Chainlink Price Analysis: 04 March

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

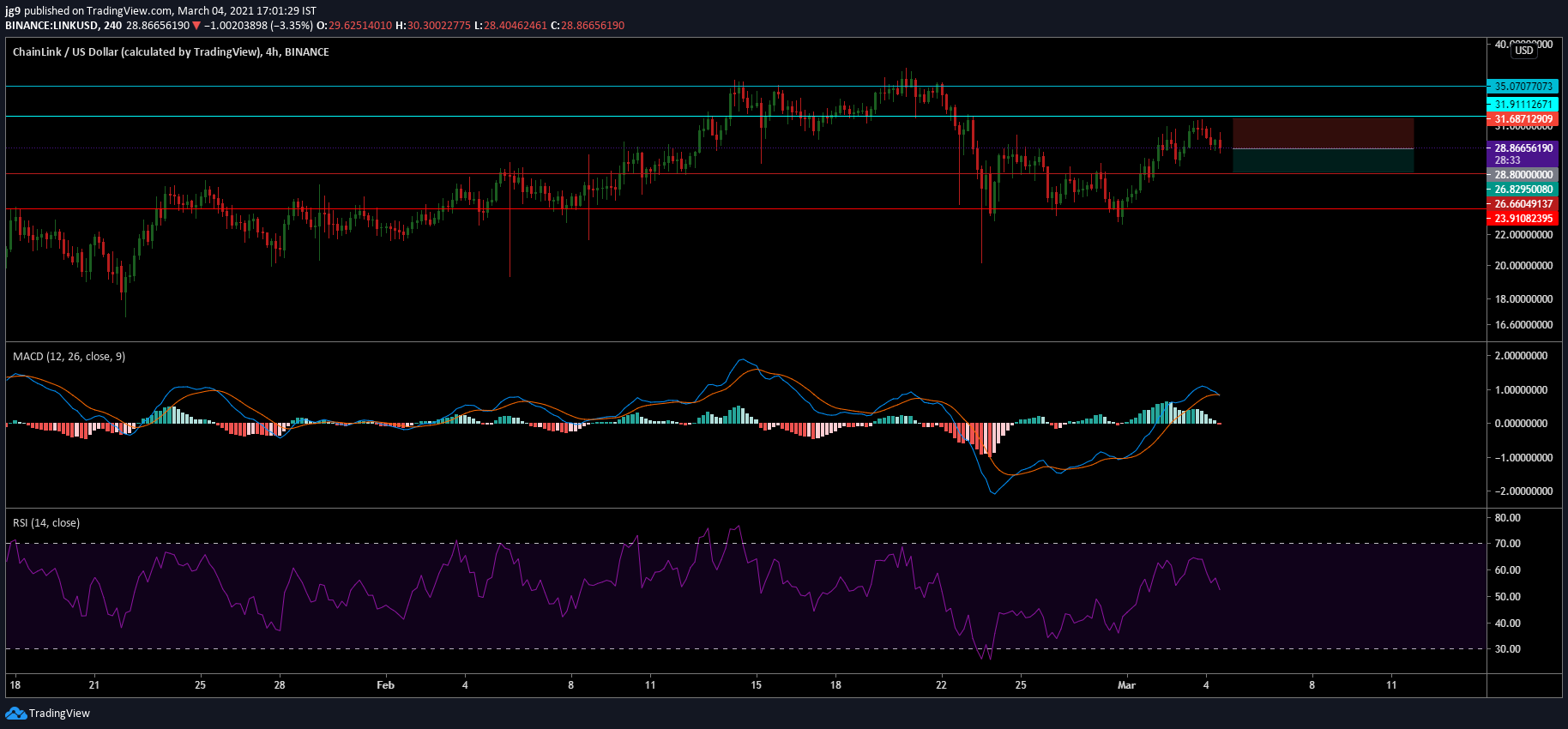

Chainlink’s price registered quite a lot of sideways price movement towards the end of February. However, over the last few days, LINK has been able to initiate an uptrend on the charts. At the time of writing, LINK’s price seemed to have come into contact with a strong resistance level. If the uptrend is to continue, this level needs to be breached over the next 24 hours.

At the time of writing, LINK was being traded at $28.8 with a market capitalization of over $12 billion. The coin saw its price rise by close to 7 percent over the past week, before noting a slight correction yesterday.

Chainlink 4-hour chart

Source: LINK/USD, TradingView

LINK’s price seemed to be inching closer to its immediate level of resistance at $31.9 and the crypto will try to breach this strong resistance over the next few hours. The crypto has failed to go past this level on multiple occasions over the previous day. If the altcoin is unable to do this, then it may once again find itself subject to even more sideways movement on the charts.

The short-term prospects of LINK rely on it breaching this resistance level. However, if that doesn’t take place, traders can short the coin as it may end up heading towards its support level of around $26.6. There was also another strong support at $23, but a move that low didn’t seem likely for LINK in the short-term given the present market conditions.

Rationale

The technical indicators painted a rather divisive picture. The MACD indicator was on the verge of a bearish crossover and may underline a fall in bullish momentum in the coming hours. This doesn’t help LINK’s hopes of breaching the $31.9-level in the short-term. The RSI indicator, on the other hand, was closer to the overbought zone (a bullish sign), with the same retracing towards the neutral zone, at press time.

Important levels to watch out for

Resistance: $31.9, $35

Support: $26.6, $23.9

Entry: $28.8

Take Profit: $26.8

Stop Loss: $31.6

Risk/Reward: 0.68

Conclusion

LINK’s price will continue to be range-bound in the short-term if it fails to breach the resistance level at $31.9 once again. In such a scenario, the coin will see its price fall to its immediate support at $26.6, creating an opportunity for traders to open short positions.