Has Friends.tech lost its position in the SocialFi sector

- Friend.tech faced competition from Post.tech and Stars Arena.

- Despite the dominance of Friend.tech, Base failed to compete with Arbitrum in various sectors.

Ever since its introduction, Friend.tech has been scaling new heights in popularity, becoming a central figure in the burgeoning world of SocialFi. A unique bonding curve pricing model underpins its appeal, luring in users from various corners of the crypto universe.

Is your portfolio green? Check out the ARB Profit Calculator

This increasing popularity is not an isolated phenomenon. Instead, it has ignited a wave of activity in the broader SocialFi space, with several competing networks and their respective dApps vying for attention and market share.

The result is a vibrant ecosystem marked by innovation and fierce competition.

1/ Numerous @FriendTech forks have expanded onto various chains, achieving ~300k daily transactions altogether.

Could all these competitors potentially surpass the flagship FriendTech platform?

Explore our in-depth analysis to uncover the insights ? Data from @DuneAnalytics. pic.twitter.com/3RKaKysHyQ

— Impossible Finance (@impossiblefi) October 12, 2023

Competition emerges

Among the emergent players, Post.tech, a leading SocialFi platform on Arbitrum[ARB], stood as a key competitor.

It garnered a dedicated user base by offering an interface reminiscent of Twitter and a transparent Airdrop program. Yet, it wasn’t all smooth sailing; Post.tech faced its fair share of bugs and performance issues, challenging its quest for supremacy.

Another contender in the SocialFi sector was Stars Arena, the native SocialFi platform of Avalanche [AVAX]. However, it’s worth noting that the Stars Arena experienced a significant exploit recently. The platform underwent a temporary maintenance shutdown.

Nevertheless, Stars Arena has demonstrated resilience, bolstered by substantial support from the Avalanche community.

Within the competitive landscape, a distinct pattern has emerged- Stars Arena and PostTechSoFi were standout competitors, with Stars Arena notably leading the pack, boasting over 200,000 transactions.

Friend.tech, on the other hand, maintained its position at the helm in terms of daily transaction volumes.

As the competition unfolded, a nuanced picture arose.

Friend.tech retained a sizable daily active user base, yet PostTech and Stars Arena compensated with higher transaction rates. This divergence in user dynamics added depth to the SocialFi landscape, reflecting the diversity of the ecosystem.

Friend.tech remains numero uno

Market share and liquidity hold a pivotal role in the SocialFi space, and Friend.tech solidified its standing as a primary hub for liquidity by commanding over 93% of the market share concerning daily trading volumes in USD.

This robust market position posed a significant challenge for competitors seeking to chip away at its dominance.

Moreover, Friend.tech distinguished itself through its Total Value Locked (TVL), significantly surpassing its competitors. This expansive TVL disparity further underscores Friend.tech’s commanding position in the market, making it a formidable force that competitors must reckon with.

How are the protocols holding up?

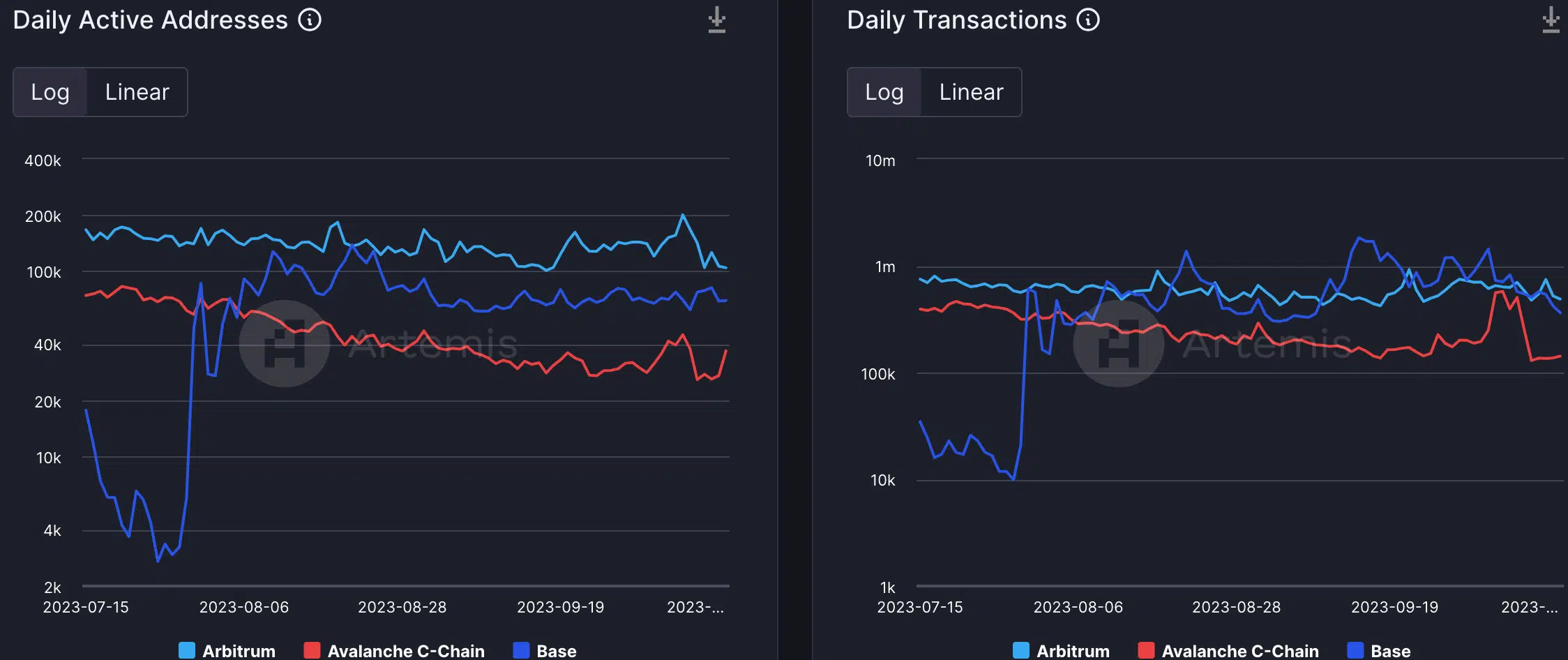

Turning to the state of the protocols hosting the SocialFi networks, Arbitrum managed to outperform the other protocols in most areas.

For instance, in terms of daily activity, Base faced a challenge keeping pace with Arbitrum.

Arbitrum consistently dominated the activity and transaction charts, surpassing both Base and Avalanche. Daily activity is a vital indicator of the overall health and vibrancy of these protocols.

Realistic or not, here’s AVAX’s market cap in BTC terms

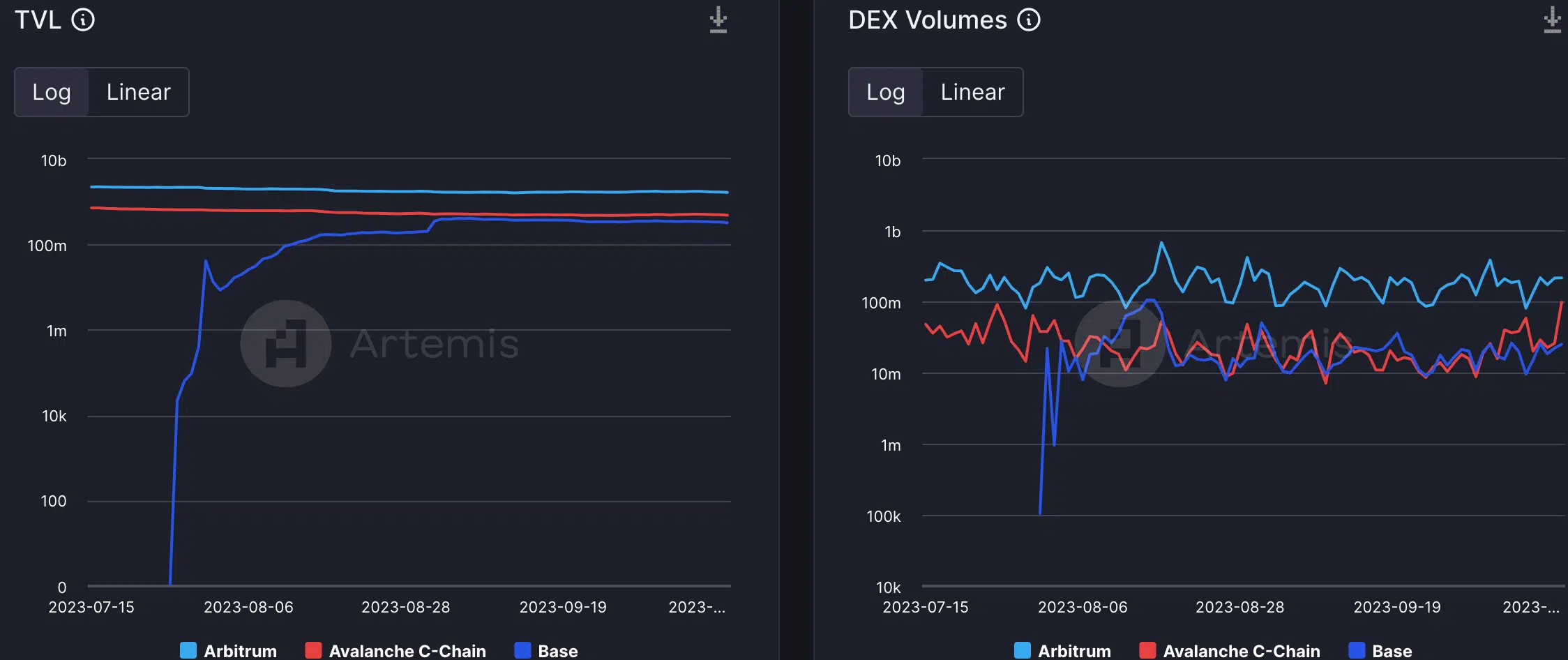

In the realm of decentralized finance (DeFi), Arbitrum stood out yet again as the reigning champion, leading in terms of TVL. Avalanche closely trailed in second place, overtaking Base in this aspect.

Further showcasing Arbitrum’s dominance, the platform also shined in terms of decentralized exchange (DEX) volumes, reinforcing its role as a pivotal player in this space.