of all open XLM contracts with a $9.48 million margin over longs, as of press time.

This highlighted the upper hand of sellers with a strong possibility of the bullish OB caving to the selling pressure.