Cardence: A multi-chain pre-sale platform

The DeFi space allows users and developers in the crypto space to create their own projects and tokens. While this network of dApps is supported by a few prominent chains, the issue of scalability and speed are still major problems in the space.

A lot of projects face problems in the token launch due to the presale process, rug pulls, lack of support, and much more.

Cardence aims to provide an IDO platform and act as a launchpad for upcoming projects on Cardano.

What is Cardence?

Cardence intends to establish itself as the world’s first decentralized launchpad and offers projects a chance to release tokens through a vesting schedule while whitelisting project participants and guaranteeing them participation on the platform.

The decentralized presale platform gives its users a fixed swap pool intended to set a fixed price for token presales. The platform would allow any project to create its own sale.

Cardence is currently running on Binance Smart Chain and is going to be live on Ethereum, KuCoin, Solana, and Cardano soon.

Simplifying pre-sale process

As mentioned earlier, Cardence is trying to solve the complicated process of launching a pre-sale through its trustless ecosystem. Apart from that some of the issues solved by Cardence regarding the pre-sale process are:

- Solving liquidity issues: Some tokens struggle with liquidity once launched, this limits the token’s uses. Cardence solves this by using smart contracts and providing a locked pre-fixed percentage of the amount. This amount is locked away automatically once the pre-sale takes place and solves the liquidity problem.

- Token dumps by users: Right after trading starts for a project, some token holders dump the tokens bought during the pre-sale. This becomes harmful for a project’s growth. While vesting periods are used to counter this, it is still risky. By adding smart contracts to this process, Cardence creates a vesting schedule that is adhered to.

- Token dumps by project creators: Another similar issue faced by buyers and token holders could be of token dumps by the team behind the project. Cardence has a team token locking feature that ensures that this does not happen. Team tokens too are locked with a similar vesting schedule as that of the pre-sale tokens.

- Pre-sale mechanisms: Lastly, one of the most important issues faced by projects is that of the lack of a proper pre-sale mechanism. The current process of sending money to wallets is tedious and in need of innovation. Cardence solves this by introducing fixed swap pools that allow for a seamless swap of presale tokens.

Key features

Some of the key features of the Cardence platform include:

- IDO launchpad: Cardence’s IDO launchpad would choose Cardano projects after careful consideration and act as an accelerator, incubator, and enabler for them.

- Multi-chain pre-sale platform: Cardence’s decentralized pre-sale platform offers features such as whitelisting of participants, releasing tokens according to vesting schedules.

- Token locker: The platform has a standalone locker app that would allow the locking of team tokens and releasing them as per the vesting schedule. The token locker app would also help projects with the distribution of time-locked tokens.

- Smart Mint: Smart Mint would allow for the generation of fully customizable tokens on the Cardano network without going through the hassle of coding them.

- Viral marketing: Cardence is the world’s first pre-sale platform that comes with the option of affiliate marketing. The platform has an analytical dashboard that helps to track the ROI of each marketing channel individually.

Tokenomics

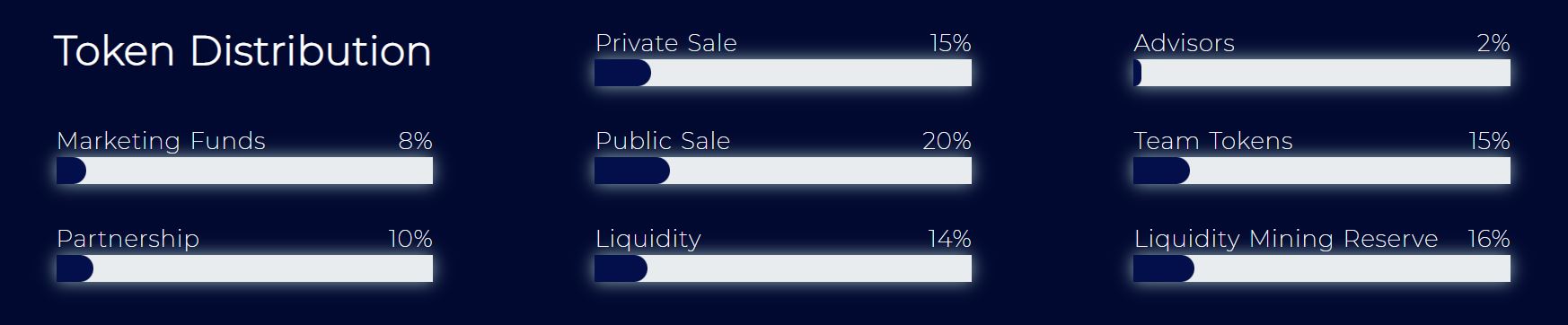

Cardence’s native token ($CRDN) is a BEP-20 token that has a total supply of 50 million with an initial token supply of 15 million tokens.

A 30% share of the tokens was set aside for the public round while a 16% share was for liquidity mining. Another 15% share of the tokens was set aside for the team and a 14% share was reserved for providing liquidity.

10% share of the tokens have been set aside for partnerships while an 8% share is for marketing. A 5% share was set aside for Cardence’s private sale while the remaining 2% share was for advisors.

Final word

dApps offer a great opportunity for everyone in the crypto space to develop their projects and run them. While the space is open for projects that have the potential to flourish, a lot of them get lost or fail due to a lack of proper guidance.

Cardence aims to be a launchpad for such projects and help them carry out not only a successful pre-sale but also provide help with their marketing requirements through their affiliate and viral marketing strategies, creating their own tokens without coding using Smart Mint, and solving the issues of liquidity by incorporating smart contracts.

The platform is focusing to become multi-chain and is currently working on integrating itself with more blockchain networks.

For more information on Cardence, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.