Chainlink, AAVE, Sushi: What’s the deciding factor for these alts?

As ETH fell over this weekend crash, several DeFi projects follow suit. Ethereum’s price action is instrumental to DeFi’s rally. In the past month, ETH’s price has dropped below $2000 on a few occasions. On these occasions, there has been a bearish impact on the overall DeFi TVL and the TVL of several DeFi projects.

While DeFi has rallied two times since the beginning of 2021, the biggest DeFi rally has not started yet, and it depends largely on the participation of ETH and ETH traders.

There is one important statistic that supports this narrative. Over 1.75 percent of all unique ETH addresses have ever interacted with DeFi projects, any DeFi project. That’s 2.8 Million users out of a possible 159 Million addresses, on the ETH network. This builds a bullish case for DeFi, as this is a scalable possibility. Making note of this, DeFi’s TVL hasn’t hit its highest point in 2021 yet.

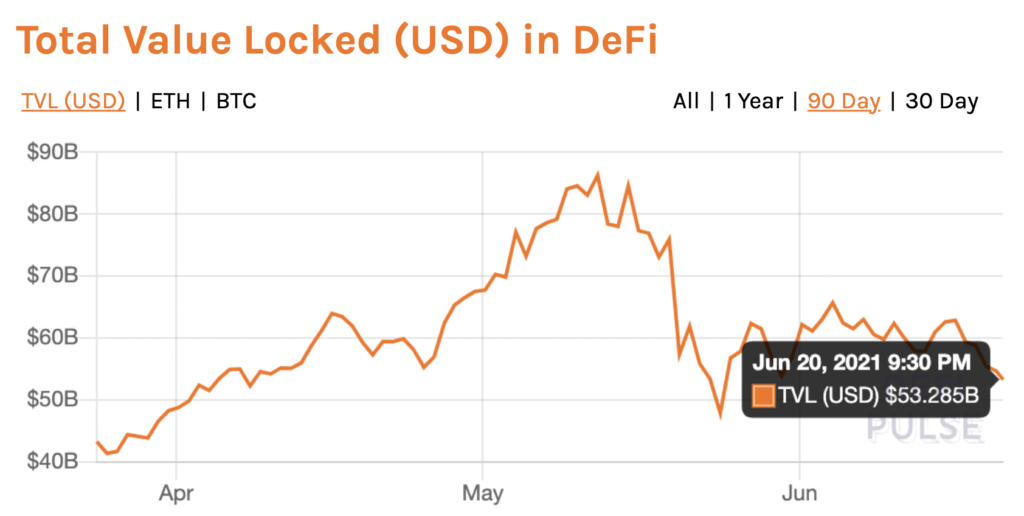

DeFi TVL | Source: DeFiPulse

Currently, DeFi TVL was at $53.2 Billion based on the above chart from DeFiPulse. Among others, AAVE is the most dominant DeFi token, currently. Among DeFi projects that have interacted with ETH, AAVE and SUSHI are the most notable. Though ETH has not directly interacted with these projects, ETH’s layer 2 MATIC has interacted with these projects since they have rallied against ETH on the chain.

The next wave of DeFi projects that rally in response to ETH may be led by LINK. At the $20 price level, 44% of LINK traders are profitable, out of 78% that hold LINK in their wallets. The number of large transactions on the LINK network has increased consistently, it is $2.23 Billion in the past week. The trade volume for LINK has increased consistently over the past week and less than 20% HODLers have held LINK for over a year. This number is less since the investment inflow increases every few months.

LINK Price Chart | Source: Coinmarketcap.com

In the past 3 months, the price has dropped closer to the $16 level, the current price level is higher than that. LINK is undervalued at the current level, following on-chain metrics and LINK’s correlation with ETH, it is likely that LINK will rally in response to ETH’s price rally. Additionally, several projects in DeFi are expected to rally further in 2021.