Decoding Dogecoin’s hopium-led 9.5% rally and what it means for the investors

Dogecoin was a relatively unknown coin until Elon Musk discovered it. Every time the ‘Doge-father’ has spoken in its favor, the token goes for a walk-up high on the price chart. The man who initiated a crash by discontinuing Bitcoin payments also managed to initiate a DOGE’s rally on 15 March in the midst of a bear market.

Dogecoin’s day out

DOGE had a rather interesting day on 15 March after the memecoin suddenly rallied. The rise was, of course, motivated by the words of none other than the ‘Doge-father.’ Elon Musk conveyed to Microstrategy’s Michael Saylor that he won’t be selling his DOGE, BTC, or ETH.

The conversation, which was in the context of the rising inflation and falling value of USD, led both the men to state how much they value cryptocurrencies.

As a general principle, for those looking for advice from this thread, it is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high.

I still own & won’t sell my Bitcoin, Ethereum or Doge fwiw.

— Elon Musk (@elonmusk) March 14, 2022

Naturally, the hopium caused the price to surge, and DOGE hit $0.122. But, it soon declined on the price charts. At the time of writing, it was trading at $0.1128, just 1.61% above where it was at the beginning of the day.

Since the broader market cues are currently a little bearish, the price movement going ahead will not be favoring bulls. It is also important to note that the Average Directional Index (ADX) is picking up pace in a downtrend. And, the Squeeze Momentum is also observing increased bearishness. It seems like DOGE is probably looking high to achieve $0.1 if the trend doesn’t change.

Dogecoin price action | Source: TradingView – AMBCrypto

Should the price fall again, it will only add to investors’ concerns who have only been looking for a way to escape the market’s bearishness.

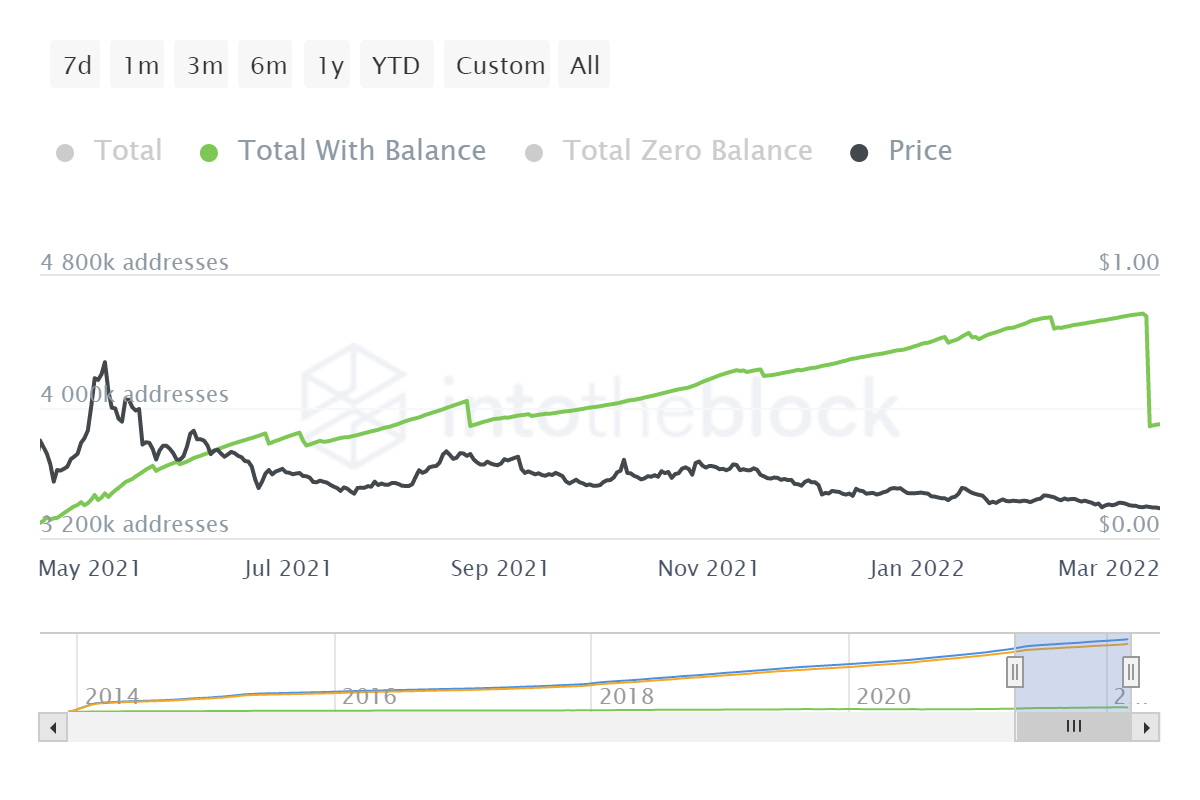

For them, the situation currently is pretty dire as over 67,000 DOGE holders exited the market following the 4% price rise on 9 March. Out of the fear of another crash, these investors took the first chance they got to prevent losses.

Dogecoin investors exiting the market | Source: Intotheblock – AMBCrypto

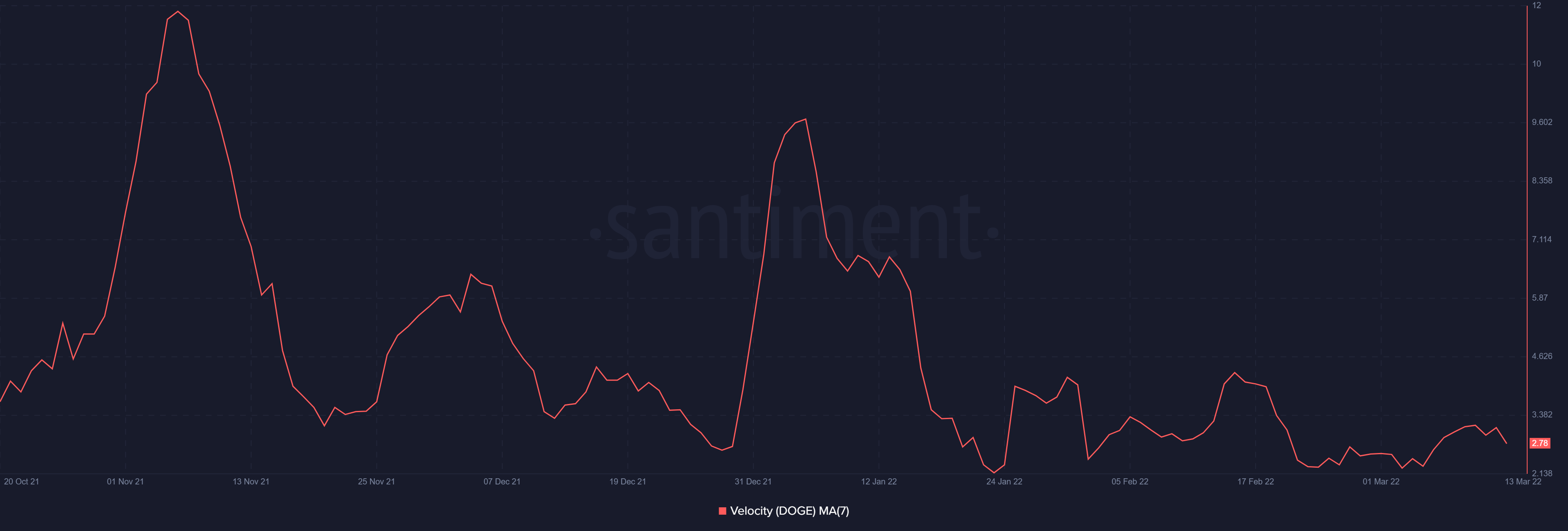

Also, velocity has been very low when it comes to Dogecoin. It indicates that investors are seemingly not moving their DOGE. Notably, continued bearishness will further reduce confidence in investors and lead to HODLing.

Dogecoin velocity | Source: Santiment – AMBCrypto

It should also be noted that the low volatility of the altcoin might keep the price swings under control. At the same time, DOGE’s correlation with Bitcoin might be a matter of concern since the king coin is indicating mixed signals.

Furthermore, as Bitcoin is up by 2.78%, a high correlation will be advantageous right now. In case, if the correlation falls, Dogecoin could end up in trouble.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)