Cardano [ADA]: Plotting the path to a 125% rally after 1 August

The crypto-winter turned crypto-blizzard has led to tokens facing some of their most difficult days. Cardano [ADA] is one such altcoin that has receded back into the bearish zone. Additionally, the bearish zone at this point has become the crypto’s second home, especially considering its performance over the last year.

However, every time Cardano…

… slipped into this area, it has only sustained the bearishness for a period of 50-60 days. Except for once during the October to December decline, right after its ATH, which lasted for 106 days.

Historically, right after this period, ADA has been known to spike and note a rally. In the past, the same has varied, but at the moment, ADA needs to reclaim the critical level of $1 if it ever intends to recover its losses.

Cardano price action | Source: TradingView – AMBCrypto

Before that happens, ADA will either consolidate or dip further until 1 August. This would mark an appropriate amount of days (52) for ADA before it jumps back into the bullish zone.

Where this would place its investors is a different conversation since these people are already disappearing. They will continue to do so until ADA registers a radical rally.

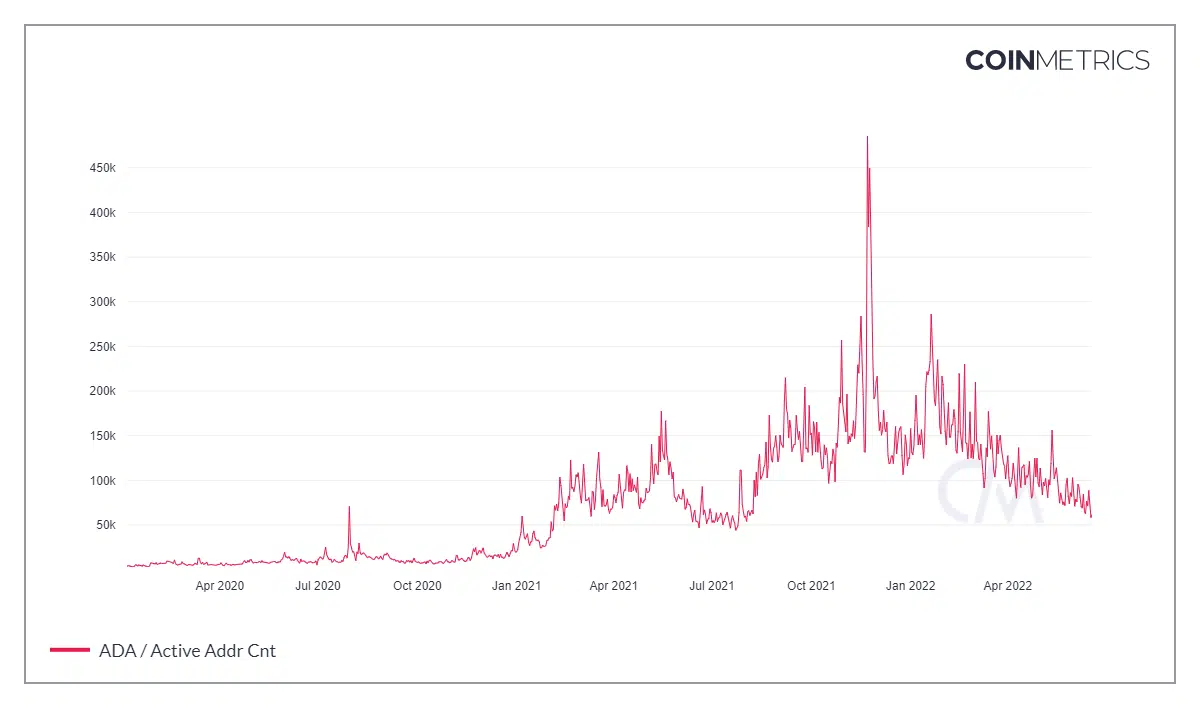

Despite the few instances of hikes observed over the last six months, investors did not care for either of them since these were just a speck in the longer timeframe. After peaking at 286k, the number of active on-chain investors declined to less than 60k today.

Cardano active investors | Source: Coinmetrics – AMBCrypto

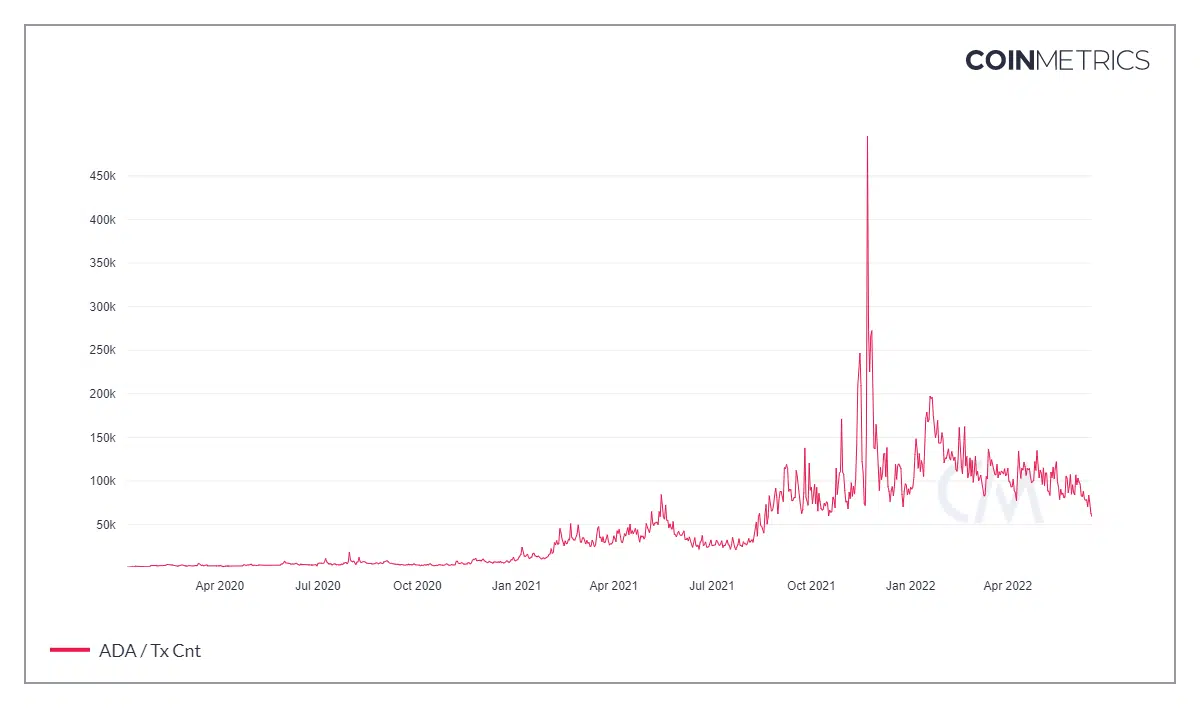

Since investors aren’t willingly active on-chain, naturally, they won’t be particularly forward in making transactions either. The same is also visible on the network as the number of transactions on-chain has fallen to just 60k.

Cardano transaction count | Source: Coinmetrics – AMBCrypto

However, if ADA can recover to $1, this could potentially change since investors would be willing to jump back in. Or at the very least, cash out without losing a lot.

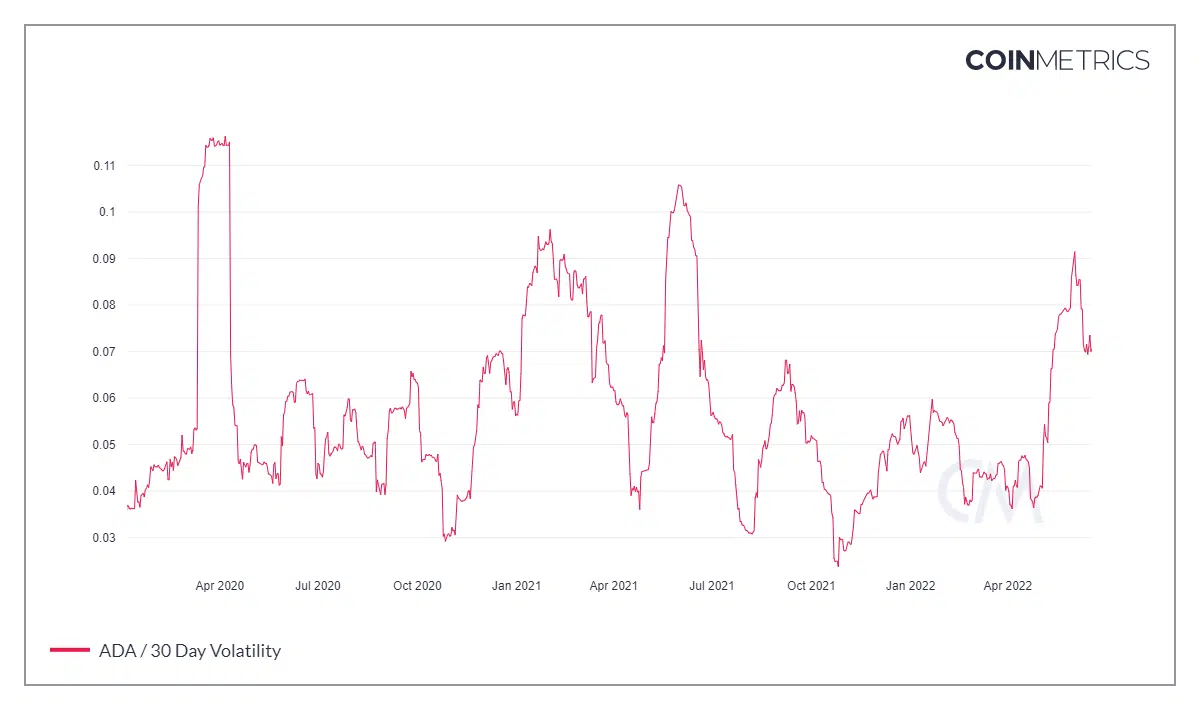

As of now, if Cardano settles in for the weeks-long consolidation, the volatility will also reduce, diminishing the possibility of a price swing after the same hit a yearly-high earlier last week.

Cardano volatility | Source: Coinmetrics – AMBCrypto

The bearishness on the charts has also been decreasing as the downtrend is losing strength. The same can be backed by the drop of the ADX indicator below 25.0’s threshold (ref. Cardano price action image).