Crypto market’s weekly winners and losers – STRK, HNT, DOGS, and ATOM

- Starknet, Helium, and SUI had the biggest gains of the past week.

- DOGS, Cosmos, and Beam were the biggest losers of the past week.

DOGS came out blazing, well, almost, as it ended up being one of the crypto market’s biggest losers in the past week. Helium led the gainers’ chart in the week before now, and this past week, it came second, making sure to remain among the biggest winners.

Biggest winners

Starknet [STRK]

Analysis of the Starknet [STRK] price trend indicates an eventful week. It started at around $0.35 and saw consecutive price increases, reaching $0.44 by the end of the week.

According to data from CoinMarketCap, STRK was the highest gainer in the past week, posting a notable 23% increase.

Additionally, the trading volume saw significant spikes during the week. Volume initially surged to over $120 million; later in the week, it exceeded $160 million.

However, as of this writing, the volume has slightly declined to around $119 million, reflecting an 11% decrease. The market capitalization of Starknet currently stands at over $776 million.

Helium [HNT]

For the second consecutive week, Helium [HNT] has appeared among the biggest winners in the cryptocurrency market. In the previous week, HNT was the top gainer, increasing by over 5%.

This past week, it continued its strong performance, becoming the second-biggest winner with a 16.6% increase.

At the start of the week, Helium was trading around $7. It saw some upward movement, but its price significantly increased momentum around 4th September.

By 6th September, HNT reached a high of $8.6. By the end of the week, it was trading at around $8. As of this writing, HNT is still trading at around $8, with a market capitalization of approximately $1.2 billion.

However, its trading volume has declined by over 50% in the last 24 hours, currently at around $16.3 million.

Sui [SUI]

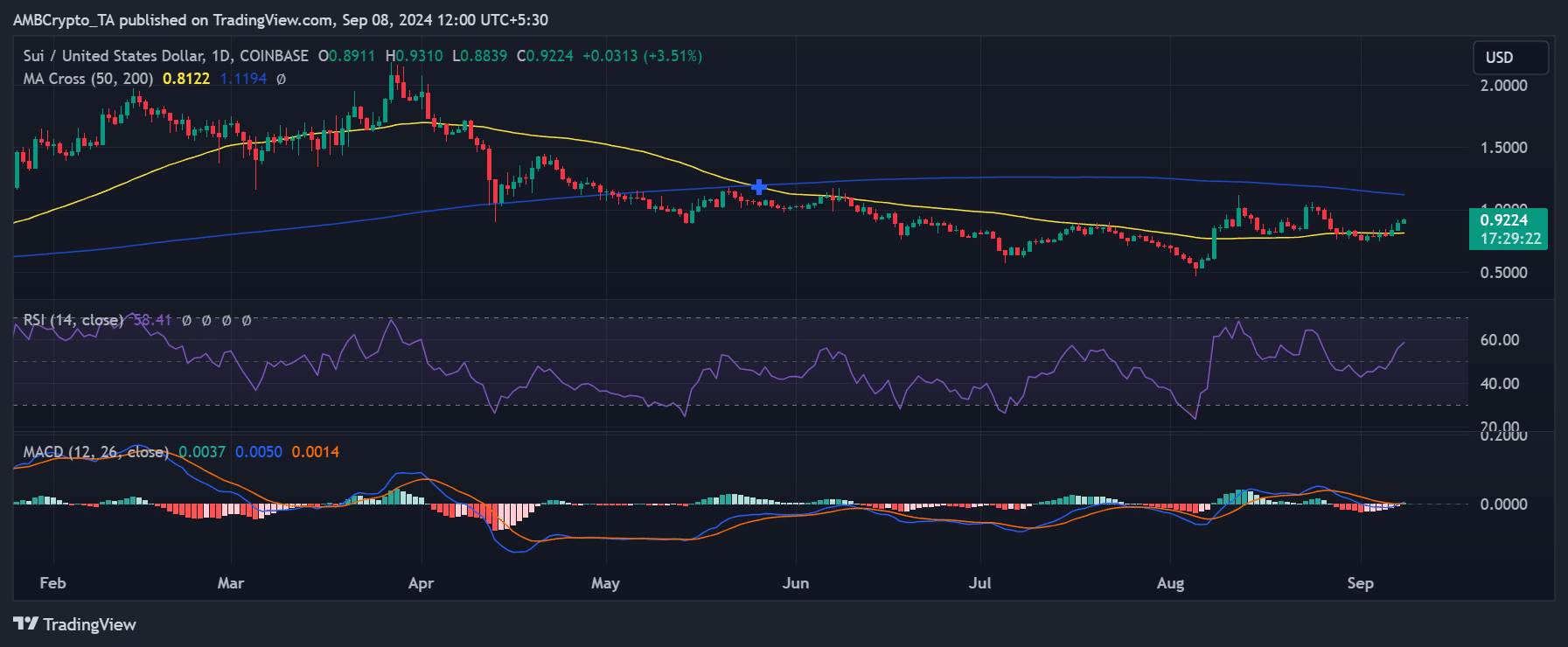

Analysis of Sui [SUI] on a daily chart shows that it started the week trading at around $0.76, experiencing an initial decline of over 4%. The price movement was choppy throughout the week, with the short-moving average (yellow line) acting as resistance.

However, consecutive uptrends on the 6th and 7th of September flipped this resistance into support. During these two days, SUI saw price increases of over 5% and 6%, respectively, and by the end of the week, it was trading at around $0.90.

Data from CoinMarketCap indicates that SUI increased by over 16%, making it the third-highest gainer for the week.

The price rise shifted SUI from a bearish to a bullish trend, as confirmed by its Relative Strength Index (RSI), which crossed above the neutral line and was approaching 60 as of this writing.

SUI is trading with an additional 3% increase, and its market capitalization stands at approximately $2.4 billion. Its trading volume, however, has declined by almost 30%, with the current volume at around $301.7 million.

Despite the volume decrease, the recent price action and trend shift suggest continued bullish momentum for SUI.

Biggest losers

DOGS [DOGS]

DOGS recently caused a spike in activity on the Ton network due to massive transactions, but it has since experienced significant declines after the initial hype subsided.

According to data from CoinMarketCap, DOGS was the biggest loser of the past week, with a decline of over 18%.

At the start of the week, DOGS was priced at around $0.0012 but faced substantial declines throughout the remaining days. By the end of the week, it was trading at approximately $0.0010.

As of this writing, its market capitalization is around $527 million, reflecting a nearly 3% decline.

Additionally, DOGS’ trading volume has dropped by approximately 35%, with the current volume at around $350.6 million.

Cosmos [ATOM]

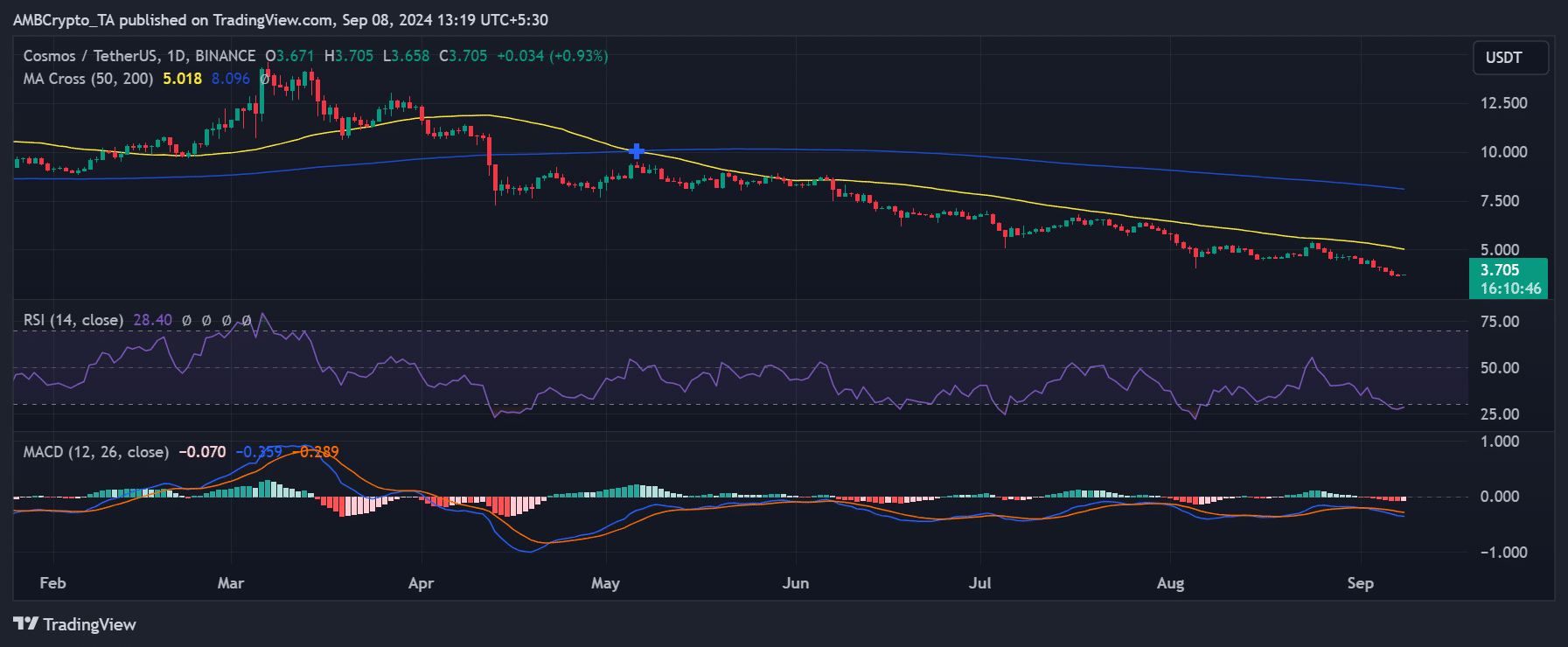

An analysis of Cosmos (ATOM) on a daily chart reveals a downward price trend over the past week. The chart indicates that ATOM experienced gains only once during the week, with a rise of over 3%, while negative trends marked the rest of the week.

Data from CoinMarketCap shows that ATOM’s price declined by over 18%.

The recent price declines have strengthened the bearish trend, and analysis of the Relative Strength Index (RSI) shows that it has dropped below 30, indicating that ATOM is now in oversold territory.

ATOM’s market capitalization is approximately $1.4 billion as of this writing. Its trading volume has also decreased significantly, dropping by over 33%, with the current volume at around $112 million.

Beam [BEAM]

Beam (BEAM) took the spot as the third-biggest loser of the week, with a decline of over 14%, according to data from CoinMarketCap. An analysis of its price trend shows that BEAM started the week trading around $0.014 but saw consistent declines.

By the end of the week, its price had dropped to approximately $0.011.

As of this writing, BEAM’s market capitalization stands at around $596 million, and its trading volume has fallen by over 30%, with the current volume at approximately $6.3 million.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making investment decisions is best.