Chainlink forges a new path: Of gains, losses, and whale moves

- LINK rose by around 10% in the last 48 hours.

- More LINK tokens were leaving the exchanges compared to the ones flowing in.

Over the past day, Chainlink’s [LINK] price experienced a notable increase, following several days of gradual upward movements and positive trends in various metrics. Considering the ongoing price uptrend, were there notable changes in other key metrics?

Read Chainlink’s [LINK] Price Prediction 2023-24

LINK gains over 10%

Based on the daily timeframe chart for Chainlink, the trading day on 18 September concluded with an impressive gain of more than 6.7%, reaching approximately $6.5.

Prior to this upward movement, LINK had endured several consecutive downtrends that had collectively shaved off over 3% of its value. As of this writing, LINK was trading at slightly above $6.7, marking a nearly 10% increase within the last 24 hours.

This price surge coincided with a notable uptick in its Relative Strength Index (RSI), which, as of this writing, was above 60, indicating a robust bullish trend.

Furthermore, the price was now trading above the short-term Moving Average (yellow line), previously acting as a resistance level. It was also approaching a position where it might surpass the long-term Moving Average (blue line) as of this writing.

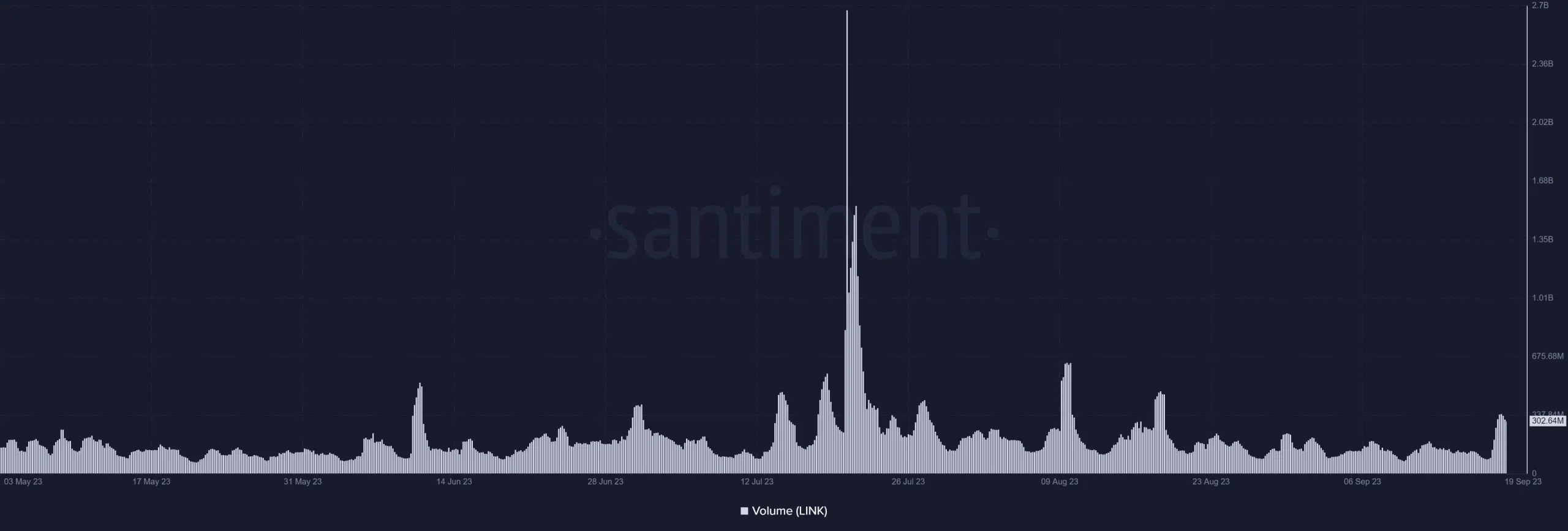

Chainlink sees more volume as price rise

While not a dramatic shift, Chainlink also experienced an increase in trading volume, as observed through the volume metric on Santiment. Prior to this recent uptrend, the average LINK trading volume hovered at approximately $120 million.

However, by 18 September, the volume had surged to exceed $300 million, and as of this writing, it stood at approximately $302 million. This suggested that trading activity had picked up in tandem with the rising price.

Short traders take a huge loss

According to data provided by Coinglass, traders holding short positions incurred substantial losses due to Chainlink’s price spike.

The liquidation chart revealed that on 18 September, short positions saw liquidations totaling $1.28 million, whereas long positions had liquidations of approximately $740,000. This marked the highest level of short liquidations in over a month.

Furthermore, as of this writing, additional short positions were being liquidated. Short liquidations exceeding $876,000 could be observed, in contrast to approximately $40,000 in long positions.

Chainlink addresses move LINK from exchanges

A 19 September post by Lookonchain revealed that certain wallet activities have drawn significant attention and generated curiosity. According to the observed data, more than 35 new LINK addresses were established just three days ago.

We noticed that ~35 fresh wallets created 3 days ago started withdrawing $LINK from #Binance today.

And have withdrawn a total of 755,687 $LINK ($5.08M) so far.

Are there whales accumulating $LINK? pic.twitter.com/IYte19TmTE

— Lookonchain (@lookonchain) September 19, 2023

These newly created addresses have begun withdrawing LINK tokens from Binance [BNB], with a cumulative withdrawal of over 755,000 LINK tokens, valued at more than $5 million.

However, the motive behind these withdrawals remained undisclosed as of this writing. This activity could be indicative of a significant accumulation move by a whale investor.

How the LINK exchange netflow has responded

According to the exchange netflow metric on CryptoQuant, Chainlink recently recorded its most substantial exchange outflow in over a month during the past two days.

Is your portfolio green? Check out the LINK Profit Calculator

The chart indicated that on 18 September, the exchange netflow was approximately -956,200, marking the highest negative netflow observed in the past month. As of this writing, the netflow stood at nearly -400,000, which was just shy of the second-highest figure recorded on 29 August.

Interestingly, the direction of the exchange flow contradicted expectations, as one might have anticipated more inflow to the exchange with the rise in price.