Chiliz’s cup and handle pattern; here’s what should traders expect

Chiliz has carved out a niche as a crypto and blockchain project that facilitates sports token mining. Its native cryptocurrency CHZ consequently experienced significant growth in the first half of 2021 and peaked at $0.83 in April. Fast forward a year later and CHZ is worth a third of its ATH.

CHZ traded at $0.25 at the time of this press, which means it improved significantly from its 2022 lows near the $0.14 price level. However, it is still heavily discounted from its ATH but that might not be for long. CHZ’s price action since the start of 2022 reveals that it has been trading within a cup and handle pattern.

Cup and handle pattern- price direction?

The cup and handle pattern is often considered a bullish sign, especially once the price pulls back to form the “handle” part. CHZ’s price action formed the handle courtesy of its bearish correction in the first two weeks of April.

The pattern which kicked off around 2 January was characterized by a curve in the price action before a resistance retest at the $0.32 price level. This is important because the curve confirms its tail end by testing resistance near the same level as its starting point.

CHZ’s RSI pulled back below the neutral zone in the last two weeks but it did not yield oversold conditions. The MFI points towards significant outflows during the same period and briefly touched the 20-level. Increased accumulation usually takes place when the MFI dips below 20 and we see some uptick in this indicator.

The MFI’s bounce back corresponds with the RSI uptick back above the neutral zone and the price rally in the last three days. The MFI looks like it is in a position to confirm a move to the upside. A look at some on-chain metrics also confirms the upside expectations.

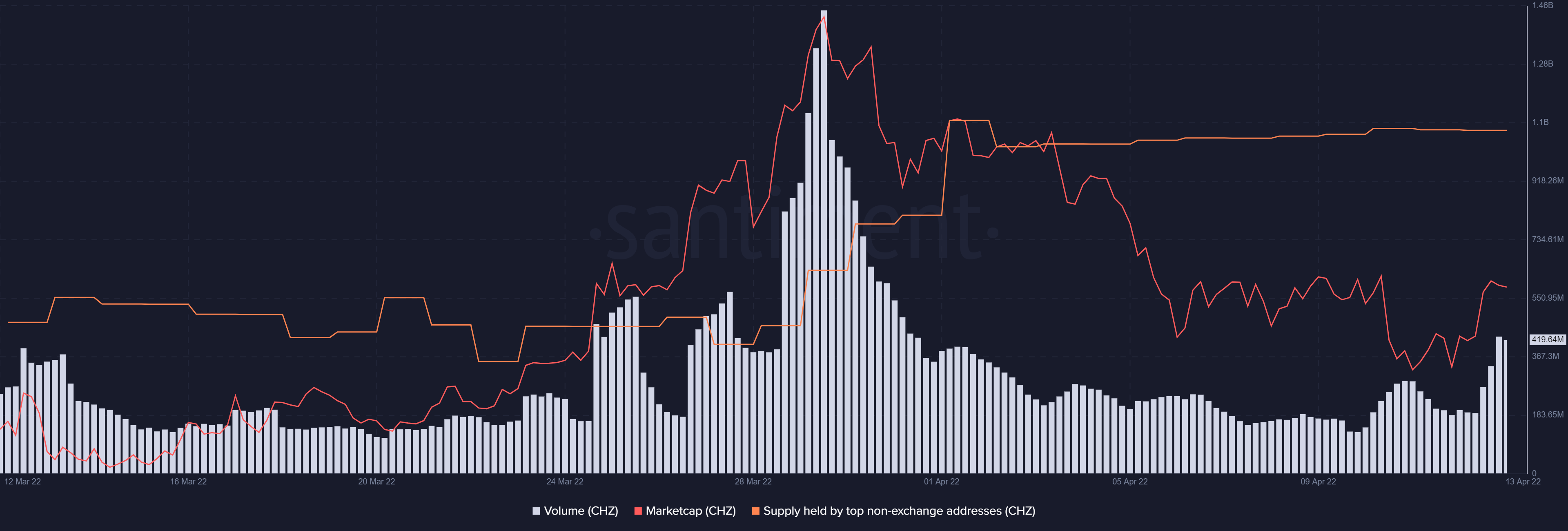

Chiliz on-chain metrics revealed an increase in supply held by the top non-exchange addresses in the last four weeks. Its volume decreased in the last two weeks in line with the price drop but it registered an uptick in the last three days. Its market cap also yielded an uptick in the last three days.

The last time that some of these metrics such as market cap and volume registered such gains, the price achieved a rally in the following days. CHZ’s metrics and indicators align with the cup and handle pattern and this might be a sign that it is ready for another bull run.