Cardano [ADA] holders will not gain without short-term pain, here’s why

![Cardano [ADA] holders will not gain without short-term pain, here's why](https://ambcrypto.com/wp-content/uploads/2023/01/traxer-MnWFs31CPEk-unsplash-1.jpg)

- ADA whales and small to medium-sized investors have reduced their ADA holdings in the past few months.

- On-chain assessments suggested that most ADA holders were logging losses on their holdings at press time.

According to a report from Santiment, small to medium-sized investors holding between 10,000 and 1,000,000 Cardano [ADA] coins have become hesitant to accumulate more of the cryptocurrency. ADA’s price experienced a continuous decline over the past few months which could be the reason for reduced holdings.

According to the on-chain analytics platform, this cohort of ADA holders ramped up accumulation during the 2019 bear market. However, these holders ended the same during the final stages of the 2021 bull market, when the ADA’s price touched $1.3.

Are your ADA holdings flashing green? Check the profit calculator

After this, these investors began distributing ADA tokens more than they bought until two months ago. This was when ADA traded for as low as $0.33.

Santiment’s analyst observed,

“This suggests that these investors may be cautious about the potential of ADA.”

Even the whales are wary

A closer assessment of ADA’s supply distribution revealed that stakeholders holding between 1,000,000 – 100,000,000 ADA tokens increasingly dumped their bags in the past few months.

Per data from Santiment, in 2022, the count of these addresses peaked at 2915 in June 2022. As ADA’s price fell during the year, these investors also sold off their holdings to hedge against further losses.

With 2819 addresses at press time, the count of this cohort declined by 3% since.

A close correlation exists between increased whale accumulation and an asset’s price. A drop in the former often results in a corresponding decline in the latter. This, coupled with the severe decline that plagued the general cryptocurrency market last year, gave ADA no chance to recover.

Read Cardano’s [ADA] Price Prediction 2023-2024

No respite for Cardano investors

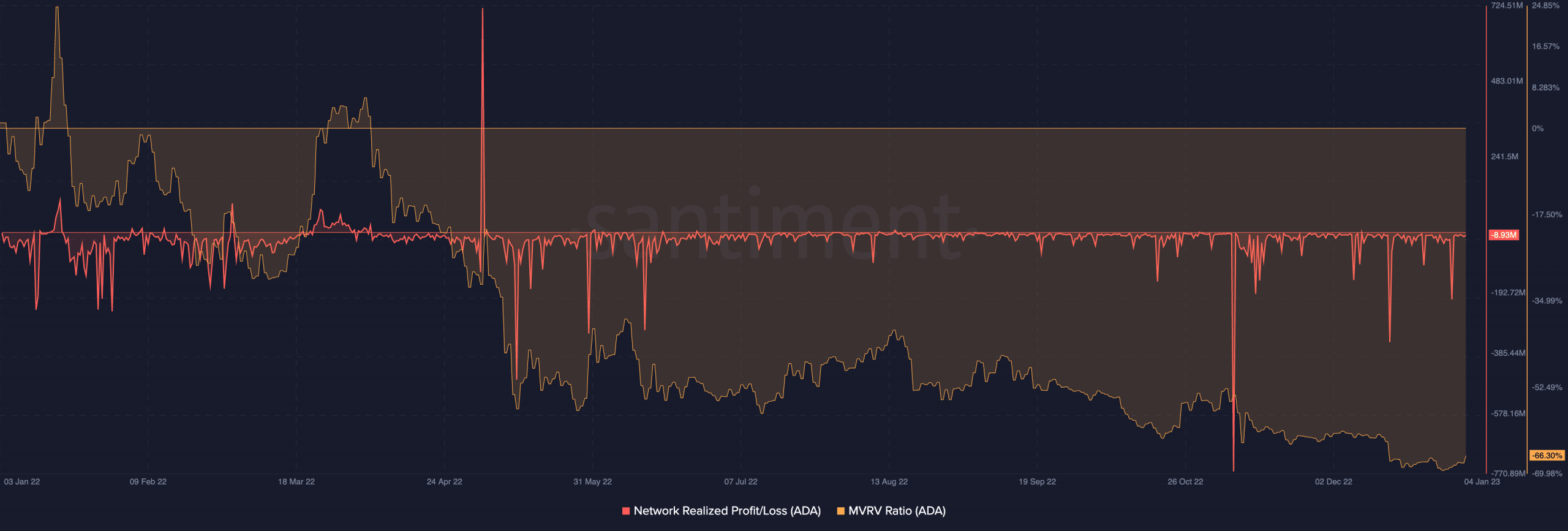

According to on-chain data, ADA’s Network Realized Profit and Loss ratio returned mostly negative values since April 2022. This indicated that all investors who sold off their ADA coins – small, medium, and whales – have incurred losses on their investments since. With many still logging losses at press time, ADA’s NPL was spotted at -7.63 million.

Similarly, ADA’s Market Value to Realized Value ratio (MVRV) has been negative since April 2022.

A negative MVRV ratio indicates that the market value of the cryptocurrency is lower than its realized value. This is a sign of potential overvaluation, as it suggests that the market is currently valuing the cryptocurrency at a lower price than it has been historically.

As of this writing, ADA’s MVRV stood at -66.30%, indicating that most people will realize losses if they all sell their holdings at the current price.