Cardano [ADA] would need to climb past this level to break its bearish movement

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

There was an influx of developers into the Cardano [ADA] Github development network in recent months. Despite developments on the technical side, the sentiment remained bearish. On the price charts as well, the trend was downward on the longer timeframes. This was an obvious sign of fear in the market and a lack of buying volume. In the next month or two, Cardano could post further losses on the charts if the $0.4 level was ceded to the bears.

ADA- 12-Hour Chart

A range from $0.44 to $0.64 was established over the past two months. The mid-point of this range lay at $0.54, a level that has been respected as both support and resistance on several occasions in the past few weeks.

Another level of importance in the past month was the $0.49 resistance level, which was right beside the psychologically important $0.5 mark.

ADA registered a series of lower highs since reaching the range highs in June. The price also fell beneath the range lows and retested $0.44 as resistance, which was not a good sign for the buyers.

Further south, the $0.4 support level could see ADA bounce, but the past month’s trend remained bearish and was not yet broken.

Rationale

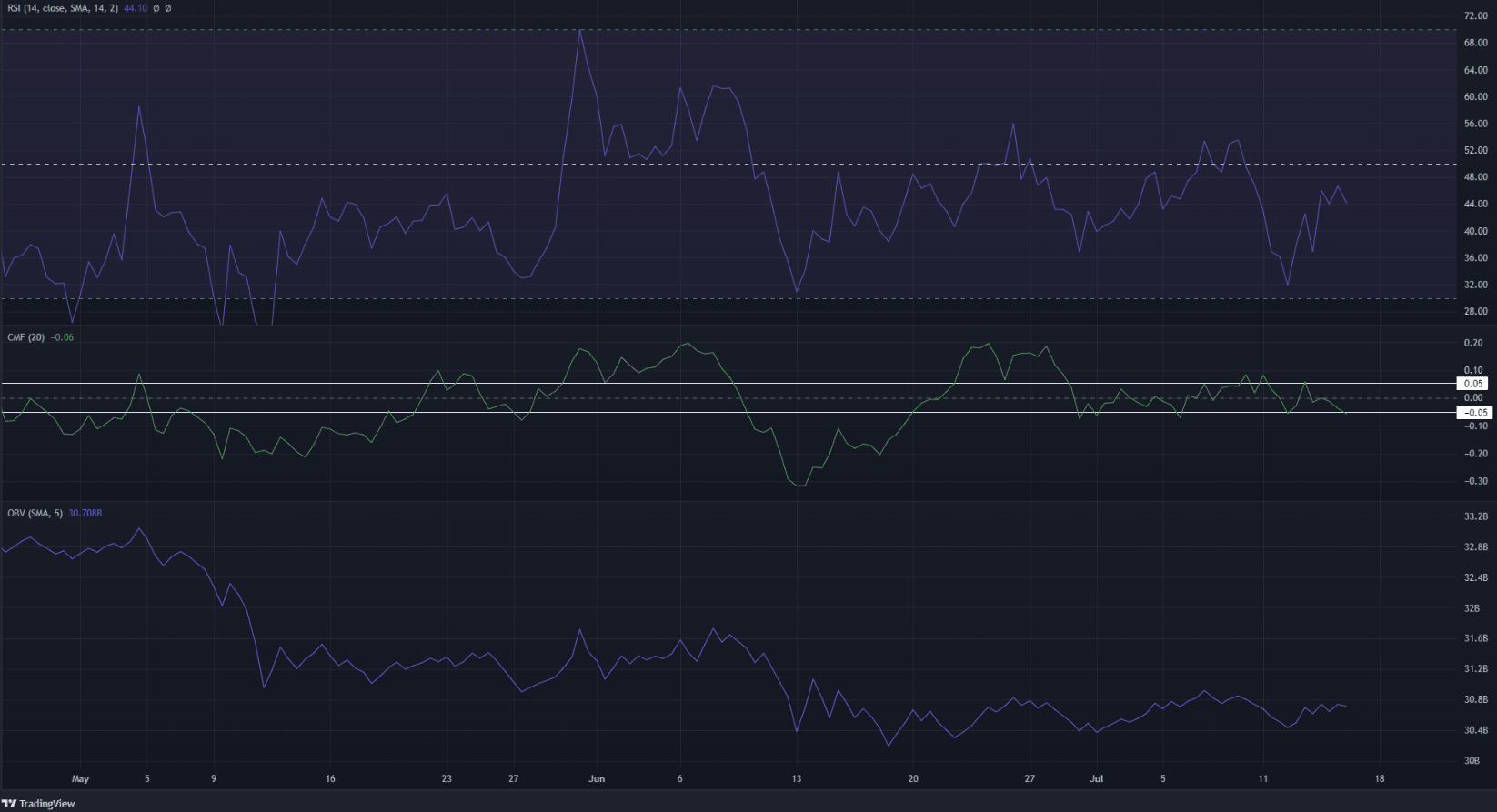

The 12-hour Relative Strength Index (RSI) has struggled to climb past the neutral 50 mark over the past four weeks. This indicated a bearish trend in progress. At the same time, the Chaikin Money Fund (CMF) also moved between -0.05 and +0.05. This showed a lack of significant capital flow into or out of the Cardano market.

The On-Balance Volume (OBV) has also remained flat over the past week. Therefore, selling and buying pressure has more or less been equal, even though the price steadily slipped lower.

Conclusion

In order to break the bearish market structure, ADA would need to climb past the $0.49 mark. There was a huge swathe of bearish territory for the bulls to fight past. The demand was simply not present yet to warrant such a move.

The indicators showed bearish momentum and were more neutral about the selling volume. Hence, buying opportunities were not yet present for higher timeframe Cardano traders.