Curve breach: Fear of liquidation stirs further FUD

- The prospect of Curve Finance’s CEO getting liquidated stirred FUD.

- CRV’s OTC transactions to major cryptocurrency players helped curb fears of liquidation.

The recent breach of Curve Finance [CRV] sent shockwaves through the cryptocurrency industry and the DeFi realm alike. Stemming from a vulnerability discovered within the Vyper EVM, the Curve protocol and its native token holders suffered significant repercussions.

Is your portfolio green? Check out the CRV Profit Calculator

FUD is on the rise

Following a devastating breach resulting in losses of around $70 million, concerns arose that the founder, Michael Egorov, who held a substantial 47% of the circulating supply of CRV in lending protocols, might get liquidated. This would cause the value of CRV to plummet to zero.

However, recent developments have brought some relief to these apprehensions.

As per the information gathered from Nansen.ai, the CEO’s outstanding loans are distributed across several platforms. The loans amounted to $60 million on Aave, $14 million on Abracadabra, $9.2 million on Frax, and $7.7 million on Inverse.

The CRV tokens associated with these loans account for around 40% of the circulating supply.

Among these platforms, Frax emerged as a source of heightened concern. The reason behind this was Frax pool’s significant APY. It was approximately 85% at the time of writing and was capable of doubling every 12 hours under full utilization.

According to the data, it could potentially reach a maximum rate of around 10,000% within just four days.

However, a positive development occurred, as Michael repaid roughly $6.6 million specifically within this pool, which effectively alleviated some of the concerns regarding the Frax pool.

Repayments and OTCs

Michael’s repayment approach revolved around OTC sales of CRV tokens to address these obligations. For context, OTC transactions refer to privately selling or buying a substantial amount of cryptocurrency directly between parties outside of traditional exchange platforms.

This method allows for negotiated terms and conditions, including pricing and lockup periods.

The most recent transactions made by Michael included a substantial sale of 54.5 million CRV at $0.40, with an approximate 30% discount. Additionally, the CRV was sold under a 6-month lockup period. That resulted in $21.8 million in proceeds.

The recipients of these assets encompass influential figures in the crypto domain, including DWF Labs, DCFGod, Machi Big Brother, and the convex founder. The ongoing redistribution of CRV from Michael to other notable players signified a massive shift in ownership.

Realistic or not, here’s CRV’s market cap in BTC’s terms

State of CRV

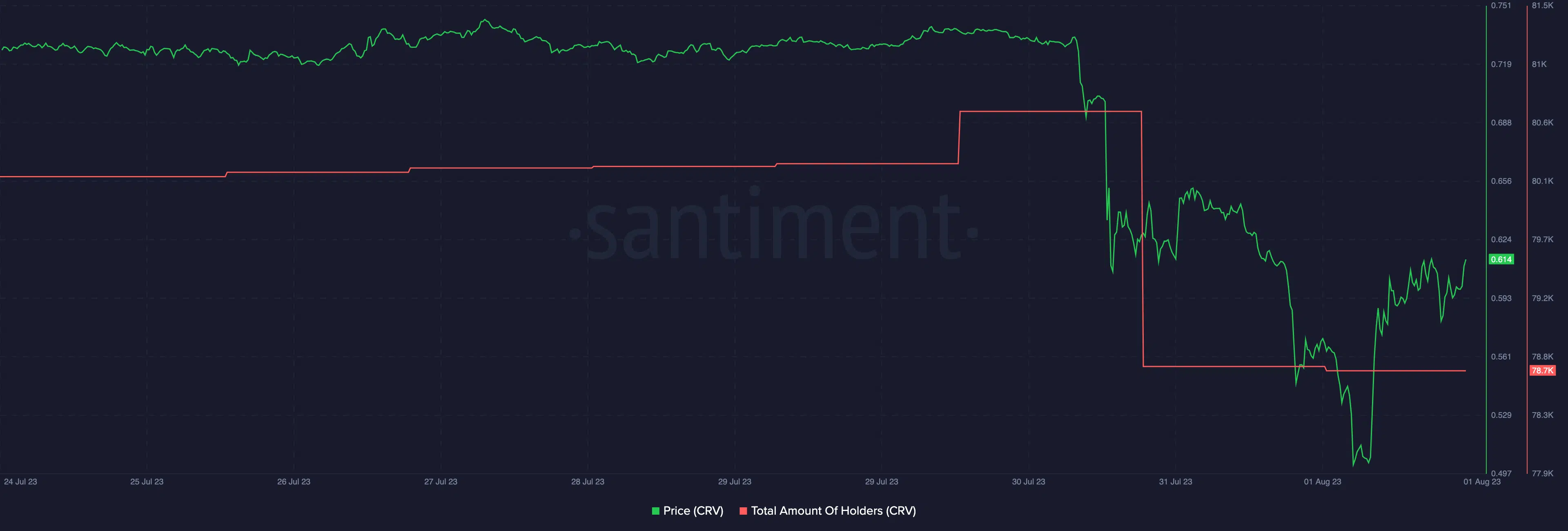

The attempts made by the CEO to curb the FUD around the event were fruitful to a certain extent. Moreover, the price of CRV during this period observed some recovery, according to Santiment’s data.

However, the same could not be said about the number of token holders holding CRV. Over the last few weeks, the number of token holders declined significantly and remained unmoved despite the appreciation in prices.