Decoding what ‘increase in stablecoin’s whale transactions’ means for BTC & alts

You have to admit, stablecoins aren’t the most exciting part of the crypto industry, especially when there are NFTs and TVLs to gawk at. However, stablecoins are important indicators for Bitcoin or alt-related activity, and no trader can afford to ignore them.

So what are the stablecoins doing?

In the mood for red

Santiment data revealed that whales making stablecoin transactions saw a mild spike even as the market entered the red territory. These initially might not seem like related points, but stablecoin spikes can sometimes help push traders into buying.

On 6 April, the most transactions that day [worth more than $100,000] were made with USD Coin [USDC], which saw 7,453 transactions. Meanwhile, Tether [USDT] saw 6,450 such whale transactions. Considering that Tether’s market cap was around $30 billion more than that of USDC at press time, this is indeed worth looking into.

? #Stablecoin whale transactions have increased mildly as #crypto markets have dipped. Just as we see spikes in whale transactions near price tops for non-stablecoins, $USDT, $USDC, $BUSD, $TUSD, and $DAI generally spike during the best buy opportunities. https://t.co/fjwGdjPbRX pic.twitter.com/nTugOgiTpq

— Santiment (@santimentfeed) April 7, 2022

Can you hear the whales singing?

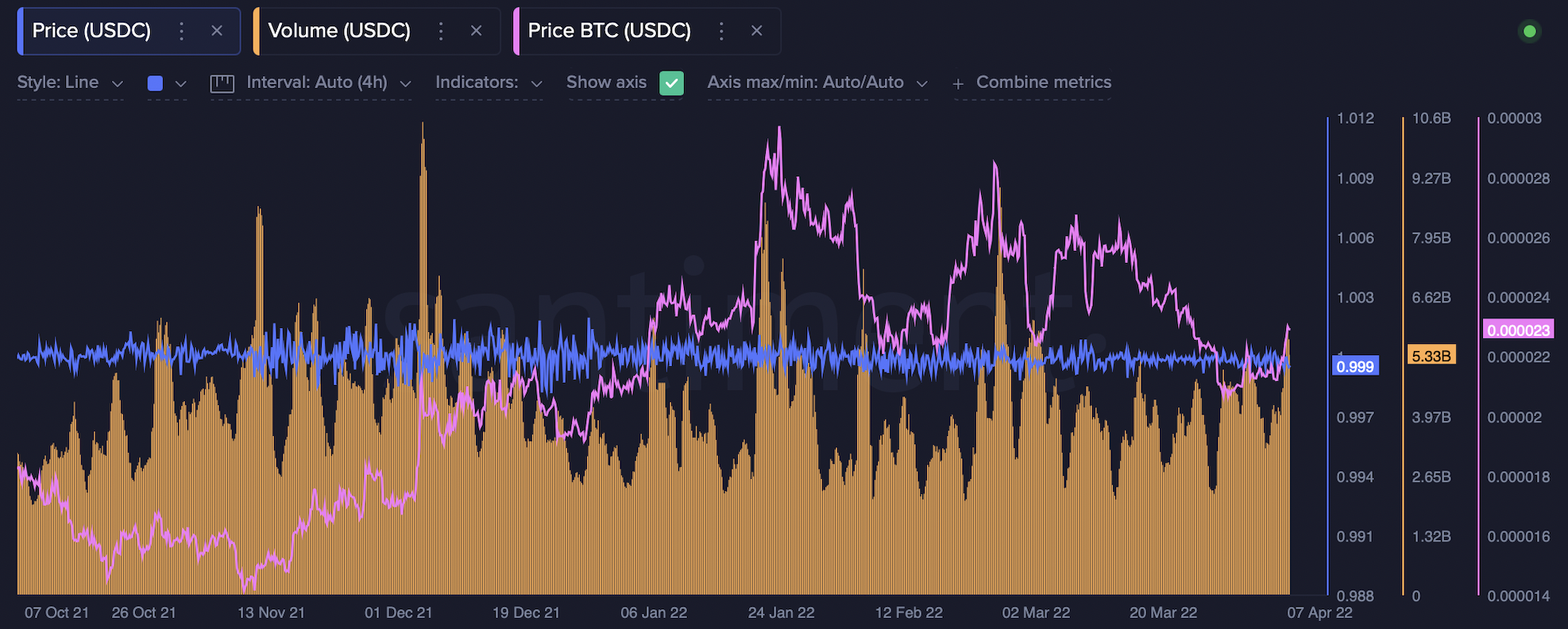

As expected, USDC did record a small surge in volumes, which started around three days ago and was continuing even shortly before press time. This is significant as previous spikes did happen close to the times when Bitcoin rallied.

Source: Santiment

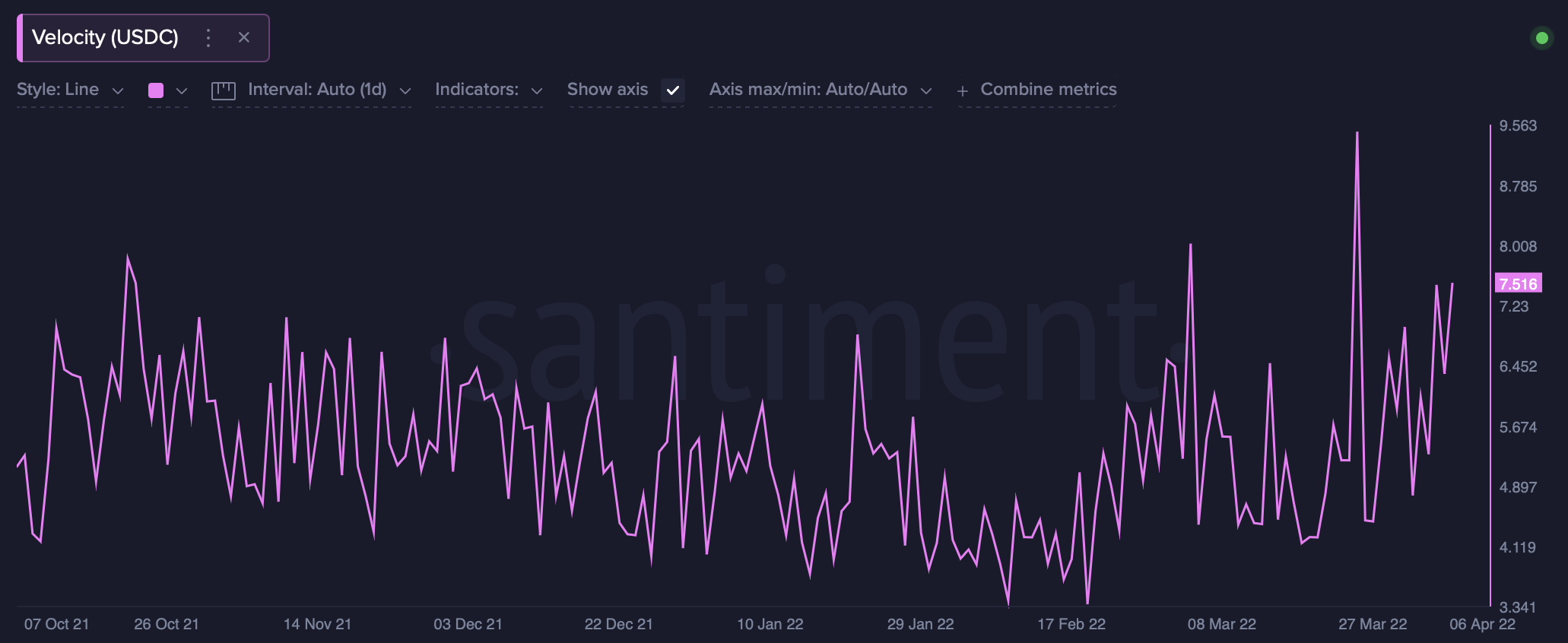

Moving to velocity, we can see that activity involving USDC has indeed been on the rise since mid-February, though with a fair amount of fluctuation. In particular, note the tall spikes around 4 March and 25 March. The question is, however, are users buying or selling?

Source: Santiment

Exchange supply can give us a better hint and in this case, it appears to be a case of selling. We can conclude this from a rise in the volume of USDC returning to the exchanges. However, this trend has been dominant since around early December 2021, when the crashes began. One interpretation is that investors were giving up their USDC and bringing home Bitcoin, Ether, or alts to “buy the dip.” And by the looks of it, this is still going on.

A bloody drop

More bullish investors were understandably upset when Bitcoin fell below $45,000 – just as many assumed the king coin was finally past its former resistance level.

However, Bitcoin might not exactly be the catch of the season, as data from Glassnode’s founders revealed that investors appeared to be showing more interest in Ethereum and other alts as well.

#Bitcoin traded volume down -26% in Q1 2022 as per Q1 2021.

Q1 2021 $BTC return: +103%

Q1 2022 #BTC return: -1.46%More money is spreading to #Ethereum and altcoins. Read more here ? https://t.co/puXlRHCMaK pic.twitter.com/Oe8zgdEDZV

— ??????????? (@Negentropic_) April 4, 2022

With the DeFi potential in store for these assets, it seems that stablecoin whales are far from becoming irrelevant any time soon.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)