Ceres DAO: Deploying a Beta+ Alpha investment strategy in Ventures DAO

The current venture capital model is also facing changes due to the rise of the crypto industry and the DAO concept. Before we go into details, we need to introduce Ventures DAO.

Ventures DAO is an organizational vehicle for democratizing investment. Like traditional VC, its primary purpose is to raise capital, but it does so without relying on the approval of large traditional VCs. And because of its more diversified sources of capital, a more diverse portfolio is possible in Ventures DAO.

Much of what makes Ventures DAO stand out from traditional investment structures is that they are often egalitarian and transparent in their underlying design based on blockchain technology. Overall, investment decisions have also shifted from relying on a single leader to relying on community voting and consensus.

Also, under a specific DAO smart contract, members of the DAO have the right to launch or terminate their participation in the DAO’s investment activities at any point in time. Traditional VCs, on the other hand, often require investors to stay in the fund for a certain period of time.

For a long time, large VCs and big money investors often bought tokens at relatively low prices during the early seed and private placement rounds of projects to make large profits. After the project is officially launched, most VCs will sell it for a profit, and this short-term profit-seeking behaviour will undoubtedly cause great harm to the long-term development of the project.

Compared to the traditional crypto VC investment model, Ventures DAO allows a larger group of small investors to participate in the investment process of early-stage crypto projects. Its existence can impact the throwback phenomenon of traditional VC investments by providing community users with the opportunity to invest in early-stage projects and to reap the benefits of investing in early-stage projects.

Venture DAO’s investment process differs from a typical venture fund because each member of the DAO can act as the lead person and make investment recommendations to the DAO.

Investment decisions are also based on the results of DAO voting, rather than through the investment committee. DAO participants will use the DAO’s own governance token to vote on which projects to invest in.

Typically, each venture DAO will have an exclusive community treasury that holds all assets in a multi-signature wallet and distributes capital in a transparent manner.

This model will enable a relatively healthy venture capital ecosystem that will provide a more convenient source of funding for Web3 projects and help crypto flourish.

As we are sharing about the advantages of Ventures DAO, we can make the following specific summary:

- DAO’s organizational model harnesses the wisdom of the group to make investment decisions, and the most important feature of the DAO community is that it brings together people from all over the world with different professional backgrounds, and the distributed office model allows for shared decision-making. At the same time, DAO members are a community of interest, so in order to protect their individual interests, members will contribute their exclusive industry resources, expertise, and insights to help guide and facilitate investments in projects with real potential.

- The DAO model allows for a true sense of up-chaining of the operating investment funds, which further increases the transparency of investment decisions. This means that the community must manage investment funds and the making and execution of decisions through extensive communication and voting, instead of having a centralized leadership group determine the direction.

- Compared with traditional crypto VCs, members of a DAO have greater autonomy. Depending on the DAO’s smart contract deployment model, any DAO member has the right to exit the DAO at any point in time and get back their share of the DAO’s total assets. This allows for greater organizational flexibility and also protects DAO members from getting into “governance limbo.” In contrast, however, traditional crypto VCs typically require investors to stay in the fund for a certain period of time. There are certainly some hidden risks.

We’ve covered a lot about Ventures DAO, and in fact, a large number of industry insiders have generally seen it as one of the most promising DAO models for a long time. The combination of decentralization and investment decision-making undoubtedly brings the flow of benefits and funds back to the original idea. And we will also introduce a trendy Ventures DAO project, Ceres DAO, in detail from many dimensions today.

Ceres DAO – Empowering Web3 with DAO as a base

Ceres DAO is the world’s first decentralized digital asset management infrastructure and management system based on DAO governance and powered by Web3. Using a new, standardized DeFi asset investing paradigm, Ceres DAO offers non-custodial, decentralized asset management services for digital asset holdings.

Ceres DAO is a community-driven organizational structure that, in terms of governance, offers a flexible mechanism that can involve DAO members in investment choices in a way that conventional venture capital fund models cannot.

The change would also lower the entrance barrier for DeFi, enabling consumers to access more investment options and returns without requiring active money management or exposure to risky asset classes.

Economic Model

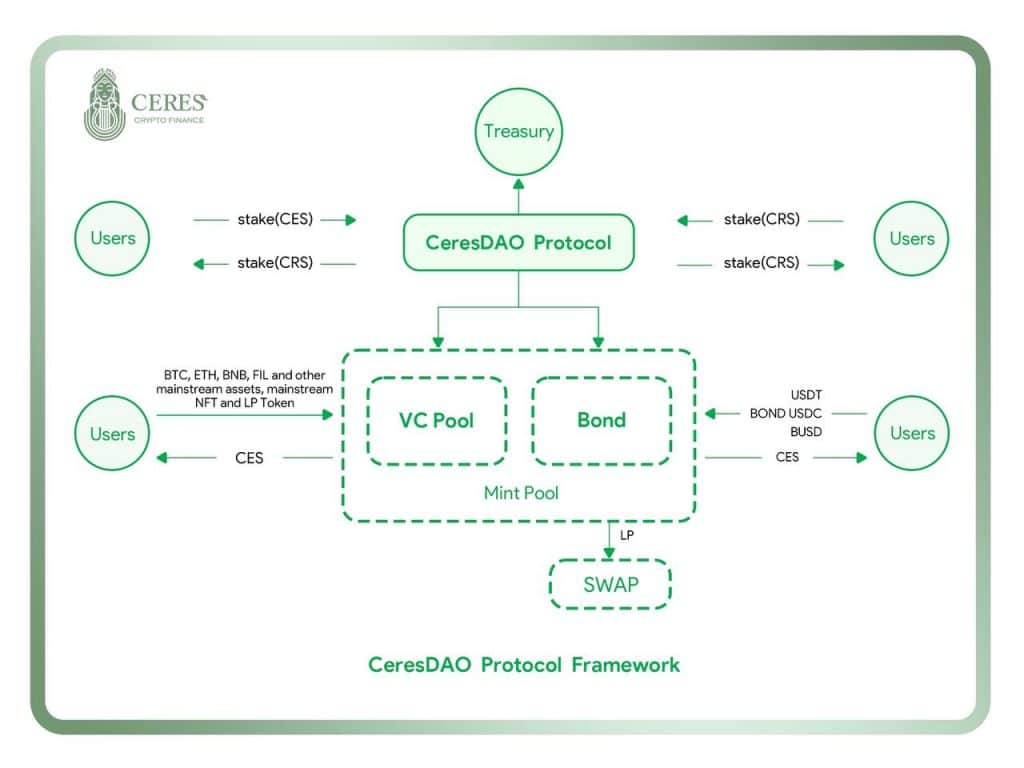

Ceres DAO uses a co-share model, also known as AB shares. There are two main tokens included in the Ceres DAO ecosystem, which are the CES Token and the CRS Token.

Among them, CES Token is an equity token, while CRS Token is a secondary market liquidity token. The price of both is 1:1, but the equity is different, and we will discuss each of them and the relationship between them next.

1、Equity Token – CES

The biggest role of CES, Ceres DAO’s equity token, is to determine the next action and direction of the DAO through on-chain proposals and voting.

The CES Token can be minted in two ways.

1) VC Pool (Mainstream Asset Pool)

VC Pool conducts CES minting through mainstream assets such as BTC, ETH, BNB, FIL and etc.

2)Bond Pool

Bond Pool minting CES via stablecoins such as USDT, USDC or BUSD. The VC Pool and Bond Pool have a daily minting limit of 1 billion CES Token. After CES is minted by the above two methods, it will be released linearly after 7 days.

The funds in the CES mint pool will be distributed in the following proportions.

- 50% – injected into the treasury

- 30% – injected into LP pool (converted into stable coins and matched with CRS token for LP tokens)

- 10% – Commission (5% for CRS buyback-burn, 5% for operations)

- 10% – Marketplace Incentive (5% for DAOs Incentive, 5% for Nodes Incentive)

2. Circulating Token – CRS

CRS is a liquidity token issued by the Ceres DAO protocol, whose primary role is to provide good liquidity to the entire ecosystem.

In terms of access, CRS Token can be obtained through CES pledge, DEX purchase or 1:1 exchange of CES.

CRS has a total supply of 1 trillion tokens, for which the specific allocation ratio is shown below.

- 60% – Mining Pool

- 10% – Foundation

- 15% – Institution

- 7% – Development

- 7% – Ecosystem

- 1% – IDO

3. The relationship between CES and CRS

Following the foregoing introduction, it is clear that the core components of the Ceres DAO protocol are CES, an equity token, and CRS, a liquidity token.

Users can acquire CRS Token through staking, secondary market trade, or the CES exchange, whereas CES Token can be acquired through the two minting methods listed above.

In terms of CES and CRS conversion, it is carried out precisely in a 1:1 ratio (not reversible). The particular allocation ratio of this component of funds is provided below. At the same time, a transaction tax of 20% will be imposed on the conversion of CES to CRS.

- 10% – injected into the treasury

- 5% – injected into LP pool (converted into stable coins and matched with CRS token for LP tokens)

- 5% – as commission (2.5% for CRS buyback-burn, 2.5% for operations)

It is worth noting that both CES and CRS can be staked to generate CRS Token. Staking is critical to the long-term growth of the ecosystem. Users are incentivized to stake their CES and CRS for compound returns. The incentive rate can be adjusted to market conditions to avoid hyperinflation.

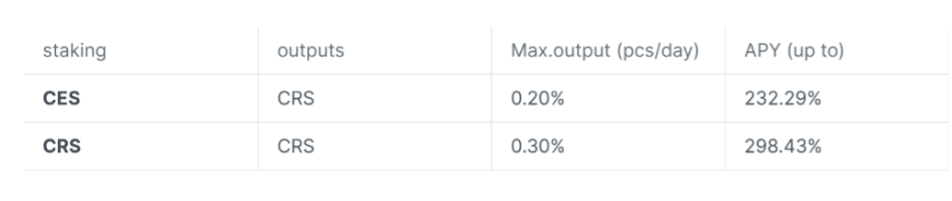

The current actual status of pledge awards is shown in the following chart:

In the staking mechanism, the maximum daily CRS output is 100 million coins/day. If the actual output of the staking falls below 100 million pieces, the remaining CRS will be burned to avoid hyperinflation.

4、Evaluation and summary

Ceres DAO uses an AB share model that allows the entire ecosystem to remain relatively stable by operating with a clear separation between equity tokens and liquidity tokens.

By carefully examining its AB share concept, we can quickly see that there is some innovation in the design of Ceres DAO’s economic model. In an effort to guide the community toward truly decentralized governance, the project owner has always purposefully avoided over-centralization. At the same time, the allocation ratio allows us to determine the trade-off between community feedback and project development.

However, we are unsure of how effective it will be in practice, which will surely require a lot of tests and attention.

Governance Mechanisms

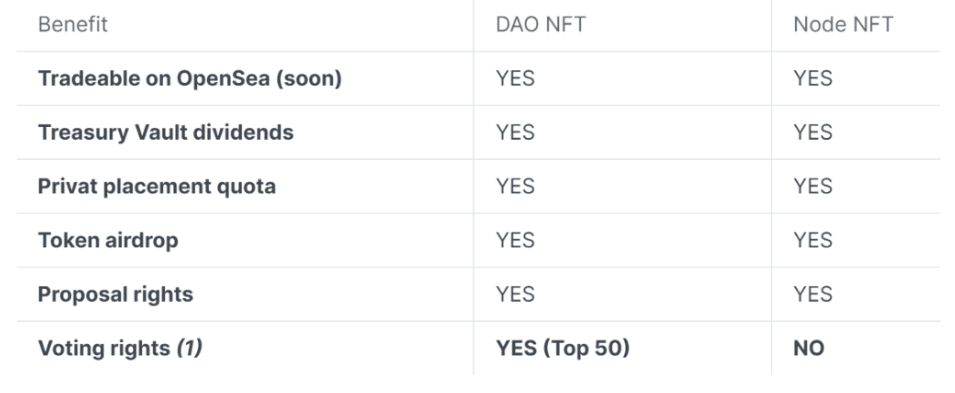

In the Ceres DAO ecosystem, each DAO or Node has its own NFT (i.e. Rich Panda family), which is freely transferable. The difference in authority between DAOs and Nodes NFTs is shown in the following figure.

The assets used to cast the NFT will be distributed according to the following allocation.

- 50% – injected into the treasury

- 50% – Copyright tax

Under this governance model, the governance of Ceres DAO will have the following major features.

- DAOs can be involved in the governance and deployment process of the protocol.

- After screening for quality projects or better investment opportunities, both DAOs and Nodes have the ability to make and initiate proposals to the platform. This includes, but is not limited to, new product releases, integration and collaboration with other protocols, and deployment in other Layer 1 ecosystems.

- TOP50 DAOs can participate in the governance of the platform and have the right to vote. If the approval vote reaches 67% or more, the proposal will be adopted and implemented.

However, as the market value of CES Token continues to grow, becoming a TOP50 DA0s will undoubtedly require more funding. Therefore, subsequent communities may form sub-DOs, and sub-DOs may also enter the ranks of TOP50 DAOs as a whole (multi-signature addresses) to gain access to governance.

Treasury Investment Strategy

The selection of an investment strategy is unquestionably a key component of the initiative as a Ventures DAO. Ceres DAO’s treasury will use a hybrid “Beta” and “Alpha” investing approach. We must first understand what “Beta” and “Alpha” strategies are in order to explain the strategy.

Financial terms “Beta” and “Alpha” are frequently used in traditional fund investing to refer to two components that stand for two distinct investment strategies with various risk appetites.

The beta coefficient is a risk index that is commonly used in traditional fund investing to measure the price volatility of individual stocks or equity funds relative to the overall stock market. It is a tool to assess the systematic risk of a security and can be interpreted as the magnitude of volatility relative to the broader market, or it can indicate the correlation to market volatility.

If a fund’s Beta coefficient is greater than 1, it is more volatile and riskier than the market; if a fund’s Beta coefficient is less than 1, we can assume that it is more volatile than the market and less risky than the market. The more the Beta coefficient converges to 1, the more its volatility converges with the market.

The Alpha Factor is the difference between the absolute return of an investment or fund and the expected return on risk calculated according to the beta factor. In simple terms, the Alpha factor most commonly means excess return.

The “Beta” + “Alpha” hybrid investment strategy adopted by Ceres DAO Treasury is a combination of these two strategies, i.e., a large percentage of funds is invested in mainstream cryptocurrencies that fluctuate with the market, and a small percentage of funds is invested in higher-risk Alpha projects with higher risk.

Specifically, the “Beta” investment strategy refers to investing 70% of the treasury funds in crypto assets in the crypto market, such as BTC, ETH, BNB, etc., and generating relatively stable income through DeFi lending protocol or asset appreciation.

The “Alpha” investment strategy means that 30% of the treasury funds are invested in higher-risk Alpha projects through the proposal of the investment research members in order to seek excess profits.

The reasons for this arrangement are simple. As an investment institution, Ceres DAO has to focus on both return and risk, and it is often difficult to combine both with a single investment strategy, so the combination of multiple strategies has become a necessity.

The Beta strategy provides Ceres DAO with a more stable investment return, which is affected by the volatility of the crypto market but is still a more secure investment, thus the Beta strategy also occupies a larger share of funds in the overall investment strategy.

The Alpha strategy, on the other hand, focuses on potential projects and aims to gain excess returns, which, of course, means that it will also face greater risks. Therefore, the proportion of Alpha strategy in the overall investment strategy is destined to be smaller, and at the same time, the review process of its investment will be more stringent, after all, Alpha projects are not like BTC and ETH, which have gathered a general consensus.

As the treasury’s funds under management continue to grow, users will also be encouraged to actively participate in the governance of the Ceres DAO ecosystem through CES staking. The distribution of dividends from treasury investments will be based on the following:

1) 80% of the treasury revenue will be distributed to the stakers of CES Token.

2) 10% of the treasury revenue will be allocated to Top 50 DAOs.

3) 10% of the treasury revenue will be used for project operations.

The distribution ratio of the treasury investment dividend reflects the project owner’s balanced thinking of giving back to the community and empowering project development.

At the same time, Ceres DAO uses multi-signature wallets in order to protect the treasury funds. A multi-signature wallet is a wallet that requires multiple signatures to execute a transaction. In this model, the loss of a single private key does not compromise the security of Ceres DAO’s treasury funds, which is protected to a certain extent.

Concluding remarks

The Ventures DAO is likely to drive a change in the way VC funds operate, and the entry of Web3 will make venture capital more democratic. At that point, venture capital will probably no longer need to set the threshold of investors, and the amount of assets will no longer be a restriction for entry. Traditional venture funds will also be forced to change the way they invest in projects, and they may even need to turn their business models upside down and transform themselves into Ventures DAO.

In the Web3 world, Ventures DAO does not have a central agency to provide funding, and its venture capital funds are often raised primarily through community members. In the process of investing in promising projects, DAO members conduct their own due diligence, and community outreach, participate in community governance, and Ventures DAO members coordinate resources around common investment interests.

Web3 will enable people to come together in innovative ways, including the aggregation of capital and other resources, in a model that goes far beyond the rigid structure of the current venture capital space.

However, Ventures DAOs are undoubtedly a long way from reaching their full potential. Many of the tools currently in use are not fully compatible with the existing legal framework, and the existing decision-making mechanisms do not appear to be suitable for investment purposes, as they disguise incentives for convergence toward common goals. But in the long run, Web3, the engine of innovation, will undoubtedly provide relevant solutions to most of these obstacles.

Back to Ceres DAO, which is currently in a fairly early stage, but its overall project and ecological plan have been clearly presented. As a venture DAO, the investment strategy and economic model are certainly crucial for Ceres DAO. And it has indeed made a lot of designs for this, which to a certain extent can reflect the willingness and sincerity of the project owner to do things.

However, looking at these designs, it is easy to see that the general framework is already in place, but the overall details are still to be enriched. At the same time, since the project itself still lacks actual market practice, it still needs a lot of testing to determine the feasibility of its strategy.

Overall, though, Ceres DAO is a sincere project, as evidenced by the many trade-offs in its economic model and distribution strategy. Also, venture DAO is quite a track to watch, and in my opinion, it has the potential to be the next round of breakout. Therefore, Ceres DAO with these two points is certainly a project worth experiencing and watching.

Building Web3.0 venture ecosystem:

- Website:https://ceresdao.finance

- Twitter:https://twitter.com/CeresDAO

- Telegram:https://t.me/CeresDAOofficial

- Discord:https://discord.gg/ceresdao

- Youtube:https://youtube.com/channel/UCY9nL_ndhUmGO7NL4dE-lnQ

- Medium:https://medium.com/@CeresDAO

- Document:https://ceresdao.gitbook.io/ceres-docs

- Email:cerespunk@gmail.com