Can Uniswap V3’s surprising performance invalidate recent losses

Uniswap [UNI] took a hit just like every other cryptocurrency. But its presence in the market as a decentralized exchange might have something more in store for the token of the protocol.

Uniswap V3 for the win?

According to a report, V3 has been found to register higher returns on fees for passive LPs outperforming comparable v2 positions by an average of 54%.

At different fee tiers range-bound stablecoin pairs, V3 outperformed V2 by different margins. For tier one, 5, 30, and 100-bp, V3 exceeded V2 by 160%, 68%, 16%, and 80% respectively.

Although it has been over a year since its launch, V3 achieved its purpose of performing better than its predecessor.

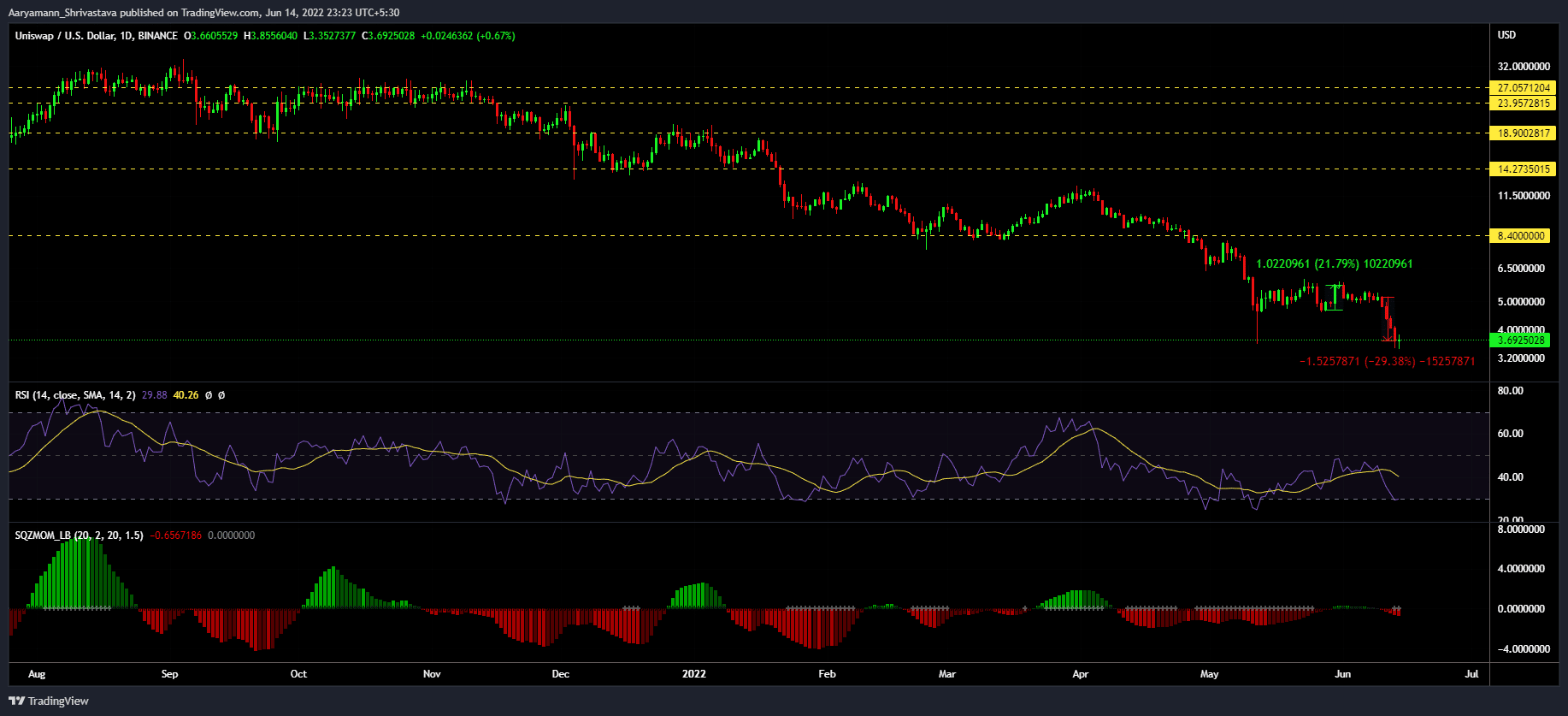

This could be a counter to the bearishness experienced by the investors over the week- It resulted in a 30% crash.

Uniswap price action | Source: TradingView – AMBCrypto

One of the biggest advantages that UNI holders have in this regard is its dominance as a DEX and the demand that DeFi and similar exchanges have in the market.

However, it doesn’t completely rule out the panic and fear investors might have following the crash, and the same is visible in their on-chain behavior.

Furthermore, in the last 48 hours, over one million UNI worth $3 million was sold into exchanges.

What next?

Although the candlestick stood in the green on 14 June, marking a 2.5% rise, it still didn’t cover the losses that have occurred since May. For instance, on 13 June, the investors who moved their UNI holding around were subjected to losses extending to more than $17 million.

Uniswap network-wide losses | Source: Santiment – AMBCrypto

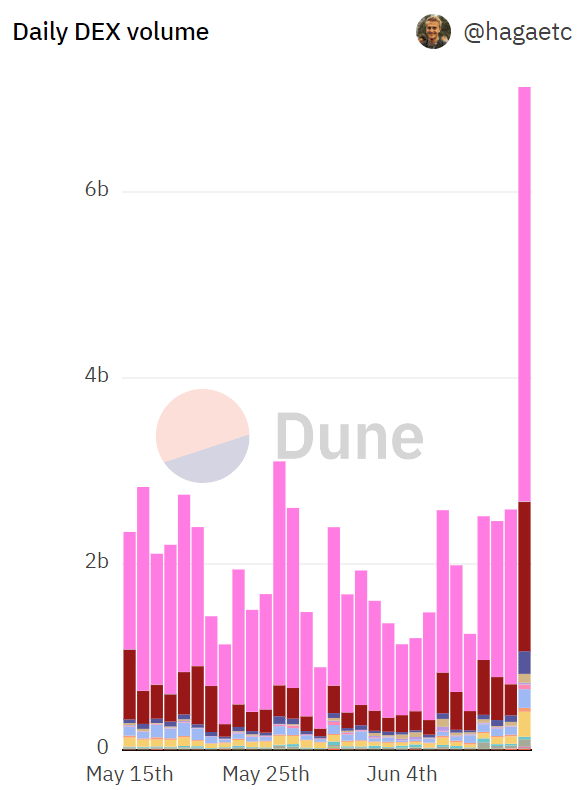

Apart from UNI being the subject of transactions, other tokens were also heavily transacted throughout 14 June, as is visible on Uniswap’s on-chain data.

The total volume of assets that moved around 13 June surpassed the highest recorded single-day volume in a month.

Within 24 hours, more than $4.4 billion worth of volume was recorded on Uniswap, evincing investors’ panic was not limited just to the spot market.

Uniswap DEX volume | Source: Dune – AMBCrypto

In the case of Uniswap as an asset, it might have to remain dependent on the broader market cues. This is because the aforementioned developments haven’t done much for it except propagate the DEX’s usage.