Decoding Crypto.com’s new Brazilian license and CRO’s growth prospects

- Crypto.com secured a new payment institution permit from Brazil.

- The holders of its native token, CRO, saw more losses.

Crypto.com moved closer to strengthening its position in Latin America after receiving a new license in Brazil. With over 10 million Brazilians owning cryptocurrencies, the license could be a game changer for both users and the exchange.

Read Cronos’ [CRO] Price Prediction 2022-23

It would be interesting to see how the recent development affects Crypto.com’s native token, Cronos [CRO].

New license, new profits?

On 15 December, Crypto.com announced that it had received a payment institution license from the Brazilian Central Bank. This meant that Brazil could expect more regulated fiat wallets from the exchange, allowing users to make payments with fiat and digital currencies.

Olá ??

We're thrilled to announce our latest milestone in strengthening regulatory compliance, this time in Brazilhttps://t.co/vCNztATkNg has received a Payment Institution License from the Central Bank of Brazil

Details about the license:https://t.co/XgFCkZY0kR pic.twitter.com/8J15yGOJLU

— Crypto.com (@cryptocom) December 15, 2022

This is a good sign from the perspective of crypto regulation and the expansion of the exchange. However, the development was less impactful for investors, especially holders of CRO.

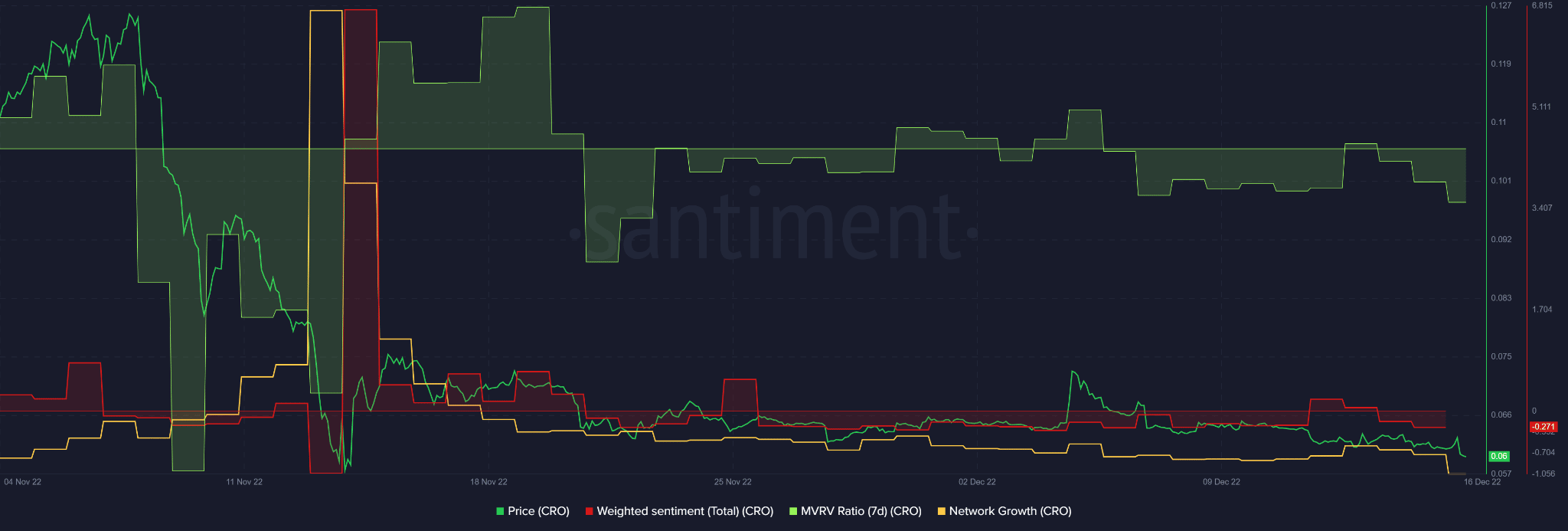

According to Santiment’s data, CRO saw a decline in network growth at the time of writing. Given the positive correlation between network growth and CRO’s share price, another decline could push the token’s price lower.

In addition, the overall weighted sentiment slipped deeper into negative territory, showing that the new development did not have any significant and immediate impact on investors.

Crypto.com and Brazil’s deal affects CRO

Overall, these metrics weighed on the price of CRO and exposed investors to losses as the seven-day MVRV (market value to realized value) ratio fell further.

The daily chart of CRO was also colored red but showed the possibility of a reversal if the price followed its historical trend.

Since mid-November, the prices of CRO reversed whenever the Relative Strength Index (RSI) reached the entry level of the oversold territory. At press time, the RSI was moving toward the oversold area and could reverse if it followed the previous trend.

Such a reversal and increased buying pressure could pull CRO higher in the coming days and turn its $0.0635 resistance into support.

However, the On Balance Volume indicator (OBV) declined, so the price reversal could be delayed if the buying pressure subsided in the next few days. In other words, the prices of CRO could only rise if the trading volume increased.

Therefore, the new Brazilian license could be a significant milestone for the exchange and the vibrant crypto community in Brazil. However, CRO holders do not share the same enthusiasm, at least not in the short term, as they are exposed to additional losses.