Cardano’s ‘swelling’ wallets should have ADA investors gazing- Here’s why

- Cardano registered a 55% increase in wallets as more investors continued to choose decentralized projects

- Long and short-term ADA positions remain in similar situations with considerable declines

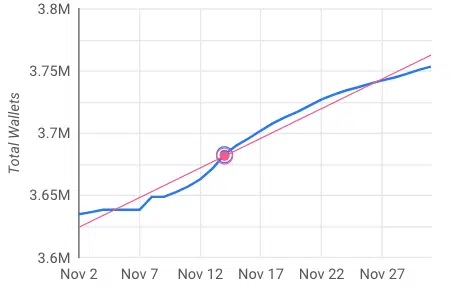

According to data from Cardano blockchain insights, wallets existing on the Cardano [ADA] network had edged closer to four million. This milestone meant that the Proof-of-Stake (PoS) blockchain had been able to register more than 55% growth in the last year.

At the time of writing, wallets on the ADA network were 3.753,590. This number showed beyond doubt that Cardano had recorded massive growth despite the unstable market conditions.

According to the ADA ecosystem tracker, over 100,000 wallets were onboarded onto the blockchain since the beginning of November.

Read Cardano’s Price Prediction for 2023-2024

This sublime increase in wallets might not be unconnected to the fall of FTX, especially as investors pledged to move to decentralized exchanges. Since Cardano’s network was primarily decentralized, it was likely that the increase signified a “vote of confidence” in the project.

Long-term HODLing justifies nothing yet

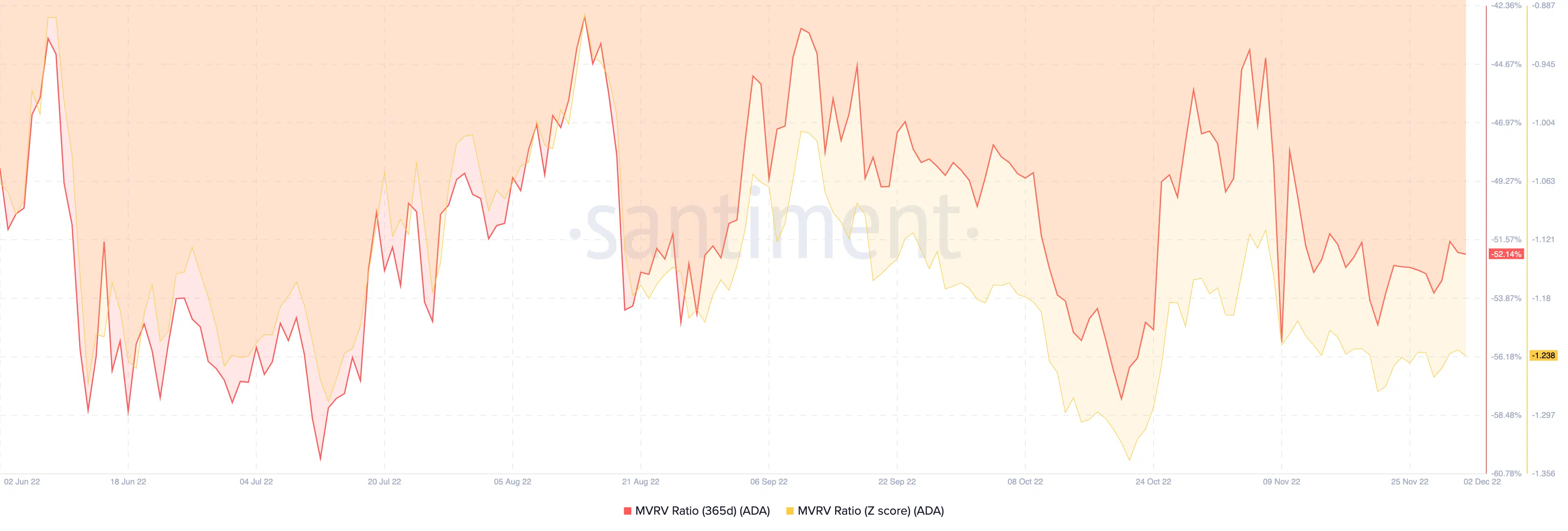

Despite the hike, ADA’s long-term holders were still in severe torment. This was because the Market Value to Realized Value (MVRV) ratio indicated massive loss for these ADA devotees. According to Santiment, the 365-day MVRV ratio was -52.14%.

While the 30-day condition was not any better, it implied that investors with ADA in their wallets were far from doubling the value of their assets.

In actual fact, the drop in value reflected a further turn towards the downside than a significant respite. As for the z-score, ADA was at the -1.238 point. It indicated that ADA was undervalued at the current spot, and the present value could offer a moment for investors to accumulate.

However, this did not guarantee that ADA would no further decline, even though it was 89.78% down from its all-time high.

Are wallets lending a hand?

Cardano also recorded an uptick in transaction participation as the wallet count increased. Based on Santiment revelations, the 24-hour ADA active addresses had surged to 72,400. The seven-day count also showed an increase to 347,000. This implied that wallets created were not just registered for dormancy. Instead, they had been actively involved in contributing to deposits on the Cardano network.

However, the circumstance contrasted with the state of the ADA circulation. At press time, the one-day ADA circulation had dropped from 287.56 million to 112.48 million.

With over a 100% decrease, it implied that the number of unique ADA tokens that exchanged hands during the period was not substantial. Hence, short-term traders were barely trading the token. Still, it did not mean a decrease in interest.