Cardano, its whales, and what they can do to push it to $1

After its month-long movement under the line, Cardano is now getting back up closer towards the $1-mark. Having depreciated significantly over the last few months, ADA was trading at $0.905 at press time. Even so, optimism remains high, especially since the altcoin recovered by 12.87% over the last 4 days.

Cardano candles turn green

In addition to the rally, price indicators have also been flashing bullish signals. In fact, the Relative Strength Index is at its highest since January, with the MACD noting bullishness too.

Alas, for every optimistic signal, there are always others that negate the chances of a good thing happening.

During its previous rally of 28 February, when ADA was up by 12.5%, the uptrend didn’t last for even a day. As soon as it was exhausted, the alt’s price started falling on the charts. Ergo, there are legitimate concerns that the same could happen this time too.

Cardano Price Action | Source: TradingView – AMBCrypto

Whaling about ADA’s investors

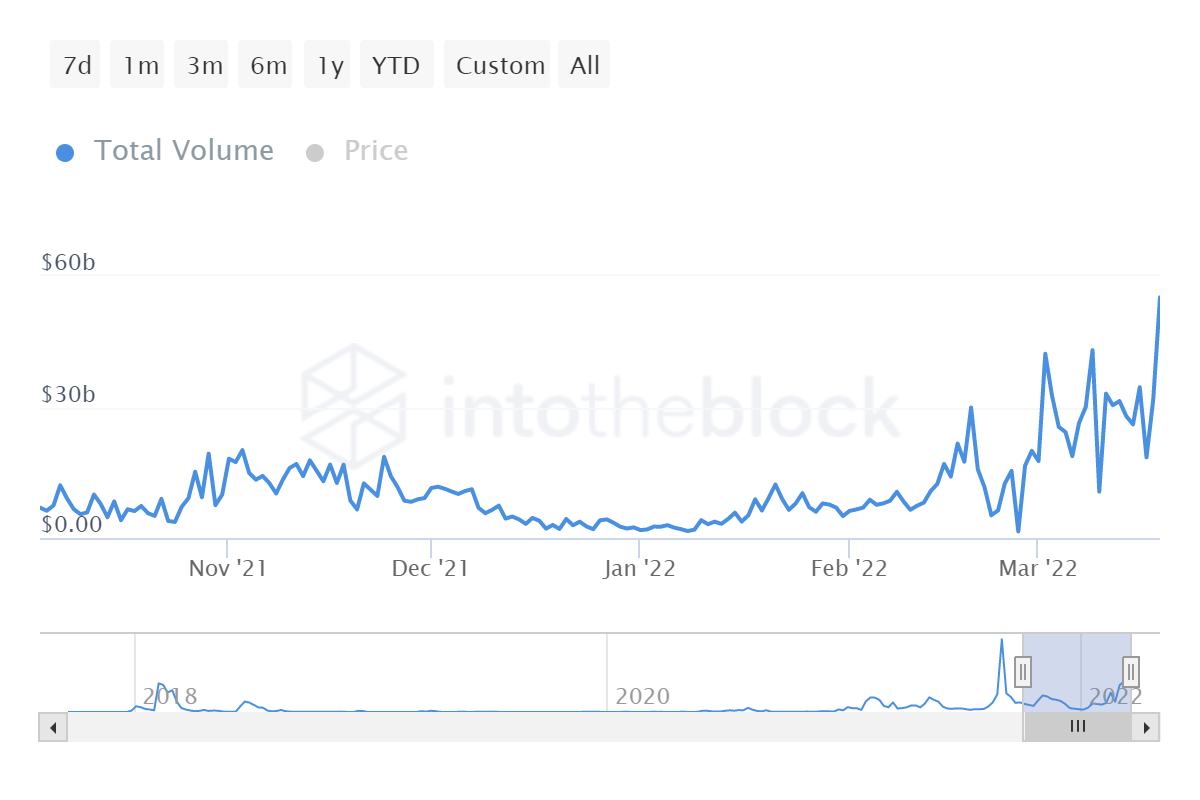

However, the one unique and unseen aspect of this rally is investors’ behavior. Fuelled by the hope of recovery, ADA holders have been very active with transaction volumes today touching $55.43 billion. At the same time, 95% of this has been movement initiated by whales – Altogether accounting for $55.12 billion.

Cardano transaction volume | Source: Intotheblock – AMBCrypto

This suggests that the 3.47 million ADA holders who account for 82% of all the addresses holding between 0 – 1k ADA cumulatively control just 0.93% of all supply.

On the contrary, the whales who make up for 4.8% (214,000) of all addresses are responsible for the movement of almost 85% of the supply.

Cardano balance distribution | Source: Intotheblock – AMBCrypto

Put simply, this is not an investor-motivated rally. It is a rally triggered by whales, something that makes hitting $1 equally possible and uncertain.

Now, while the overall network performance is indicative of the former, the 400% rise in volatility over the last 24 hours suggests the latter.

Cardano volatility | Source: LunarCrush

However, one thing is for certain – When ADA does make it above $1, it will face trouble at its actual resistance of $1.02. That level hasn’t been tested for over a month now. In fact, it acted as a strong support level earlier in January.

So, if Cardano can close above it, then maybe we’ll see more from retail investors than whales.

![Cardano [ADA] price prediction - 8% rally next, but here's why you should be careful!](https://ambcrypto.com/wp-content/uploads/2025/07/ADA-price-prediction-Featured-400x240.webp)