Chainlink [LINK] – Retail investors should look forward to more ‘whaling’ around

Chainlink, building on its uniqueness, has reached a point where the kind of services it provides to blockchains, DApps, and crypto-companies have become pretty much exclusive to Chainlink.

Even if another competitor tries to capitalize on that market, it won’t be easy at all. Especially since Chainlink, over the last few quarters, has established its supremacy in this space. However, while that is surely benefiting the chain, is it also benefitting its investors?

Everything you need to know about this quarter

Back during Q2 of 2021, Chainlink deployed about 167 of its decentralized oracle networks. Today, that figure stands at 910. That is a yearly growth of 444%, most of which was seen over the course of Q2 and Q3 of 2021.

In Q1 2022, #Chainlink grew to support 900+ decentralized oracle networks & powered Web3 innovation across top #blockchains. Key milestones:

? 2B+ data points

⛓️ 65M+ on-chain calls

? 4.4M+ randomness requests

? 20K+ automated transactionsA snapshot of Chainlink adoption ⬇️ pic.twitter.com/A7LSDjyfIc

— Chainlink (@chainlink) April 16, 2022

As the second quarter of 2022 begins, Chainlink can be expected to expand and mark a similar rate of adoption. However, in doing so, it must also be able to carry the people who have invested in the asset. Alas, that doesn’t look to be the case at the moment.

Marking a new all-time high is now a dream for LINK holders. Instead, being saved from falling through the descending wedge is their only prayer right now. After multiple attempts at breaching it, LINK once again failed earlier last month and ended up being trapped once again.

Chainlink price action | Source: TradingView – AMBCrypto

At the time of writing, however, the price action had shot up by 11%. This, despite no significant catalyst triggering the movement.

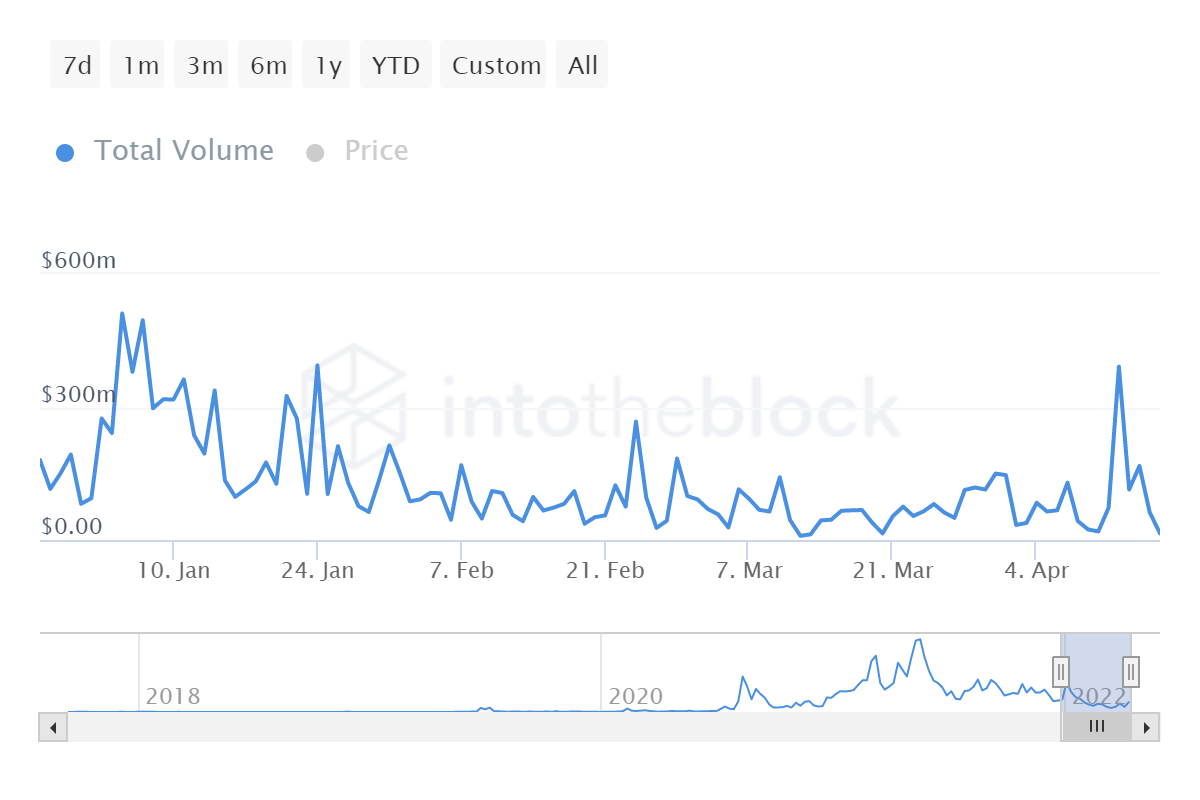

The only significant development on the metrics front has been the sudden reappearance of Chainlink whales. They conducted $391 million worth of transactions on 12 April, touching a 3-month high. Coincidentally, that was around the same time when the prices slightly recovered as well.

Chainlink whales transaction volume | Source: Intotheblock – AMBCrypto

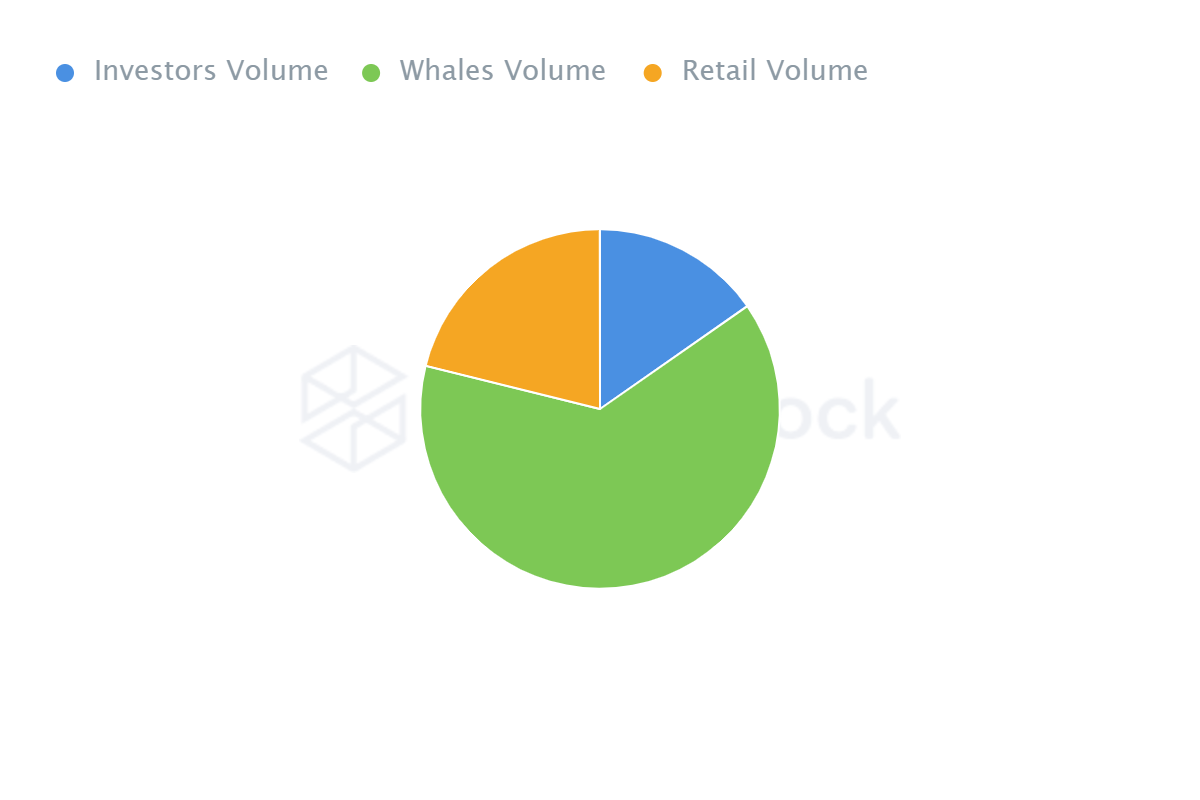

The impact of these whales is significant because they solely handle 63.58% of the entire supply. Thus, any sudden change in their behavior will bear an impact on the rest of the supply.

Chainlink whales domination over supply | Source: Intotheblock – AMBCrypto

Now, coming back to the question of if Chainlink can save itself, the answer is yes. With these whales reappearing after three months as Q2 began, the rally triggered by them will be fruitful for retail investors.

Consequently, the rate of growth expected from Chainlink over the next two months will also play a significant role in keeping LINK above its critical supports.