Compound rallies 23% within a day, should buyers await a retracement?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Compound bulls were ecstatic after the recent gains

- It was possible that COMP could retrace a significant chunk of the recent rally- and buyers could hunt for the ideal entries

Compound [COMP] noted double-digit percentage gains in the past 24 hours. The governance token dipped to $38.24 on 26 September but rallied to $50.28 by 28 September. This represented a 31.5% move northward in under two days.

Read Compound’s [COMP] Price Prediction 2023-24

While it might be attractive to think that the bulls can drive prices higher, the more prudent course of action could be to wait for a retracement. How low would COMP be able to dip, and would such a scenario be a realistic expectation?

The move was almost vertical, but COMP traders should beware of FOMO

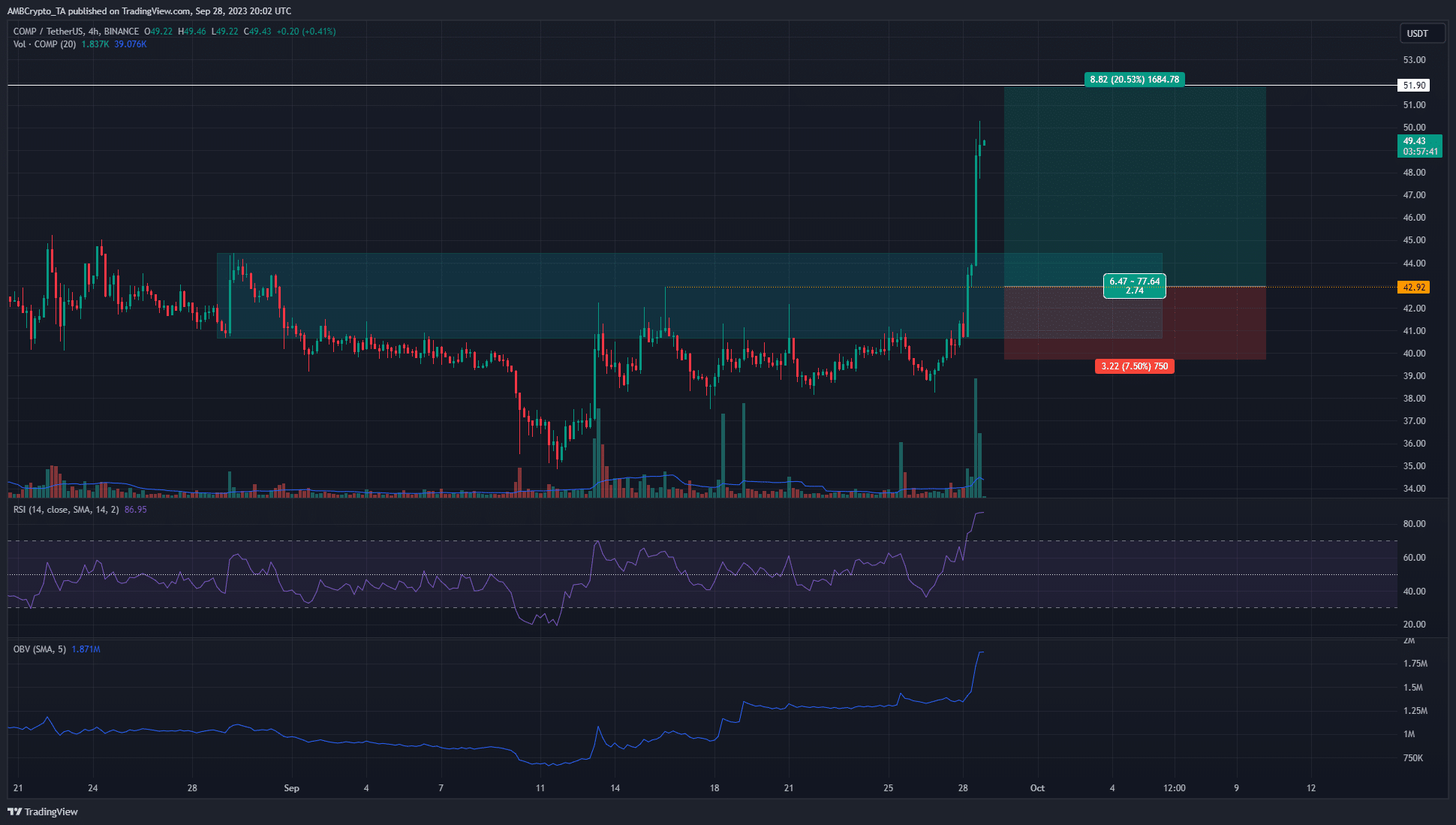

The four-hour chart noted that the $42.92 was a local high that Compound registered on 16 September. Additionally, the cyan box represented a former bearish order block on the daily chart that reached from $40.68 to $44.44.

When COMP breached the $42.9 and the $44.44 levels in recent hours, it showed bulls were in complete control of the market and that sentiment was euphoric. The move indicated bullish dominance and showed that COMP could easily push past the $50 level soon.

Yet, before that, we could see a retest of the former bearish order block, now a bullish breaker block. This zone has confluence with a fair value gap on the H4 chart from $41.79 to $42.94, and a retest would offer an ideal buying opportunity.

Another thing traders can watch out for is a rejection from near the $51.9 resistance. Over the next few days, such a rejection would enable traders to plot Fibonacci retracement levels for the rally and determine where they could look to enter go long.

The Open Interest chart reflected intense bullish sentiment

Source: Coinalyze

The breakout past $44.44 was accompanied by a huge spike in the Open Interest. It surged from $25.5 million to $46 million. This gigantic leap was due to bullish speculators entering the market in droves indicating powerful bullish conviction.

How much are 1, 10, or 100 COMP worth today?

The spot Cumulative Volume Delta (CVD) also leaped higher and the funding rate was positive. Yet, it does not rule out the possibility of a retracement. Based on the price action, a drop to the $42-$44 region could present a good risk-to-reward buying opportunity targeting $51.9.