Crypto Twitter suspects a link between SBF and BALD, here’s what set it off

- BALD gets rug pulled, leaving many holders with losses. Conspiracy around SBF being behind BALD surfaces.

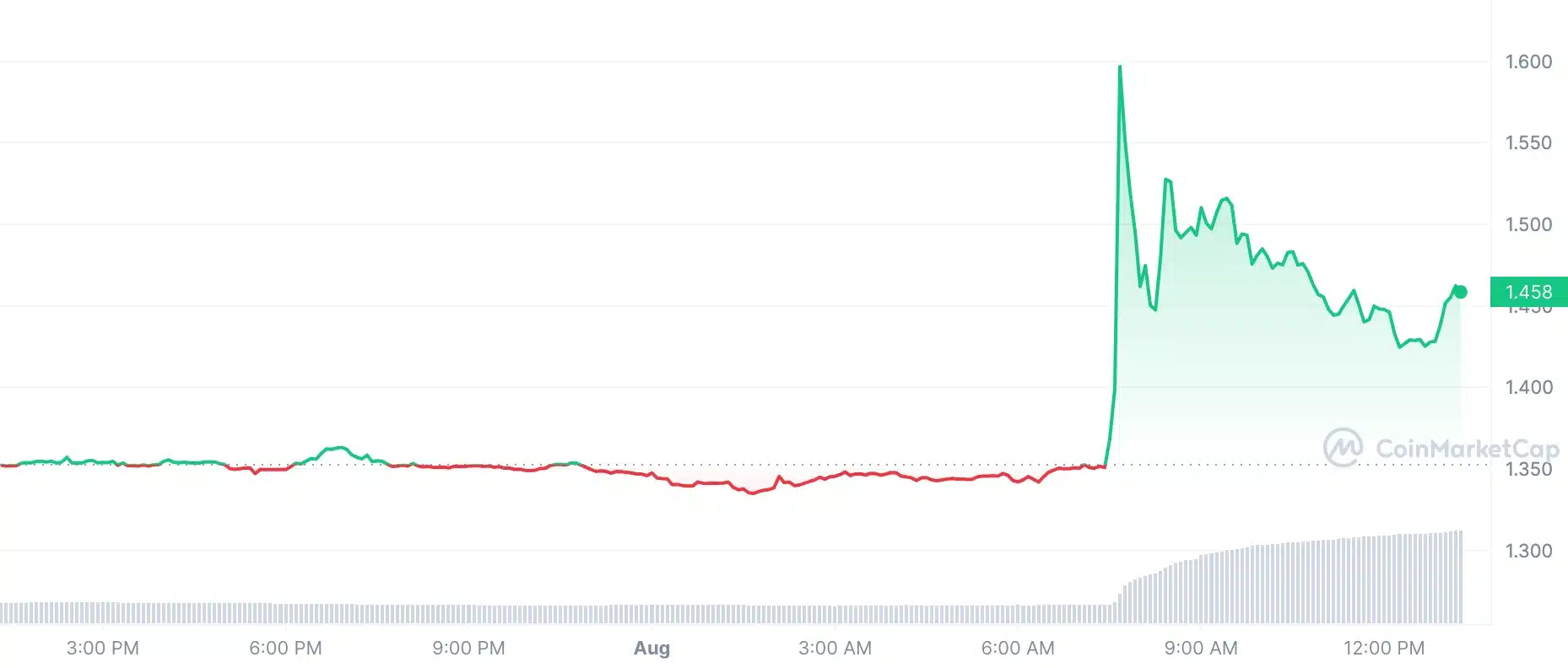

- The possibility of a relaunch of FTX outside of the U.S leads to a pump in FTT’s price.

The crypto market experienced turmoil in the last 24 hours, with Curve, a prominent DEX, falling victim to an exploit resulting in over $52 million in losses on 30 July. However, amidst the chaos, there was a glimmer of optimism due to the emergence and excitement surrounding memecoins on the BASE network.

Is your portfolio green? Check out the FTT Profit Calculator

BALD holders lose their money

One such popular memecoin, BALD, possibly referencing Coinbase CEO Brian Armstrong’s bald head, witnessed a remarkable surge in interest. On July 31st, its price skyrocketed, attracting numerous participants eager to join the rally. However, the optimism was short-lived as the coin was soon rug-pulled, leaving many holders with losses.

According to Aegis, a Web3 security firm, the BALD token’s rugpull led to a staggering loss of around 5,000 ETH. Which was equivalent to approximately $9.28 million. The malicious act involved the deployer adding 6,077 ETH liquidity initially and subsequently removing 11,077 ETH. Thereby inflicting substantial financial damage on unsuspecting investors.

However, the developers of BALD took no responsibility for the rug pull. In a social media post, the BALD developer firmly denied engaging in token sales through a market order. Instead, the developer clarified that their actions were limited to adding and removing two-sided liquidity and making purchases within the protocol. This response seeks to address any concerns or misconceptions surrounding the token’s recent activity and the developer’s involvement.

I didn't sell a single token at any point since deployment. Just added/removed 2 sided liquidity and bought

— Bald (@BaldBaseBald) July 31, 2023

However, a holder contended that adding two-sided liquidity constitutes selling tokens, prompting the BALD developer to acknowledge the point and respond with a simple, “correct.”

At press time, BALD was trading at $0.006157 and its price fell by 70.75% in the last 24 hours according to CoinMarketCap’s data. The rugpull of BALD has the potential to impact not only its holders but also Coinbase, further complicating the company’s ongoing battle with the SEC’s lawsuit.

Put your tinfoil hat on

The incident prompted several blockchain enthusiasts to look deeper into the developer’s on-chain history. As a result, some of them uncovered a potential link to Sam Bankman Fried (SBF) regarding the Ethereum wallet address responsible for deploying the BALD. For context, SBF is the founder and former CEO of the cryptocurrency exchange FTX.

According to them, the token received substantial ETH funding from wallets associated with FTX and Alameda Research. This discovery raised further questions and speculation about the token’s origins and the possible involvement of prominent entities within the cryptocurrency ecosystem.

alameda popping up in the $bald dev 🙂 pic.twitter.com/w3WeEeu7Ci

— redacted (@redactedp4mp) July 31, 2023

The Twitter community’s assumption of SBF’s alleged involvement with BALD was further fueled by several factors, including the significant ETH transfers between FTX and the Bald token’s deployer. Additionally, the deployer’s status as the first voter on all Sushi proposals raised suspicions.

Moreover, the similarities in sentence structures between the Bald deployer’s tweets and SBF’s added to the speculation.

Thread of Bald tweets + SBF tweets that have similar sentence structure:

? (1/X)

— hype (@hype_eth) July 31, 2023

The deployer’s significant involvement in DYDX, both as the biggest farmer and in posts that resembled SBF’s, added to the growing suspicion. These factors collectively contributed to the growing perception of a potential link between SBF and the BALD token’s creation.

Despite the growing belief in SBF’s involvement with the BALD token, not everyone was convinced of this conspiracy. Some individuals argued that attributing the BALD debacle to SBF was a stretch that lacked concrete evidence and was mostly speculative.

Not everyone is convinced

Crypto influencer Tiffany Fong, who spoke with SBF after his arrest, refuted the conspiracy. She clarified that SBF used a “flip phone without internet connection” since April, countering any link to BALD.

Read FTT’s Price Prediction 2023-2024

Additionally, she mentioned that SBF was feeling paranoid because he recently shared Caroline Ellison’s private writings with the New York Times, which the Department of Justice could view as potential “witness intimidation”. Given these circumstances, she expressed doubt that he would choose the present time for a rug pull.

Guys, SBF hasn't had access to a normal phone or laptop since April 2023 when his bail conditions changed. He's basically been using a flip phone without internet connection & a laptop with restricted access to whitelisted websites (e.g. NYT, WSJ, Courtlistener, etc).

Note: He…

— Tiffany Fong (@TiffanyFong_) July 31, 2023

FTX to make a comeback?

Speaking of SBF, the FTX exchange could make a comeback soon as well. Recent filings showed that FTX was actively working on restarting its exchange services for international customers. This news impacted the FTT token positively and caused it to rally by 8.00% over the last 24 hours. At press time, the token was trading at $1.458