Chiliz shrinks >16% but ETH whales have different plans for CHZ

- Chiliz put up a deplorable performance despite anticipation for a rally in the wake of a global sports event

- In the forthcoming days, CHZ might not halt its downtrend

Chiliz [CHZ], the Ethereum [ETH] token that powers Socio.com found favor with the latter’s whales, jumping into the top ten tokens purchased.

Whale tracking platform, WhaleStats, reported that the action was taken by the top 5000 ETH whales. Despite the stack-up, CHZ brushed aside market bulls, as it slid 16.55% in the last 24 hours.

Read Chiliz’s [CHZ] Price Prediction 2023-2024

Staying careful with wishes

The fall-off came in the wake of the ongoing FIFA world cup. Prior to the global event, investors anticipated an excellent CHZ performance, to a large extent, caused by consistent uptick in the lead-up to the event.

Unfortunately, the circumstances have been different. According to CoinMarketCap, Chiliz’s 30-day performance was a 48.24% downswing, trading at 0.118 at press time.

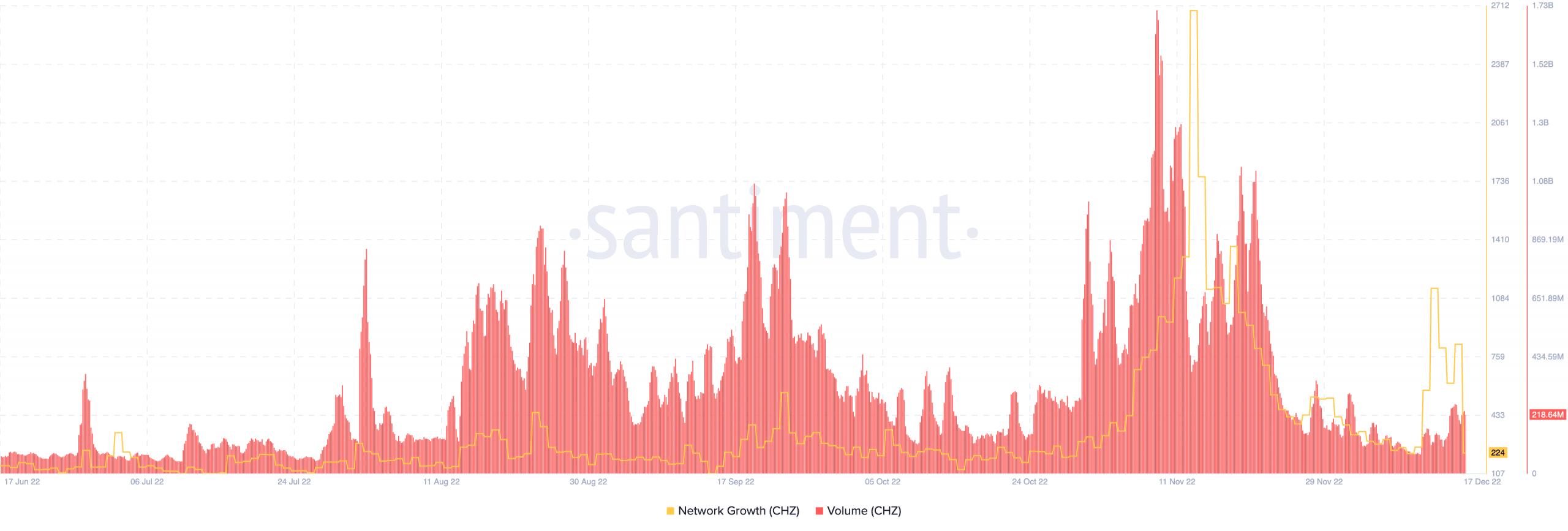

Taking into account its network growth, on-chain data showed that CHZ had deteriorated. An overview of this metric keeps track of the new addresses that have transacted using the Chiliz network. Since it decreased to 224, it indicated notable hesitation in transferring CHZ tokens across wallets.

The volume numbers also failed to comply with investors’ presumption. At press time, CHZ volume had decreased slightly to $21.79 million. This state of the volume indicated a declining market strength as CHZ in profit or loss resisted movement from 16 December.

Red is the new green

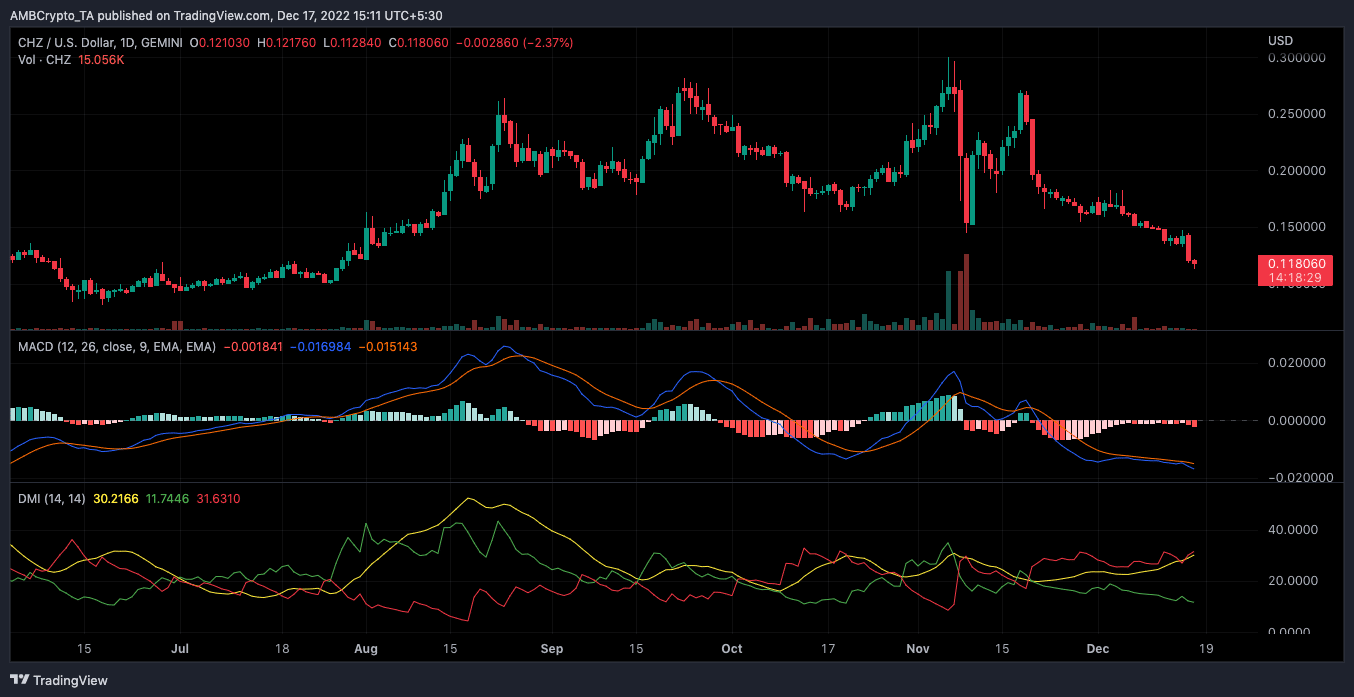

On the daily chart, it seemed CHZ had no desire for respite. This condition was reflected by the Moving Average Convergence Divergence (MACD). According to the MACD, both buyers (blue) and sellers (orange) momentum was below the histogram. Not only that, the fact that the orange line positioned above the blue reflected that of a bearish momentum.

Per its movement, CHZ did not appear to exit its downside anytime in the short. According to the Directional Movement Index (DMI), the direction in buyers’ favor (green) was not up to that with those selling (red). While the buying power remained at 11.74, selling strength was up at 31.63.

A more detailed evaluation of the DMI also echoed the stance of the Average Directional Index (ADX). Based on the ADX (yellow) indications at 30.21, there was immense support for the selling direction. So,the CHZ fall off the charts might close in on termination soon.

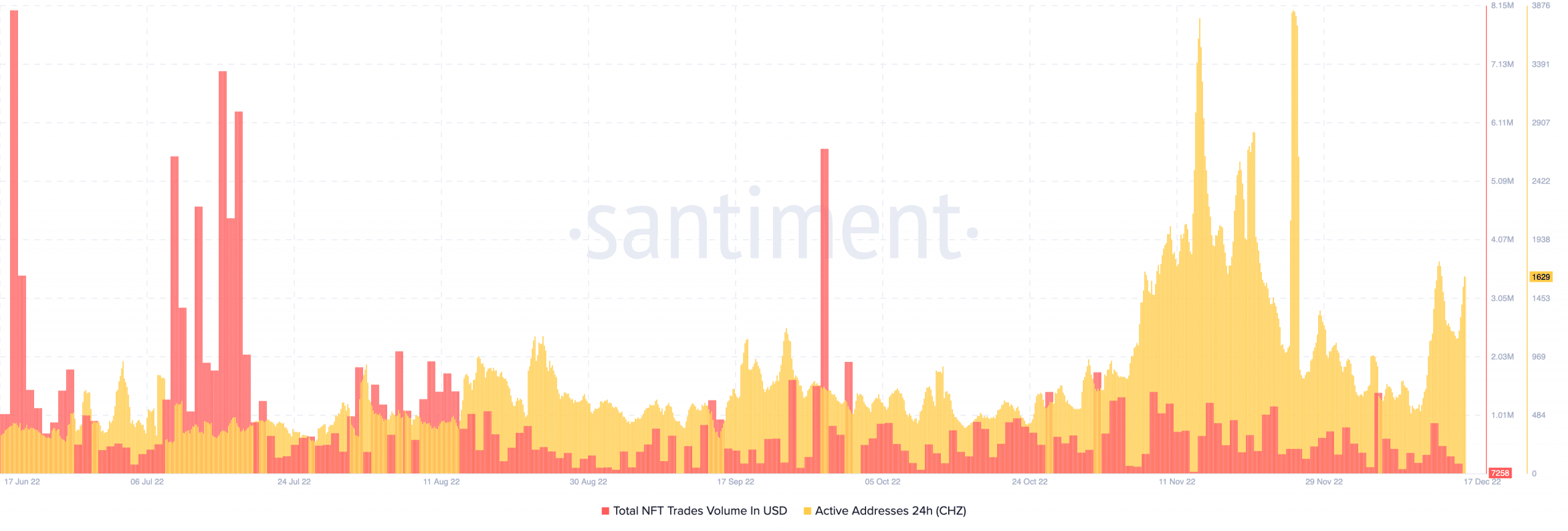

In other parts of its on-chain situation, Chiliz was not doing well with investors’ involvement with digital collectibles linked to the network. According to Santiment, the CHZ NFT trades volume had subsided to 7258.

The last time there was a noteworthy uptick in this regard was on 13 December. However, 24-hour active addresses were ripe with activity as it increased to 1629. This increase suggested a push for CHZ adoption despite its declining price.