Compound tightens its rules to prevent Aave-like exploit, details inside

- Compound DAO had voted unanimously to implement changes in the rules of the protocol

- This move was motivated by the need to keep the protocol safe after the Aave exploit

Recently, COMP holders at Compound Finance, a major player in the cryptocurrency loan industry, approved a proposition put out by the company. The current proposal passage reacted to the recently attempted exploit in the loan industry. What exactly does this proposal contain, and how will it affect customers?

Details and motivations for the proposal

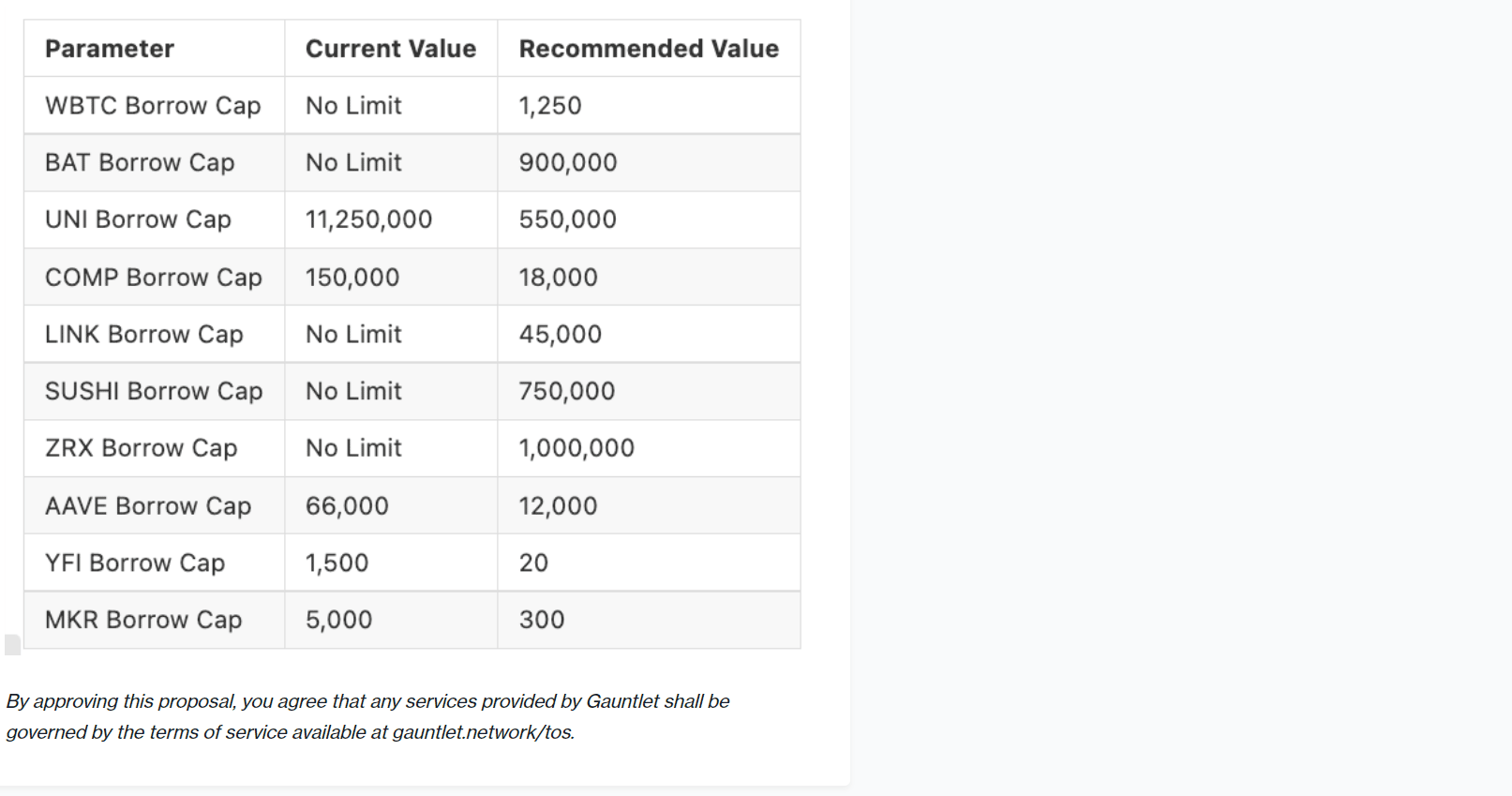

Borrow limits for ten tokens were accepted by the Compound Decentralized Autonomous Organization (DAO) members in a unanimous vote. These tokens include the Wrapped Bitcoin (cWBTC2), Uniswap (cUNI), Chainlink (cLINK), and Aave tokens that are implemented in the protocol (cAAVE).

The Compound tokens allow holders to earn interest on funds contributed to lending pools. On 24 November, when the proposal was initiated, there was resounding community support. An implementation of this plan, as proposed by Compound, is scheduled for 30 November.

The driving force behind it was the requirement to preserve the protocol’s overall risk tolerance while balancing the risks of different assets. Additionally, this action followed an attempt to hack Aave, another well-known crypto-lending system.

A user going by the name of Avi Eisenberg attempted to exploit Aave. The lending network’s procedures were the focus of the attack. In an effort to incur bad debt on the system, he borrowed huge amounts of illiquid CRV coins on Aave. Aave responded by blocking the borrowing functionality and passing a proposal to stop this from happening again.

Some improvements to the protocol’s security were suggested by the financial modeling platform Gauntlet, which Aave uses. There was talk of putting a hold on some Aave v2 tail assets to prevent future, potentially loss-making squeezes. In order to prevent traders from manipulating markets and setting off a short squeeze, these new proposals were developed by Compound and Aave.

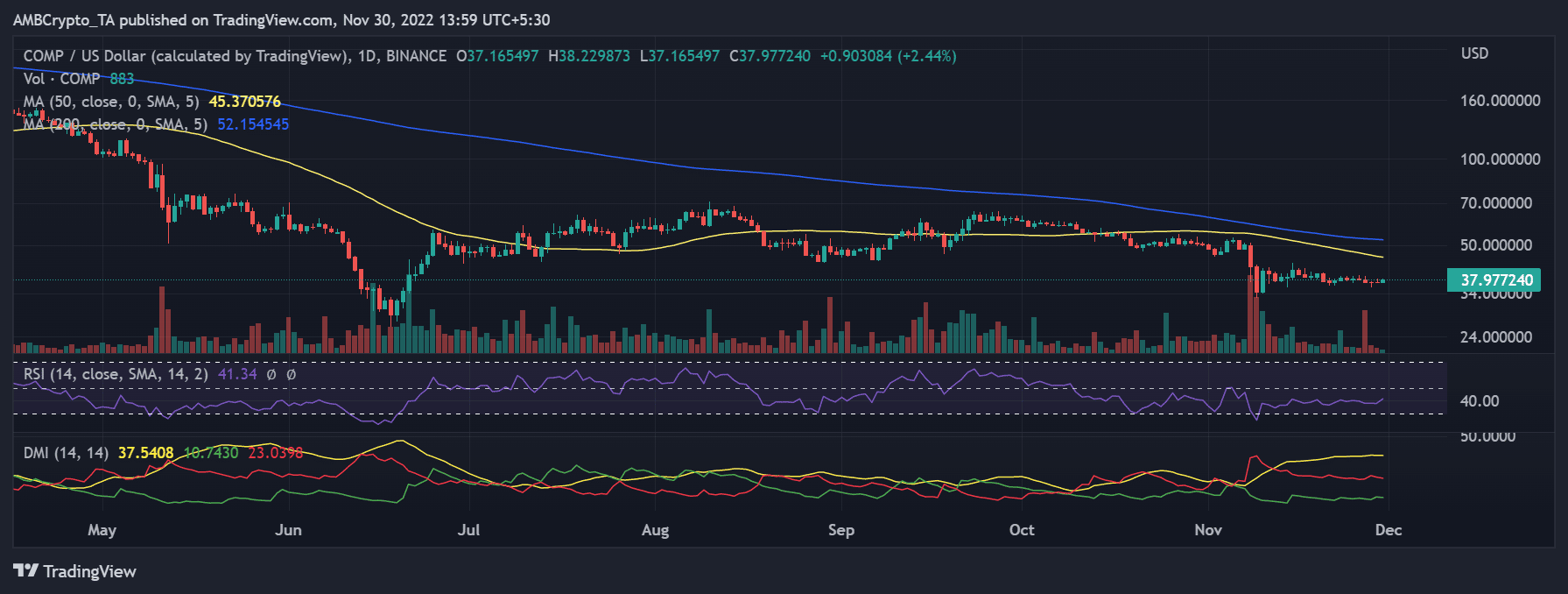

COMP in a daily timeframe

The COMP token increased by over 2% as of the time of writing, according to a look at it in a daily timeframe. The token had a poor price move before the trading time that was observed. Clearly, the market had been flat and trading at a loss.

Relative Strength Index (RSI) analysis revealed that the coin was moving in a bearish direction. The RSI line, which could be observed in a daily timeframe below the neutral line, served as a sign for this.

A study of the Directional Movement Index (DMI) indicator also supported the token’s bearish trend. On the chart, the plus DI line was below 20, while the signal and minus DI lines were visible above it. The position of the DI lines indicated a bear trend and supported the pattern seen with the RSI.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)