Cardano and Ethereum case studies you don’t want to miss out on

The crypto community is hyped about Cardano as the Vasil hard fork is expected to be released soon.

Over the last few days, developers have been working extensively on the testnet. This, to ensure a smooth rollout of the Vasil hard fork.

However, ADA’s daily chart indicated that its price movement did not correspond to the developments in its ecosystem.

On one hand, where Ethereum’s on-chain metrics reflect better days ahead, Cardano’s situation seems off track. At the time of writing, ADA was trading at $0.3357, showing a negative 9% 7-day growth and a market capitalization of $16,577,900,579.

A glance at metrics

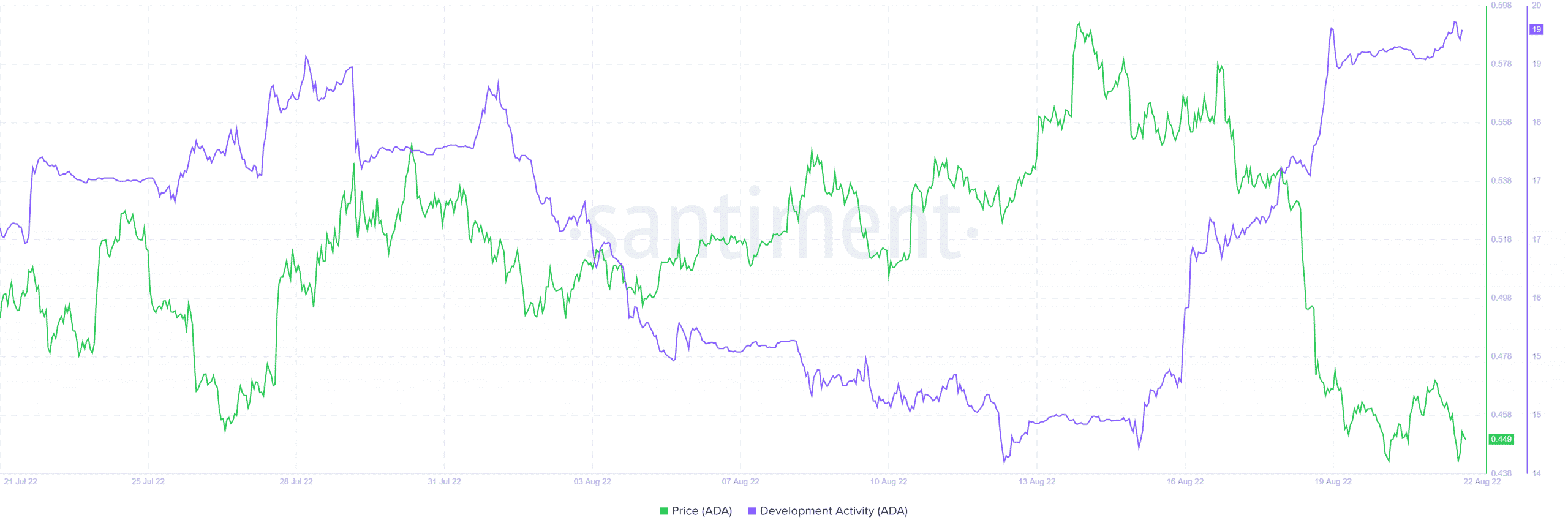

Well, despite the massive plunge in ADA’s price on 19 August, development activity on the Cardano network took the opposite route.

Recently, Cardano faced several criticisms accusing Cardano’s testnet of being “catastrophically broken,” which grabbed the attention of many in the crypto community.

This episode was followed by a major price drop that pushed down ADA from $0.3793 to $0.3358 in a matter of 24 hours.

Charles Hoskinson, the co-founder of IOG, himself stepped in to try and normalize the situation.

In a recent Ask-Me-Anything session on YouTube, he mentioned,

“You can’t conflate a failed testnet with the mainnet because testnets are constructed and destroyed all the time in this industry. That’s their point. They are in no way, in any way harm Cardano itself.”

However, things did not look in favor of Cardano. Its active address count also dropped to 58,139 on 20 August.

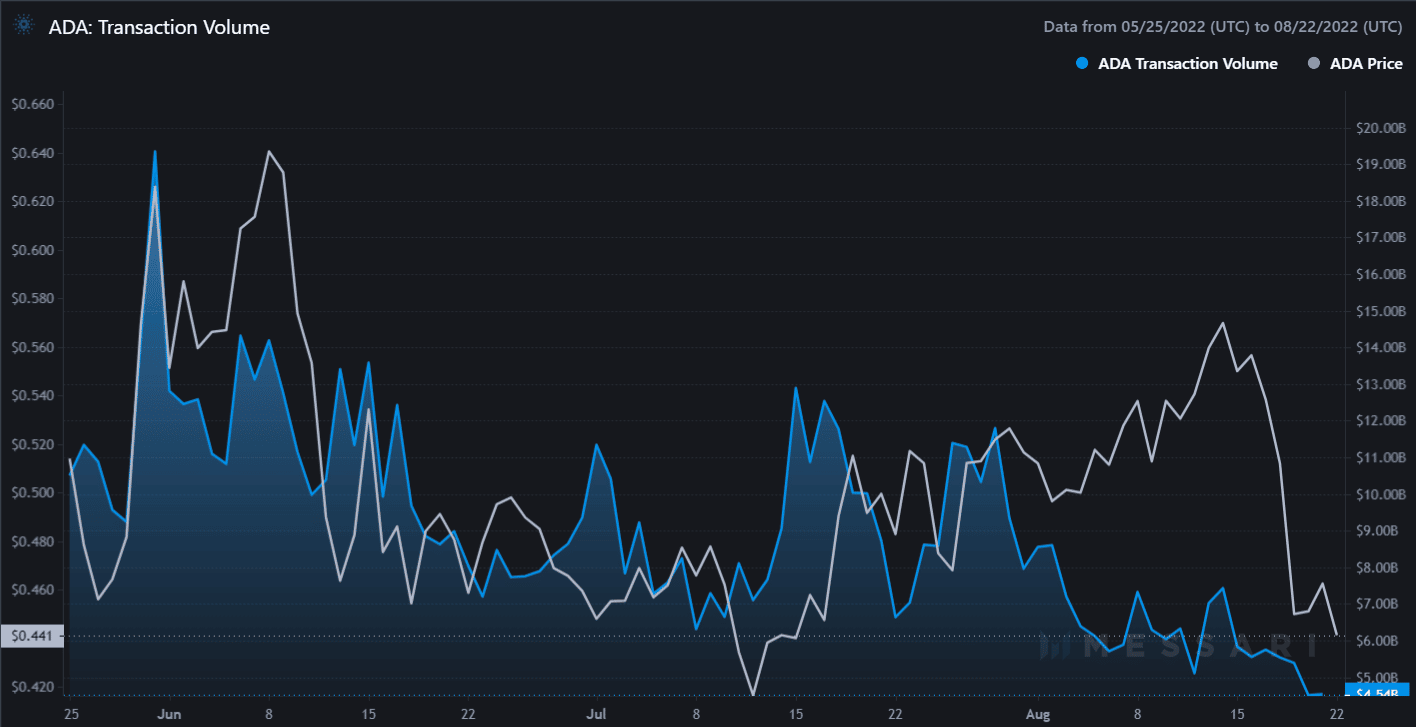

Moreover, ADA’s transaction volume also followed the same route and registered its 2022 low of $4.54 billion.

On the other hand, Ethereum, which is also expecting a hard fork in the month of September, witnessed a massive surge in its number of active addresses with non-zero balances as it reached an all-time high. This was quite the opposite of Cardano.

Looking forward

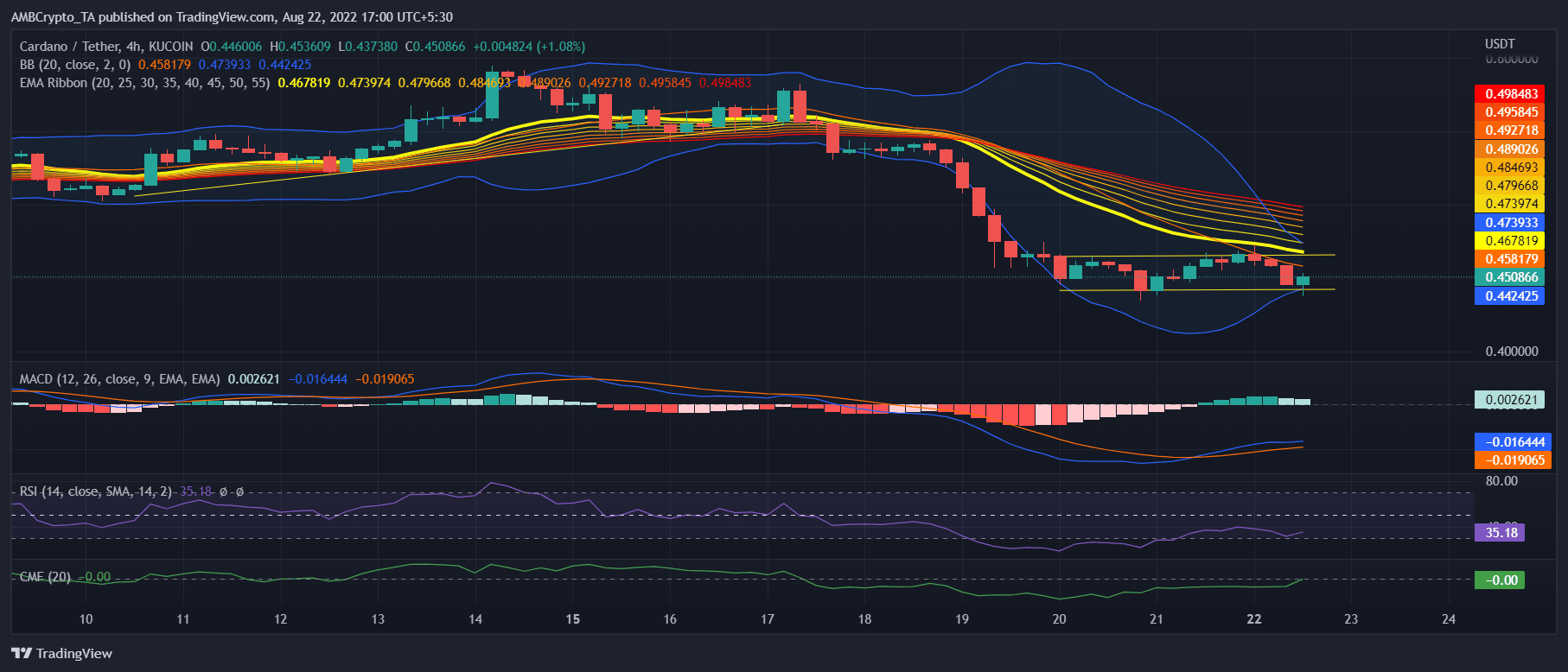

ADA’s 4-hour chart on 22 August indicated a massive bear advantage in the market, as depicted by the Exponential Moving Average (EMA) ribbon.

Furthermore, the Bollinger Bands showed that after being in a volatile zone, ADA’s price might crunch. Thus, minimizing the chances of a breakout in the short term.

However, several indicators suggested otherwise. RSI and CMF pointed out that the market was entering a neutral position after being in an oversold zone.

The same possibility was also noted in the reading of MACD. It displayed a bullish crossover.

Amidst all the hype related to the delayed Vasil hard fork, what is in store for ADA is hard to answer.

Inventors, therefore, should consider all the possibilities before making any decision.