Could Lido Finance [LDO] be the biggest gainer amid staking crisis speculation

- The LDO token went against the crypto market trend after staking ban speculation emerged.

- Not many investors held LDO in non-custodial wallets as exchange inflow skyrocketed.

The Lido Finance [LDO] price increased against the broader market sentiment after Coinbase CEO Brian Armstrong raised an alarm about a possible crypto staking ban. But why has Lido gained after speculation of a potential prohibition?

Realistic or not, here’s LDO’s market cap in ETH’s terms

Complete decentralization to take home the prize?

Well, the difference between staking on Ethereum [ETH] and Lido Finance is that the latter’s staking procedure is decentralized in nature. Ethereum, on the other hand, is subject to oversight from regulators.

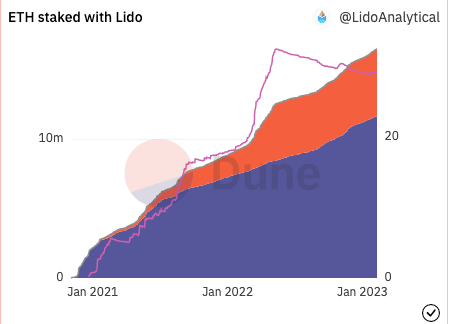

At the time of writing, the token of the liquid-staking protocol increased by 5.50%. Although the LDO price increased, the Lido share per the staked Ether [stETH] did not significantly go up. According to Dune Analytics, the LDO share had decreased to 29 at press time.

However, the total LDO deposited into the pool was on a continual increase. At the time of writing, about 4.82 million LDO had flowed into the staking pool as revealed by the image above.

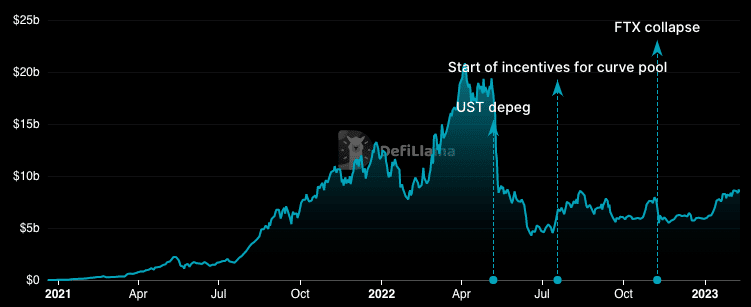

This means that more users have increased chances of becoming Ethereum validators and also earning a yield. Besides that, Lido Finance’s sustenance of the DeFi Total Value (TVL) locked top spot, coupled with the recent development might have earned it increased attention.

DeFiLlama, the TVL aggregator, showed that the Lido Finance TVL was $8.47 billion. However, the TVL despite staying above erstwhile leader MakerDAO [MKR] had decreased by 2.10% in the last 24 hours. This explains how investors have resisted putting more liquidity into protocols under the chain.

Read Lido Finance’s [LDO] Price Prediction 2023-2024

Self-custody cheer but…

However, Cardano’s [ADA] founder Charles Hoskinson weighed in on the staking ban rumor. In a response to Armstrong’s tweet, Hoskison rallied support for non-custodial staking. He wrote,

“Ethereum staking is problematic. Temporarily giving up your assets to someone else to have them get a return looks a lot like regulated products. Slashing and bonds not so good. Non-custodial liquid staking on the other hand is like the mining pools we’ve used for 13 years”

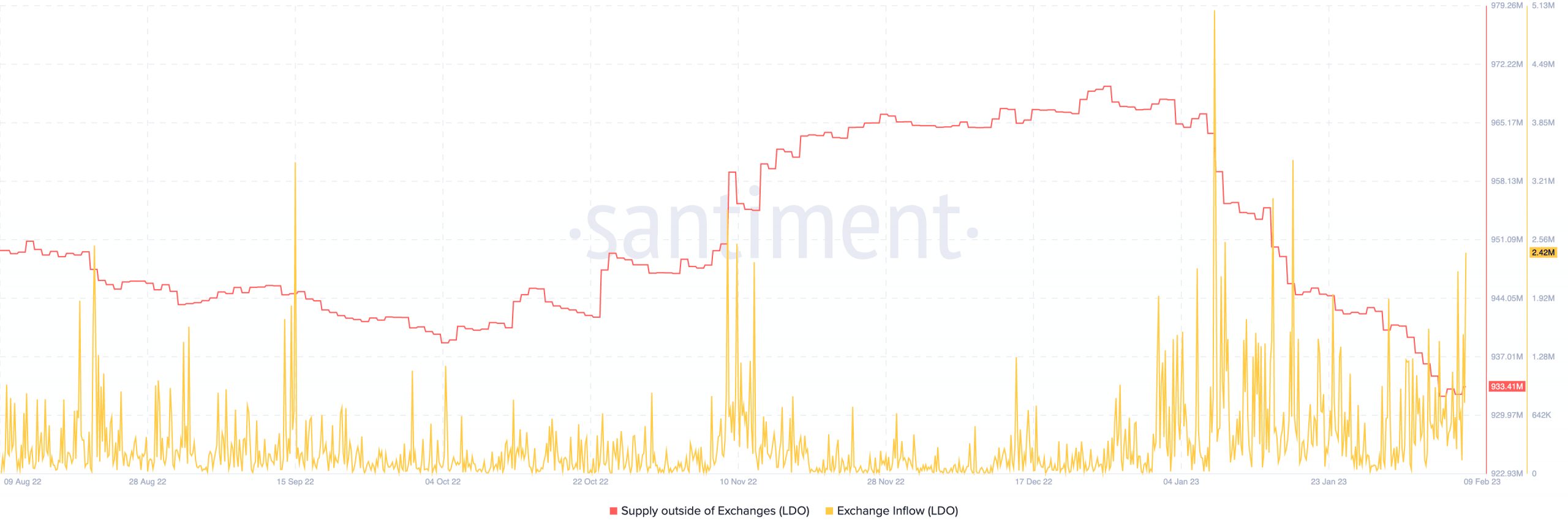

Despite the call, on-chain data from Santiment showed that the LDO supply outside of exchanges was not particularly encouraging. At press time, it was down to 933.41 million— and has been on a downward trend since January.

This implies that LDO self-custody storage did not align with its fundamentals. In contrast, the exchange inflow increased significantly to 2.42 million.

But this could be a result of the LDO spike recently and the 38.68% increase in the last 30 days. Hence, there could be cases of selling pressure in the short term.