Bitcoin investors can find trading clarity in these findings

The crypto market is already showing signs of uncertainty halfway through the first half of the week.

Bitcoin has already retraced slightly in line with its current price channel, but this pullback has notably lower volumes and a lower range.

Bitcoin’s current performance is consistent with the uncertainty regarding whether it will continue rallying, or pivot.

Some analysts expect the market to continue seeking more downside as the Federal reserve intensifies its quantitative easing.

This outcome is expected to continue placing more pressure on risk-on assets such as Bitcoin,

On the other hand, BTC saw a substantial rally after the last FOMC meeting’s outcome.

These contrasting scenarios have culminated in the prevailing unpredictability. Bitcoin’s $22,863 price on 4 August was right in the middle of its current support and resistance range.

BTC’s MFI indicator has leveled out near the 50% level and the RSI demonstrates a similar outcome.

This is a reflection of the reduced outflows and a closer look at Bitcoin’s on-chain metrics may help make sense of the market.

Ready to charge

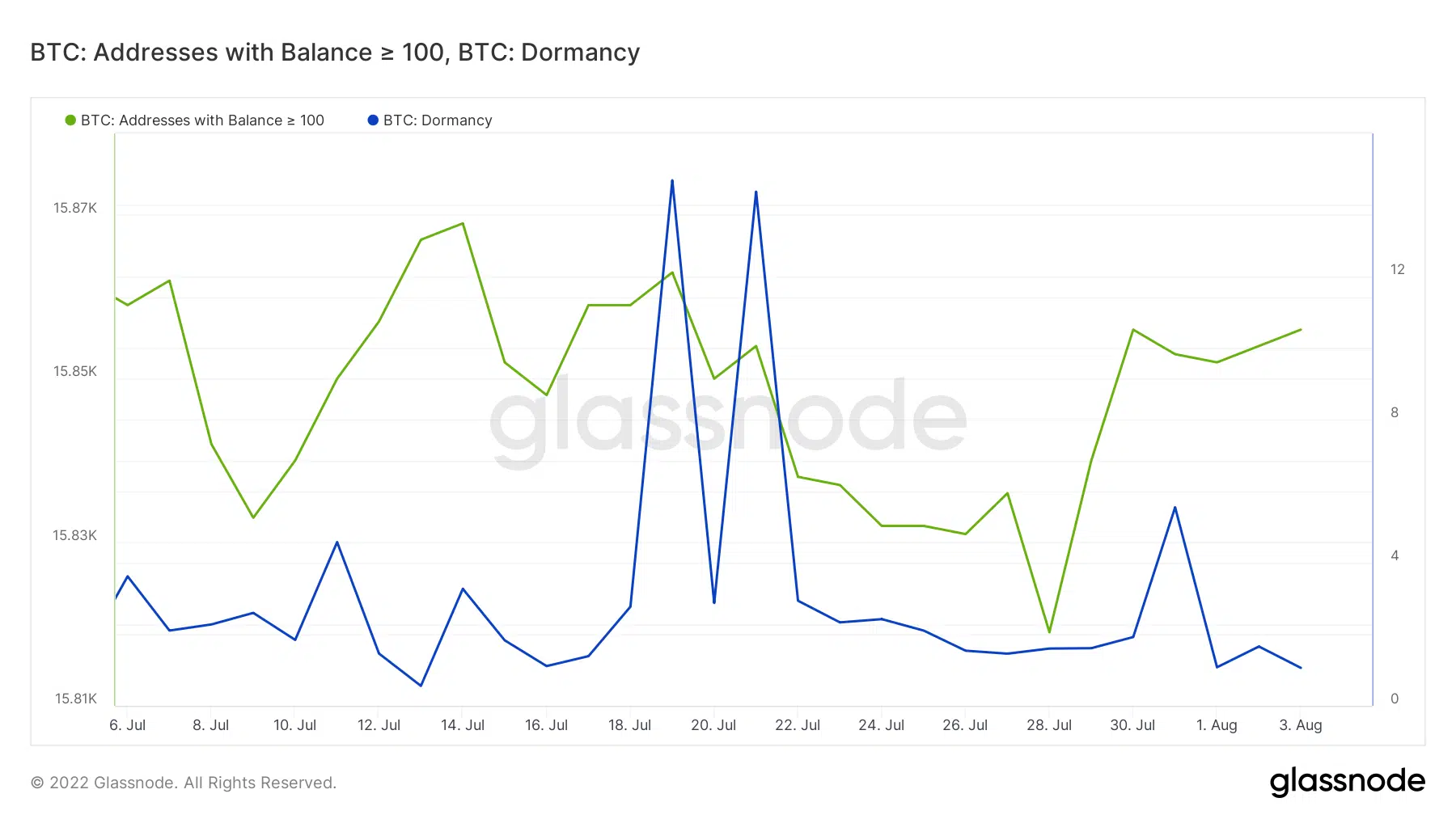

Whales have been adding to their balances during the bearish retracements, thus supporting their current range.

Addresses holding more than 100 BTC bounced back from a monthly low of 15,819 on 28 July to 15,856 by 3 June.

Bitcoin’s dormancy metric also reveals that most of the Bitcoin accumulated especially towards the end of July has not moved.

The Dormancy metric is currently close to its lowest level in four weeks. This is a sign that most BTC holders are optimistic about the potential upside.

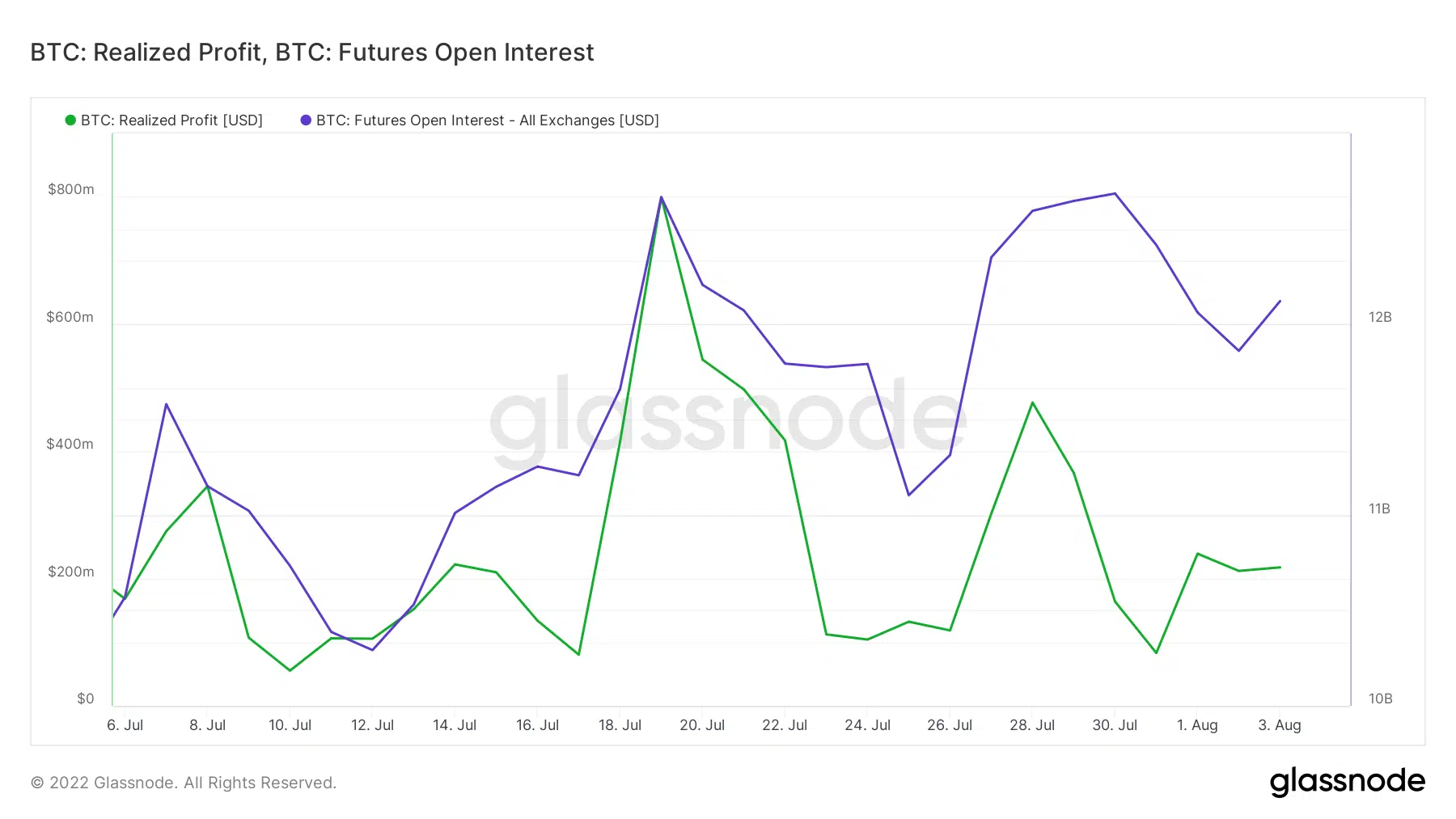

The accumulation near the current price level is confirmed by the drop in BTC’s realized profits in the first week of August.

It registered strong spikes near mid-July as investors cashed out after the previous rally. The futures market has not been left behind by this wave of demand.

The futures open interest metric registered a significant upside in the last four weeks.

These observations explain Bitcoin’s rising floor price. Whales accumulating BTC is a healthy sign that might favor the bulls.

However, the market is still waiting for the uncertainty to clear, which means there is still a significant possibility of a bearish outcome.

Bitcoin will likely retest its current ascending support line towards the weekend.

However, its ability to bounce back will depend on whether the market will depend on the prevailing sentiment. A pattern break might also be around the corner.