Chainlink observes a decline in its network growth, but traders needn’t worry

Chainlink, despite its growing number of collaborations, witnessed a massive decline in its network growth. This could suggest a potential bearish outlook for Chainlink’s future. However, many believe that the Chainlink team’s new venture into the stablecoin space could pull LINK out of its troubles.

Here’s AMBCrypto’s Price Prediction for Chainlink for 2022-2023

LINK gets chained down

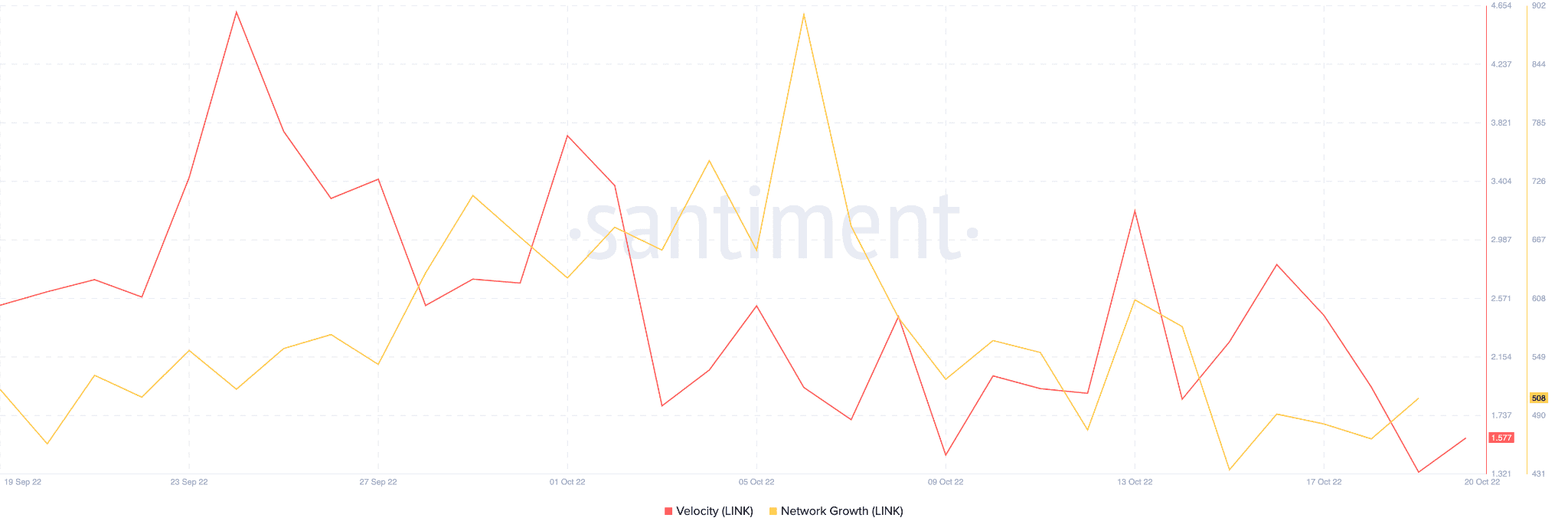

As can be observed from the image below, LINK’s network growth was on a downtrend. This indicates that the number of new addresses that transferred a given LINK for the first time declined. Thus, inferring the possibility that interest from new addresses towards the Chainlink network may be dwindling.

Along with that, the velocity of Chainlink also witnessed a plunge, implying that the average number of times that a LINK changed wallets each day reduced.

These two factors coupled together could paint a bearish outlook for Chainlink’s future.

However, despite chainlink’s dwindling network growth, it managed to foray into the stablecoin space with the help of its collaboration with TrueUSD.

Here, Proof of Reserve technology played an important role. It helps reduce the risk for users by reliably delivering data on TrueUSD’s stablecoin reserve asset balances on-chain.

Despite Chainlink’s attempts to grow its network, a lot of LINK holders continue to suffer losses. According to data from IntoTheBlock, 82% of LINK’s holders were not making any money, at the time of writing.

If this trend continues, a lot of Chainlink holders may succumb to the selling pressure and will have to sell LINK at a loss in the future.

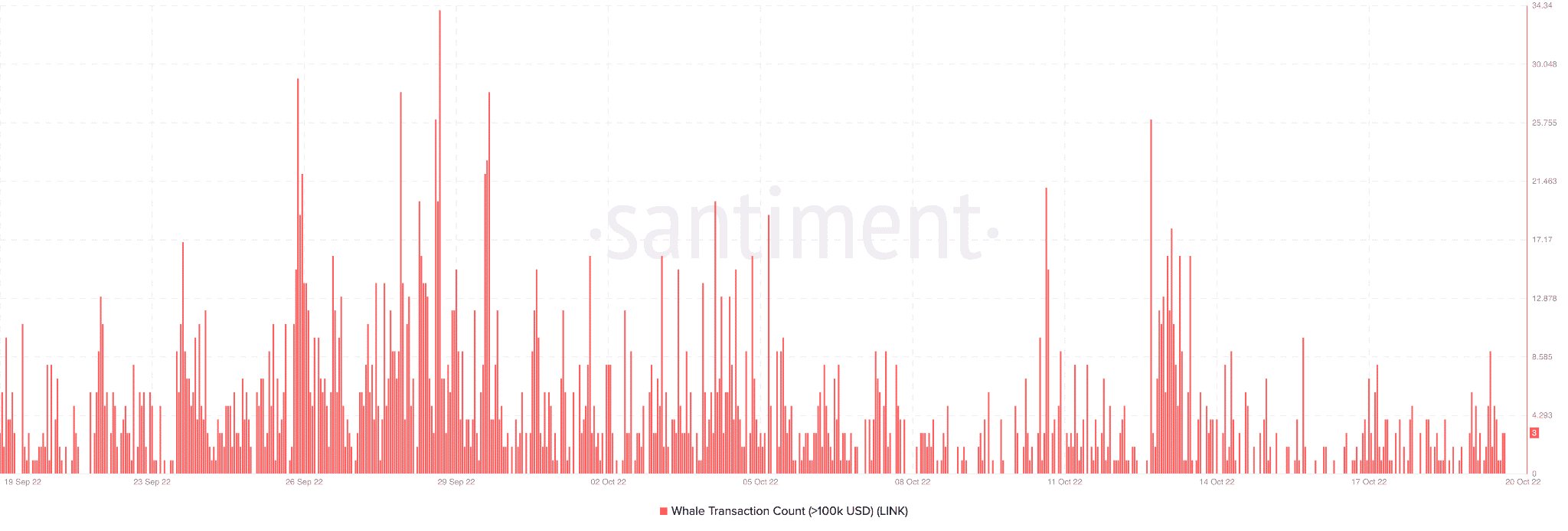

Along with traditional retail investors, it seems that whales were also losing interest in the Chainlink token. By having a look at the image below, readers can see that the number of whale transactions gradually decreased over the past month.

A decline in whale interest could have a negative impact on LINK in the near future.

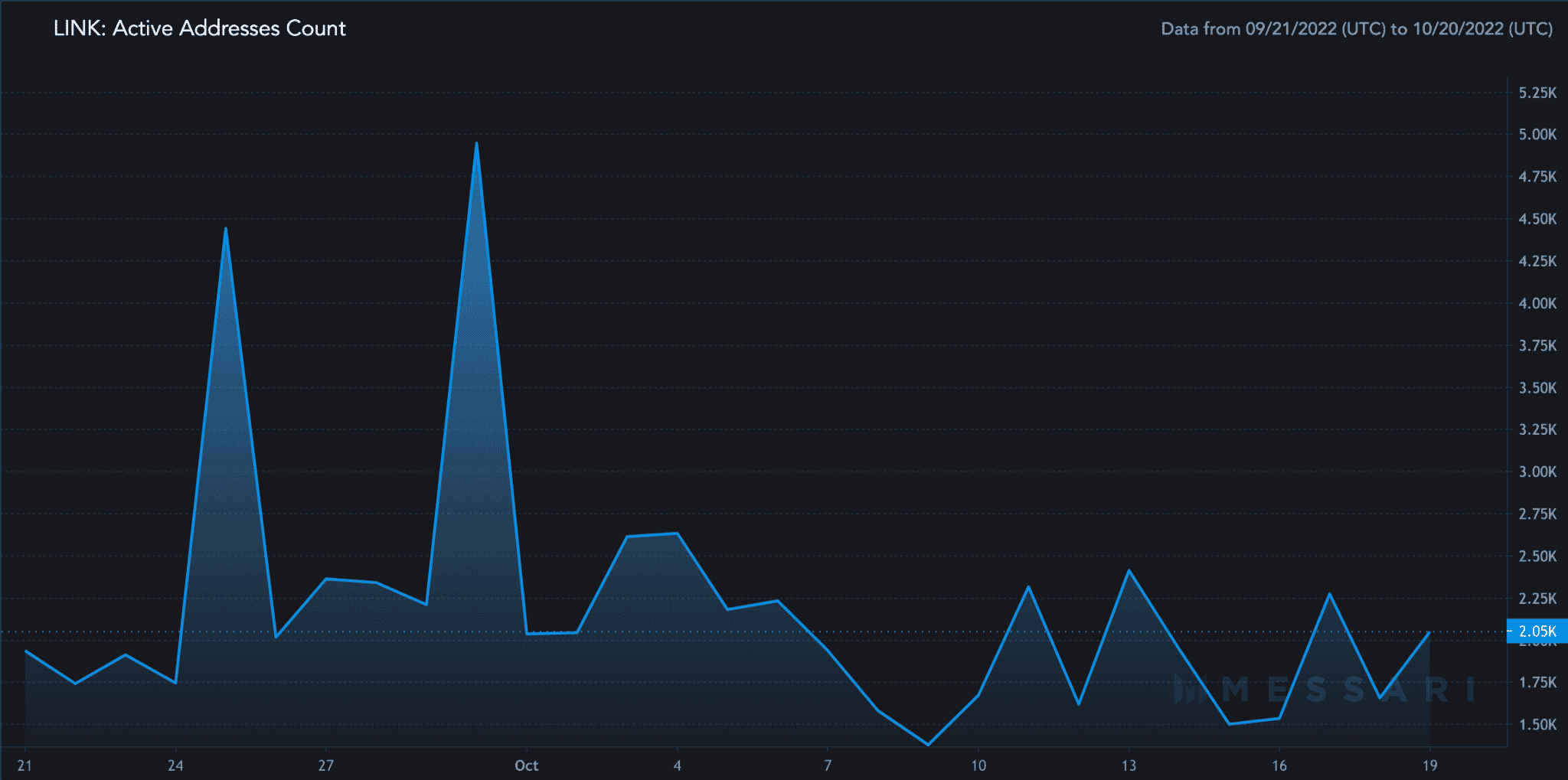

Along with the declining whale transactions, the number of active addresses fell as well. It depreciated by 15%, at the time of writing.

At press time, Chainlink was trading at $6.83 and had depreciated by 2.28% in the last 24 hours. Its volume fell by 0.39%, along with its market cap which decreased by 2.42% in the same time period.