Cardano [ADA] market weakens, but investors can still profit at this level

![Cardano [ADA] market weakens, but investors can still profit at this level](https://ambcrypto.com/wp-content/uploads/2022/12/bn-ada-fi-e1671189483169.jpg)

- ADA was in a strong bearish market structure.

- The coin could drop to $0.2963, as trading volume and active addresses declined.

- A candlestick close above $0.3026 will invalidate the above forecast.

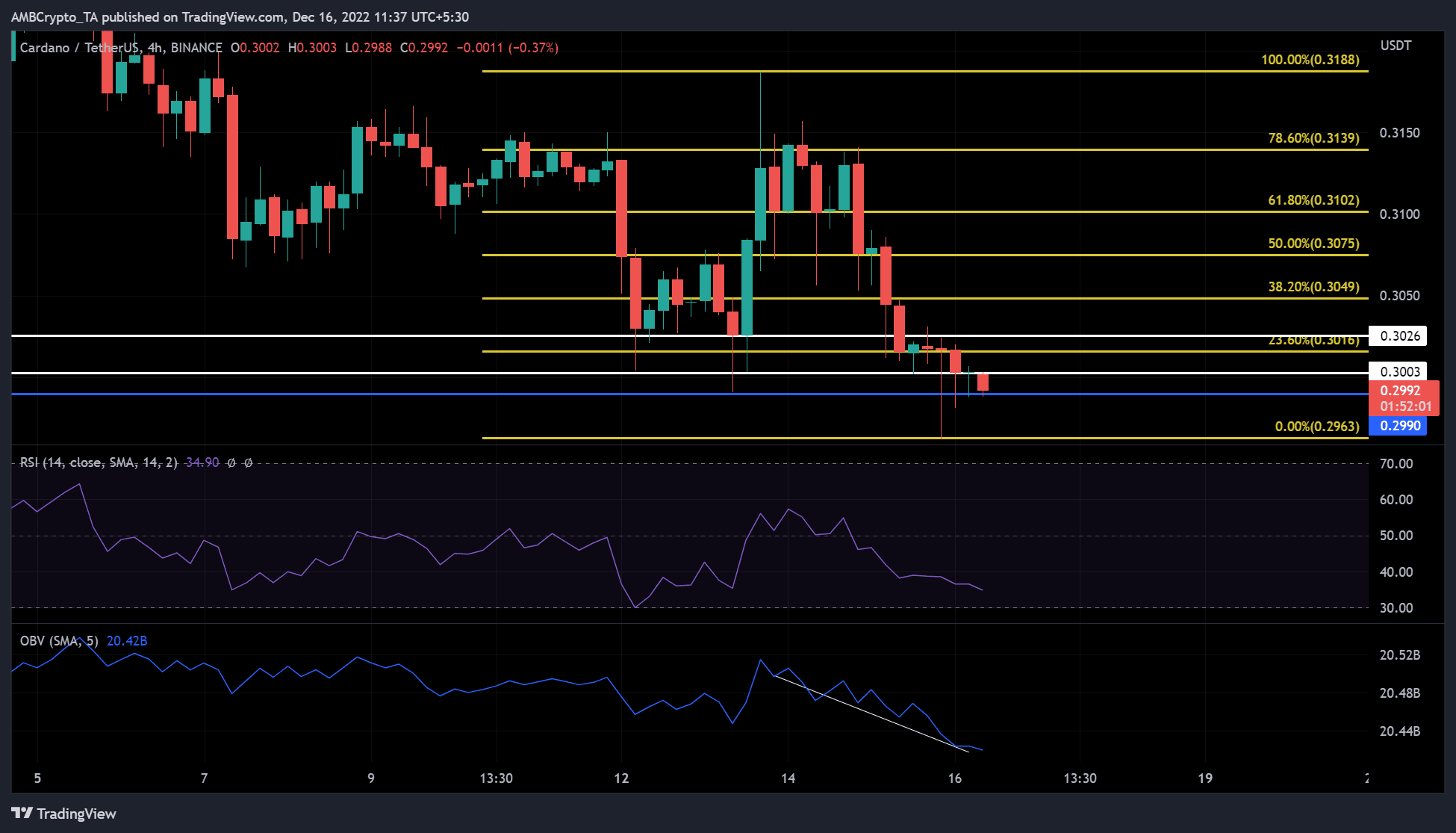

Cardano [ADA] was in an extended price pullback that threatened to slip lower. At press time, it was trading at $0.2992 but still looked slippery. As suggested by technical indicators and on-chain metrics, a drop to $0.2963 could be feasible.

If the bearish momentum prevailed, ADA investors could gain from a short-selling opportunity if the price falls to $0.2963.

ADA forms a bullish hammer: Will bulls come to the rescue and push the price up?

At the time of writing, ADA recorded a bullish hammer (second-last green candlestick with extended tail wick). It showed that bulls opposed selling pressure despite being overwhelmed at the time of publication.

So will the bulls overcome and push it up, or will selling pressure increase? Technical indicators suggested the latter at press time. The Relative Strength Index moved into a lower range bordering the oversold area. This showed that selling pressure had increased and could undermine ADA bulls.

In addition, the On Balance Volume has been recently making lower lows, which could also undermine buying pressure. Therefore, ADA could drop to $0.2963.

However, a candlestick close above $0.3016 would invalidate the above bearish outlook, especially if BTC is bullish. Such an upward move could set ADA to retest several resistances, with the immediate level at $0.3026.

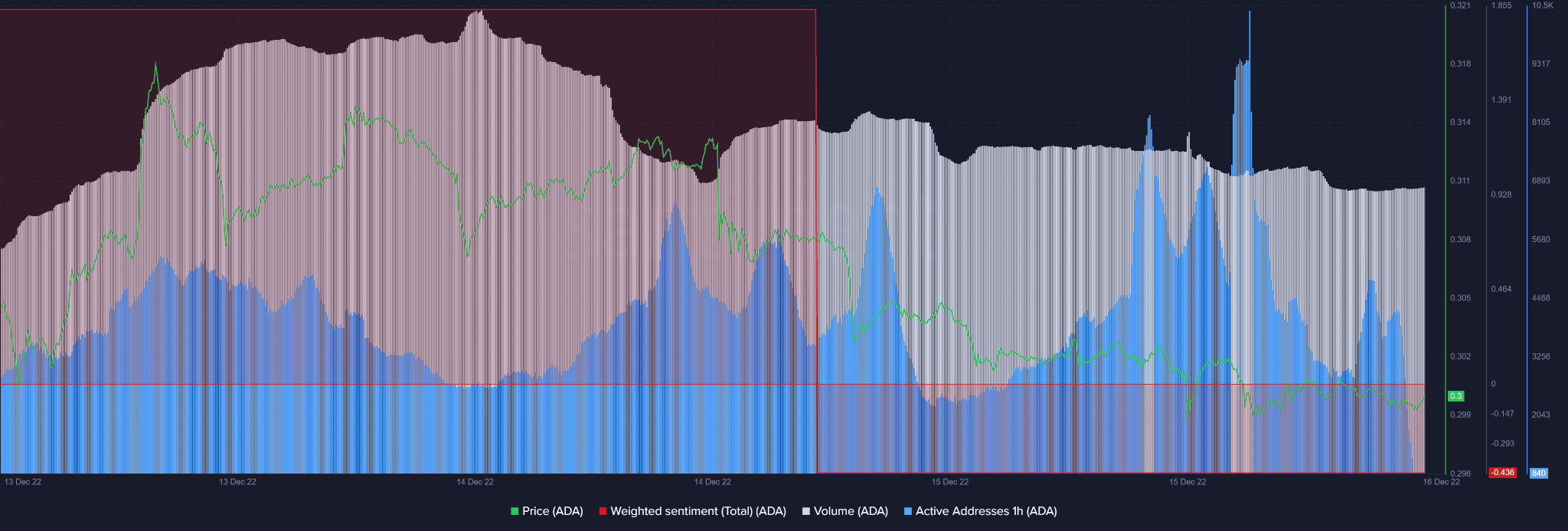

Active addresses drop while sentiment remains negative

Cardano saw a drop in sentiment into the negative territory, showing a bearish outlook. In addition, trading volume dropped slightly.

At press time, the active addresses in the past hour had declined, until press time. It is worth noting that active addresses were erratic, with an uptick and downtick closely together. It showed a fluctuating number of accounts trading ADA, making it harder to point to the exact possible market direction.

The performance of BTC can offer the necessary guidance. A bearish BTC could thus expose ADA to more selling pressure. However, a bullish BTC will pull ADA up and invalidate the above bearish forecast.