These 3 metrics indicate a bullish trajectory for Ethereum

Since January, the price of Ethereum has been trading with sudden highs and lows, leaving some traders waiting for markets to settle. After Ether dropped roughly 12% after its 20 February ATH of $2,042.93, the asset was trading at $1,790.94, at press time. However, over the last 24 hours, ETH endured an 8.4% drop and a 0.7% drop in the past week.

Regardless of the price drop, popular Chinese journalist, Colin Wu, believes that certain metrics indicated a bullish trajectory for the price of Ethereum.

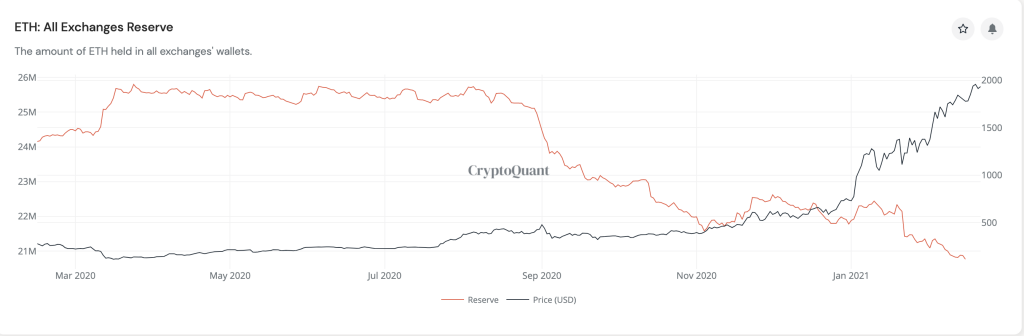

ETH Reserve

In his tweet, Wu said that when ETH fell below $1,900, exchanges’ ETH reserve was only 20.63049 million, “a record low.”

Liquidations

Along with Ether’s rally to over the $2K mark, liquidations surged as well. For instance, on 20 February, when Ether was trading at $2004.71, more than $373 million of long positions were liquidated.

Source: BYBT

In addition, Wu claimed that the “advancement” of ETH2.0 and “large hoarders” have caused a diversion of exchange reserves and added:

The ETH market is facing a shortage of liquidity, which will drive prices to continue to rise.

Addresses

Moreover, IntoTheBlock’s Global In/Out of the Money analysis indicated that Ether had an average price of $1,690, with 2 million addresses having bought 8.9 million Ether at this support.

Source: Intotheblock

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)