Curve bounces back post-hack as crvUSD rallies to ATH

- The total amount of crvUSD borrowed on Curve has reached an all-time high.

- Curve’s TVL also increased by 4% in the last week.

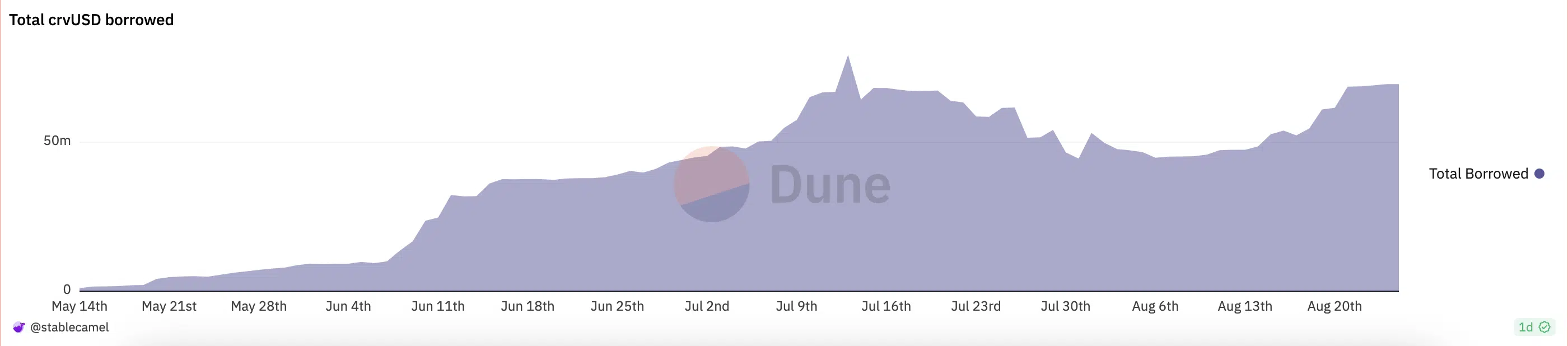

Decentralized exchange (DEX) Curve Finance [CRV] has seen a resurgence in activity following 30 July’s attack, which resulted in the loss of $70 million. As per a 25 August tweet, the total amount borrowed for its crvUSD token recently rallied to an all-time high.

Casual ATH for total borrowed in crvUSD pic.twitter.com/xeYNm4wHJ0

— Curve Finance (@CurveFinance) August 25, 2023

Is your portfolio green? Check out the CRV Profit Calculator

crvUSD is Curve’s native collateralized-debt-position (CDP) stablecoin pegged to the US Dollar. The jump in the total amount of crvUSD borrowed comes after the coin briefly lost its parity with the US Dollar in the wake of the exploit.

On 3 August, crvUSD’s price fell below $1 by almost 0.5% before regaining its peg, data from CoinMarketCap showed.

According to Dune Analytics, the total amount borrowed crvUSD as of 25 August was $69.41 million. This has risen steadily in the last week, growing by 33% since 17 August.

The recent surge in activity on Curve suggests that users’ confidence in the protocol has returned following the retrieval of more than 50% of the stolen funds and the several attempts by the project to defend the value of its native CRV token.

The prodigal ones return to Curve

As liquidity providers exited Curve in the wake of the hack, the total value of assets locked (TVL) within its decentralized finance (DeFi) vertical plummeted to a two-year low. The unabated decline in TVL caused Curve to slip from its position as the third-largest DeFi protocol before the hack to sixth position at press time.

While TVL remained at the July 2020 levels at the time of writing, it saw some growth in the last week. According to data from DefiLlama, the DEX’s TVL climbed by 4% in the past seven days. At press time, Curve’s TVL was $2.73 billion. Since the hack, this has fallen by 27%.

Increased activity on Curve in the last week also resulted in an uptick in network fees. Data from Token Terminal revealed that fees gained from transactions increased by 12.4% during that period.

As a result, protocol revenue also recorded a corresponding increase. Per Token Terminal, it increased by 10.2% in the last week.

Realistic or not, here’s CRV’s market cap in BTC’s terms

CRV continues to suffer a beatdown

At press time, CRV traded at $0.4571, experiencing a 7% drop in value in the last week. Since the hack, the altcoin’s price has declined by 38%, data from CoinMarketCap showed.

With many hesitant to open CRV trading positions, its accumulation among daily traders has waned significantly. On a D1 chart, key momentum indicators rested at oversold zones, suggesting holders continue to “dump” their CRV tokens.