Decoding if this LDO six-figure accumulation is enough fix for a breakout

Lido DAO Token [LDO] may have led investors on and eventually disappointed them but now may be the time it restores confidence. According to DeFinder, new addresses on the liquid staking protocol seem to be in full anticipation of an LDO resurgence.

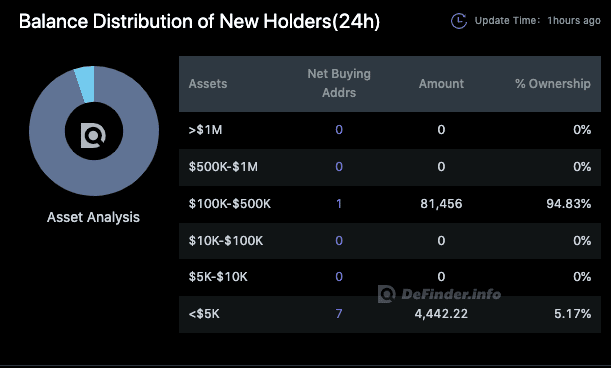

The on-chain data analyzing tool revealed that 94.83% of the 24-hour new addresses accumulated LDO worth between $100,000 and $500,000. Additionally, the remaining 5% ignored the lower number and raked up LDO worth around $5,000.

Here’s AMBCrypto’s Price Prediction for Lido DAO Token for 2022-2025

Ready to break the deadlock

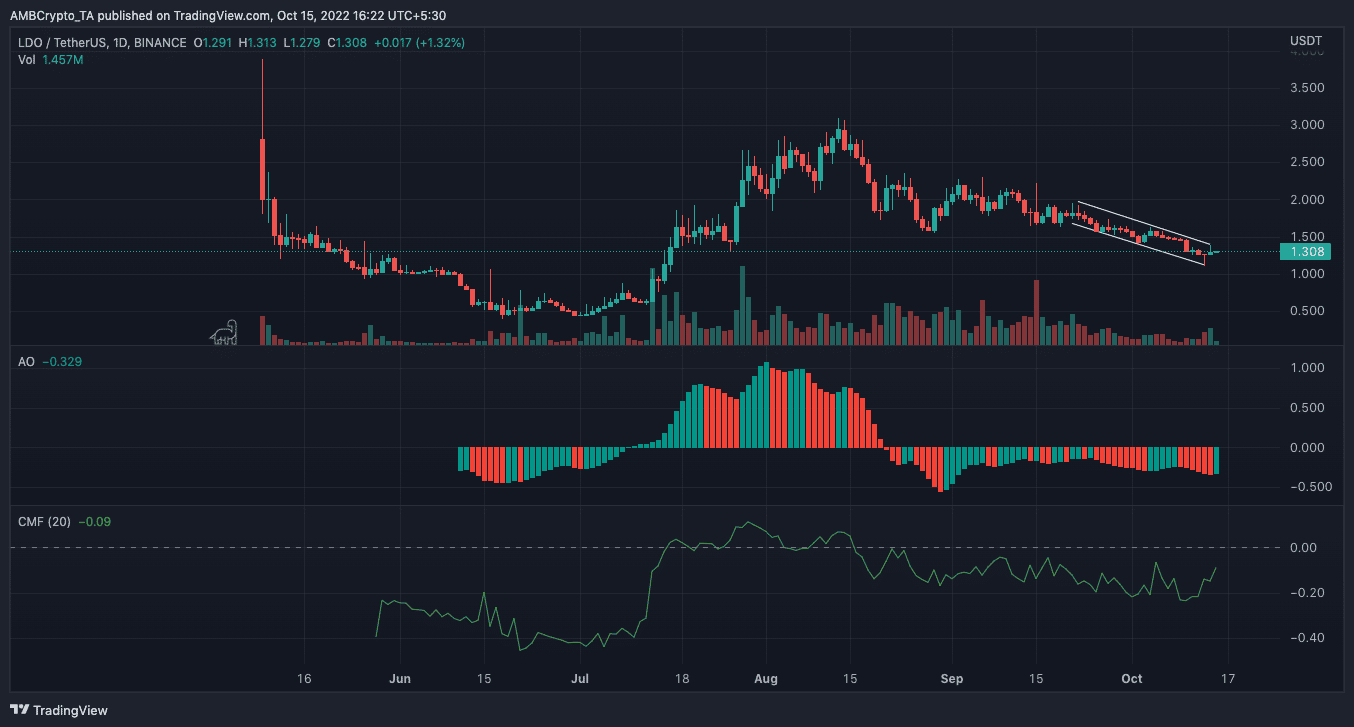

Co-incidentally, it looked like the new LDO addresses had closely monitored the trend on the charts. This was because LDO’s three-week trend had formed a descending triangle on the daily timeframe.

With the price at $1.30, the pattern showed that the token of the Lido Finance protocol could be on the verge of a breakout. While the bullish sentiment was not extraordinarily high, LDO had formed a pennant wedge at $1.15. As such, this could halt the selling pressure it had experienced in recent times.

In addition, the Awesome Oscillator (AO) showed that LDO might be getting ready for a bullish turnover despite the value at -0.329. However, LDO investors could watch the twin peaks formed below the histogram as indications on the chart revealed that it could eventually result in a bullish one.

The Chaikin Money Flow (CMF) also seemed to agree with the descending triangle pattern. According to the CMF, LDO investors might be pumping more liquidity into the chain even though it had not met the zero-mid point. Furthermore, maintaining position below the point was a signal of a bearish state. However, the increase, at press time, if maintained, could turn out in good fortunes.

Is it the same state across board?

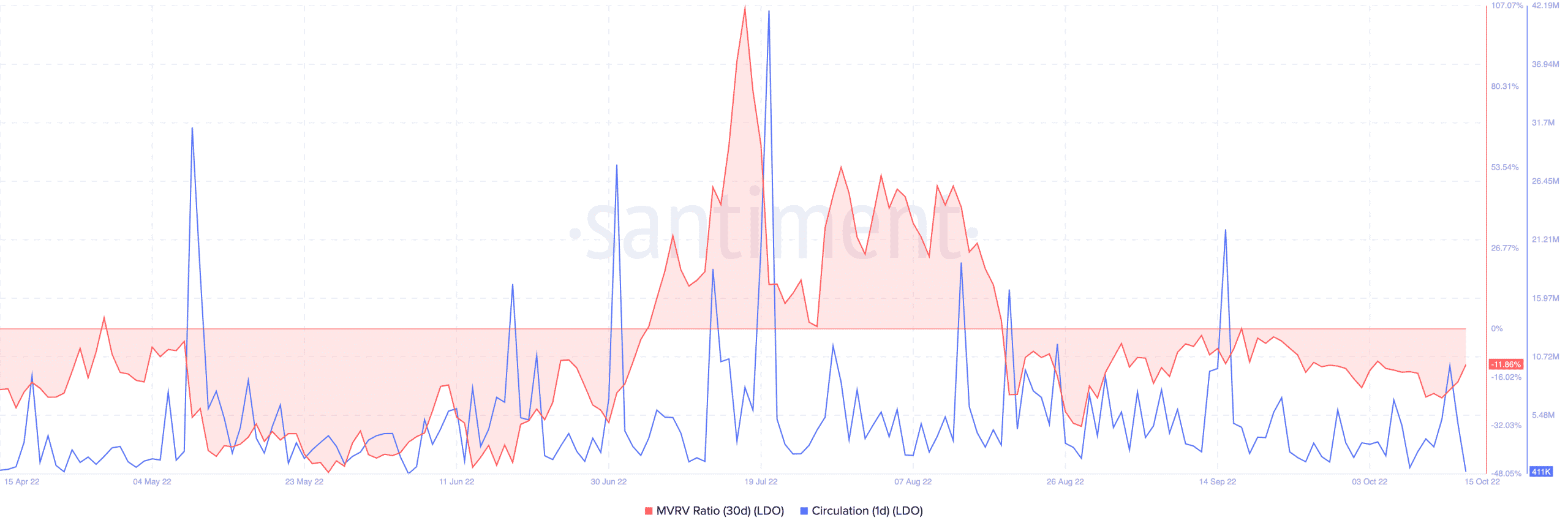

While LDO had lost 25.21% of its volume in the last 24-hours, Santiment revealed that the path to redemption could be at the corner. This was because the thirty-day Market Value to Realized Value (MVRV) ratio seemed to be in recovery mode.

As of 11 October, the MVRV ratio was -23.09%. However, it had gained about 100% as it was -11.59% at press time. Due to the increase, it was possible that LDO investors in massive losses recorded less recently especially as there was a market-wide recovery on 14 October.

In contrast, the one-day circulation which initially pumped to 7.06 million was down to 411,000. For LDO to build solid momentum, the circulation might need some revival.

With LDO trading at $1.31, investors would hope that the signals come to fruition since the token had left most in distress for a while.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)