Can Uniswap’s latest Android launch help reel in exiting users

- Uniswap has announced the launch of a closed beta Android version of its mobile wallet.

- The DeFi protocol has seen a decline in user activity since May.

On 12 October, leading decentralized cryptocurrency exchange Uniswap [UNI] announced the launch of a closed beta Android version of its mobile app.

“WEN ANDROID?” How about now? ???

?

?The Uniswap wallet is coming to Android users ?

The beta is LIVE — sign up here to get early access ✅https://t.co/9OHhpSqbez pic.twitter.com/vXsn2NS5Sx

— Uniswap Labs ? (@Uniswap) October 12, 2023

Is your portfolio green? Check out the UNI Profit Calculator

This follows the launch of its Uniswap mobile wallet for iOS in April. Prior to this launch, the majority of its transactions occurred through a web-based application.

In its blog post confirming the closed beta Android version of its mobile app, Uniswap noted that the wallet would allow its users to swap tokens on multiple chains, including Ethereum [ETH], Polygon [MATIC], Optimism [OP], Arbitrum [ARB], Base, and BNBChain [BNB], without switching networks.

The app can also automatically detect which network a coin is on and switch to that network without the user prompting it to.

Uniswap in the past few months

According to data from Token Terminal, Uniswap has seen a steady decline in user activity since May. The count of active monthly users on the protocol has since depleted by 23%. So far this month, Uniswap has recorded a count of 719,669 active addresses.

As a result of the steady fall in the number of users on the protocol, the number of transactions completed daily began to trend downward in June. Data obtained from CryptoQuant showed that between 28 June and 18 September, Uniswap’s daily transactions count observed on a 30-day moving average fell by 54%.

However, in the last month, Uniswap has witnessed a resurgence, with daily transactions count jumping by over 50% since 19 September. This has happened in spite of the 18% drop in active user count recorded within the same period, according to data from Token Terminal.

Regarding network fees, as the protocol’s user count dropped since May, its network fees followed suit. Between May and September, Uniswap’s monthly network fees fell significantly by 68%.

For context, this fell by $74 million in May to less than $25 million by September. So far this month, Uniswap’s transaction fees have totaled $8.5 million.

Demand for UNI has fallen since the month began

At press time, the protocol’s native token UNI exchanged hands at $4.01. On a month-to-date, the alt’s price has plummeted by 10%, data from CoinMarketCap showed.

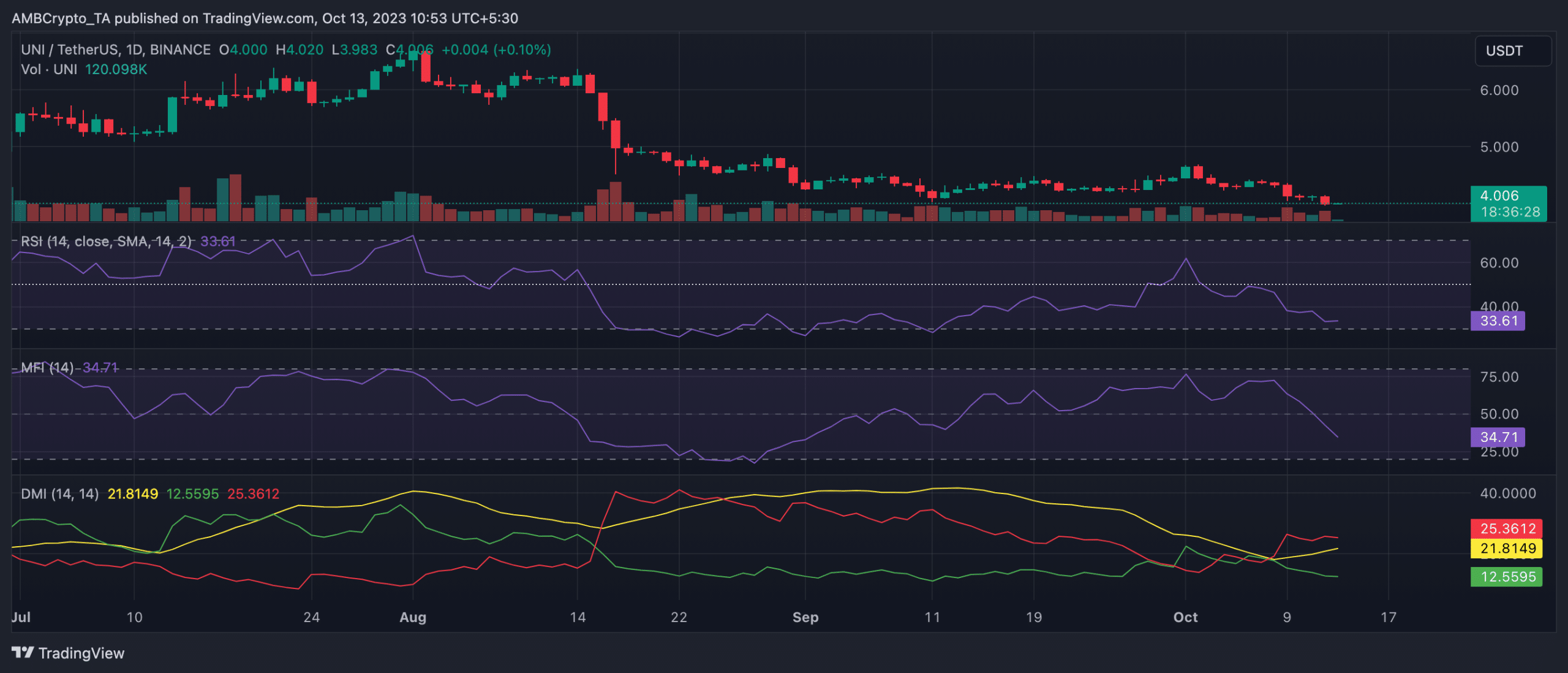

This is attributable to the low demand for the decentralized finance (DeFi) token amongst spot traders in the past 12 days. UNI’s price movements observed on a daily chart put its key momentum indicators close to oversold zones at press time.

Realistic or not, here’s UNI’s market cap in BTC terms

The token’s Relative Strength Index (RSI) was 33.61, while its Money Flow Index (MFI) was 34.77. As of 1 October, both indicators were positioned above their respective center lines. However, as the bears overpowered the bulls, forcing down demand, both indicators began to drop.

Confirming the current downtrend, UNI’s positive directional indicator (green) at 12.55 rested below its negative directional indicator (red), which was 25.36. This showed that token sell-offs outpaced accumulation among daily traders.