Cardano’s on-chain metrics reveal where ADA holders can book profit

While the world prepares for the Vasil Hard fork, a much-anticipated event set for next month, people seem to be taking their attention away from what Cardano is today in the excitement of what it can be tomorrow.

Cardano is on the verge of change?

A similar shift in sentiments was noted back in August when the Alonzo upgrade brought smart contracts to the network.

But this sentiment is only in theory right now, as technically nothing is being observed.

Following the crash that took place this month, Cardano fell too low to bounce back instantly. Trading at $0.51, it did recover from the lows, but, at press time, it was still stuck in the bearish zone. This bearish zone in the past has been home to Cordano for almost four months between September 2021 and January 2022.

Cardano price action | Source: TradingView – AMBCrypto

In the same duration, Cardano observed excessive losses. Approximately, every single day, the ADA involved in transactions on-chain were conducted in loss as opposed to profits, the hint of which was seen towards the beginning of March this year.

Cardano network-wide losses | Source: Santiment – AMBCrypto

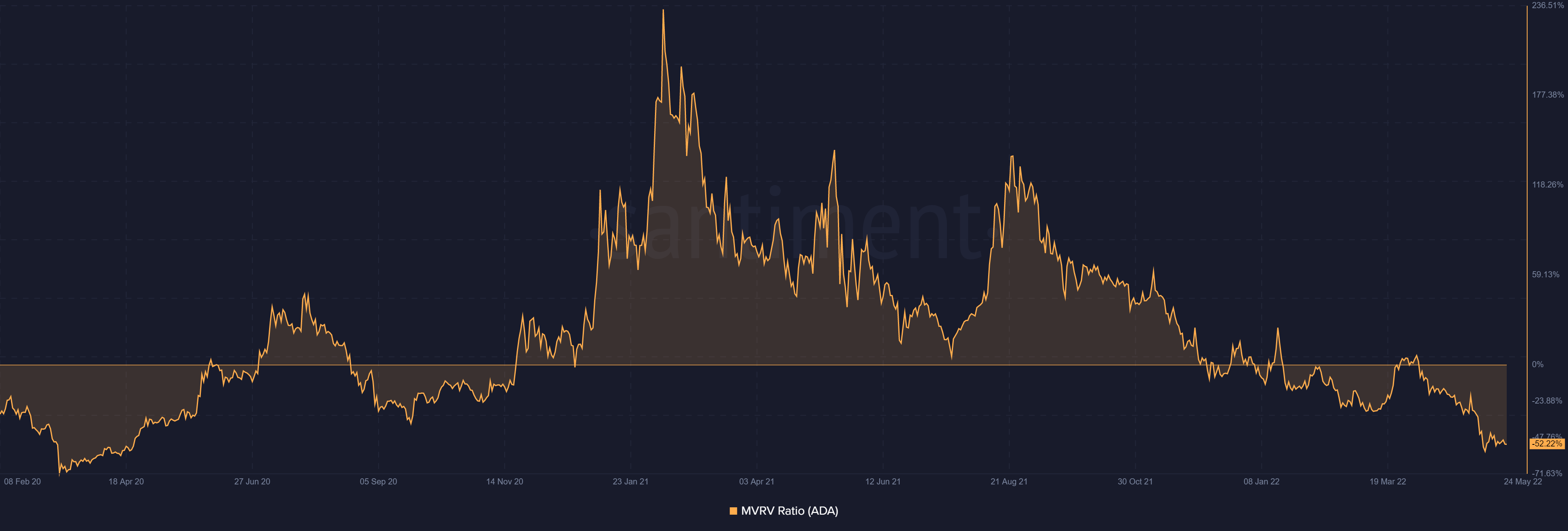

This played a critical role in Cardano’s deterioration which was later observed in the asset’s declining market value. Earlier this month, it fell to the lowest it has been in more than two years.

Cardano market value | Source: Santiment – AMBCrypto

And, with most of the Cardano currently sitting in losses, the possibility of rapid recovery is pretty much non-existent.

Furthermore, on the derivative front too, Cardano seems to be losing investors’ interest. The open interest of all Futures contracts across all exchanges has declined considerably. From over $700 million back in January this year, the OI currently stands at a little over $230 million.

Even with the upcoming Vasil fork, investors don’t seem to be interested in betting on the Future as higher calls and puts contracts would’ve been reflected in the OI.

Thus, hereon this will be an essential indicator in judging where Cardano is headed and how investors would react when the hard fork arrives.